Sejong, the "administrative capital," also sees a surge...

Regional areas continue to decline

A flyer for sale and jeonse listings is posted at a real estate agency in Gangnam, Seoul. Photo by Kang Jinhyung

A flyer for sale and jeonse listings is posted at a real estate agency in Gangnam, Seoul. Photo by Kang Jinhyung

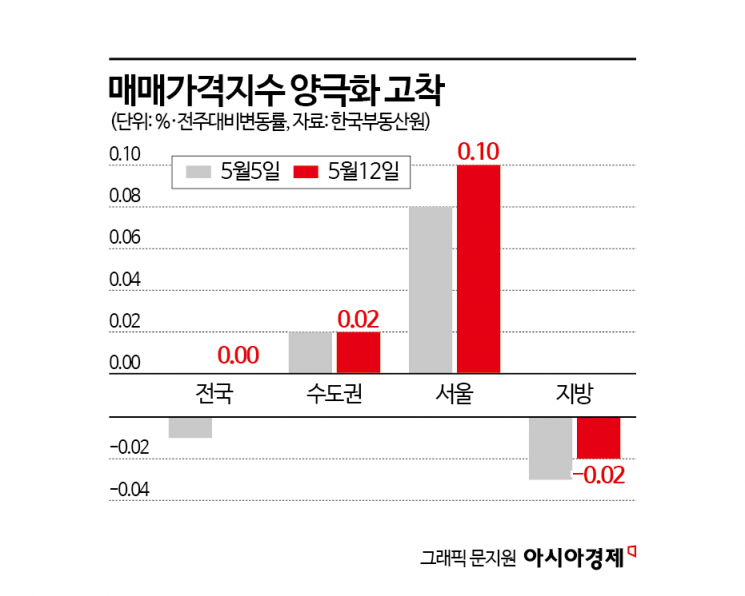

This week, apartment sale prices in Seoul rose for the fifteenth consecutive week.

According to the weekly apartment price trend for Seoul in the second week of May (as of May 12), announced by the Korea Real Estate Board on May 15, apartment sale prices in Seoul increased by 0.1% compared to the previous week.

◆Ongoing concentration in preferred complexes= The Gangnam area led the price increase. The three Gangnam districts?Gangnam (0.15%→0.19%), Seocho (0.19%→0.23%), and Songpa (0.12%→0.22%)?all recorded increases. In Gangnam-gu, complexes with reconstruction expectations in areas such as Apgujeong and Daechi-dong drove the price rise. In Seocho-gu (0.53%), newly built complexes in Banpo and Jamwon-dong contributed to the increase. Songpa-gu (0.47%) also saw prices rise, mainly in complexes pursuing reconstruction in Jamsil and Sincheon-dong.

Other districts, including Gangdong (0.10%→0.17%), Mapo (0.18%→0.21%), Yeongdeungpo (0.10%→0.13%), Yongsan (0.14%→0.15%), and Gwangjin (0.05%→0.09%), also saw larger increases than the previous week.

The Korea Real Estate Board stated, "Although a wait-and-see approach continues among buyers in some areas and complexes, demand for purchases remains steady and contracts are being signed, especially in major preferred complexes such as those with reconstruction potential. As a result, the overall upward trend in Seoul continues."

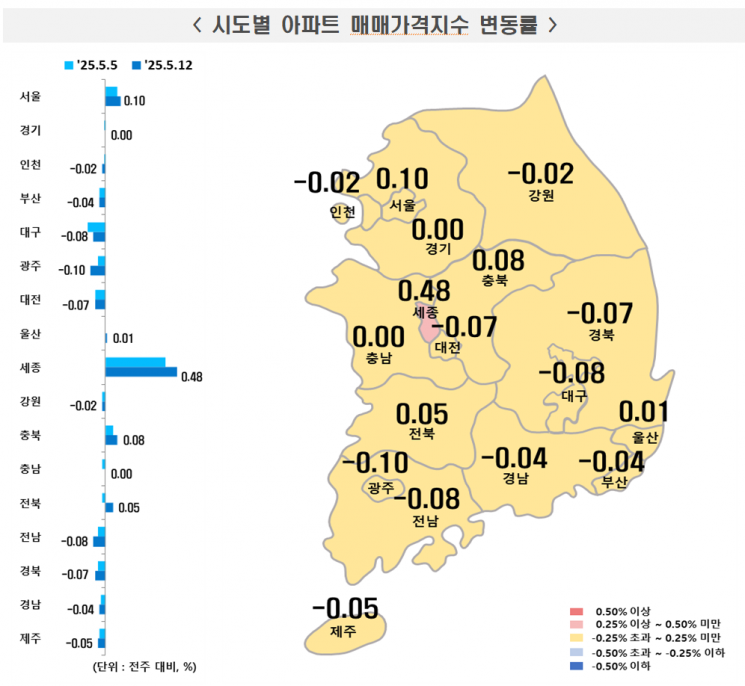

Sejong, which has drawn attention as an "administrative capital" during the presidential election period, rose by 0.48% compared to the previous week. This is a greater increase than last week's 0.4%. Prices rose mainly in small- and medium-sized and preferred complexes in Dodam, Goun, and Dajeong-dong. Gwacheon also rose by 0.35%, mainly in Byeoryang and Burim-dong, where redevelopment projects are underway. The cumulative increase for Gwacheon this year is 5.28%.

Nationwide apartment prices shifted to flat compared to last week (-0.01%). By city and province, Gwangju (-0.1%), Daegu and Jeonnam (-0.08%), Daejeon and Gyeongbuk (-0.07%), Jeju (-0.05%), Busan (-0.04%), and Incheon and Gangwon (-0.02%) saw the largest declines. Gyeonggi shifted from a 0.01% decrease last week to flat (0.00%) this week, while Chungbuk (0.08%), Jeonbuk (0.05%), and Ulsan (0.01%) recorded increases.

Apartment jeonse prices in Seoul (0.03%) maintained their rate of increase, and the Seoul metropolitan area saw the rate of increase rise from 0.01% last week to 0.02% this week. The nationwide weekly apartment jeonse price remained flat.

Apartment Sale Price Index Change Rate by City and Province This Week Compared to Jeonju. Provided by Korea Real Estate Board

Apartment Sale Price Index Change Rate by City and Province This Week Compared to Jeonju. Provided by Korea Real Estate Board

◆Metropolitan area ↑ vs non-metropolitan area ↓ persists... Sejong turns upward= In the nationwide housing price trend survey for April, released by the Korea Real Estate Board on the same day, the polarization between Seoul and regional areas was clear. The Korea Real Estate Board stated, "According to our survey of nationwide comprehensive housing (apartments, row houses, detached houses, etc.) sale price trends, housing sale prices in April rose by 0.07% in the metropolitan area and fell by 0.11% in non-metropolitan areas compared to the previous month, resulting in a nationwide decrease of 0.02%."

Seoul rose by 0.25%. However, the rate of increase in Seoul and the metropolitan area was about half that of the previous month (Seoul 0.52%, metropolitan area 0.15%).

The Korea Real Estate Board explained, "Purchase inquiries for preferred complexes, such as newly built and reconstruction-expected complexes in Seoul and the metropolitan area, remain steady. However, overall, a wait-and-see attitude is deepening due to increased market uncertainty."

The Board continued, "While demand is being maintained mainly in complexes with reconstruction benefits in Seoul and the metropolitan area, transactions are rare in other complexes due to the expansion of wait-and-see sentiment. In regional areas, an accumulation of unsold properties due to the sluggish real estate market is being observed, leading to a nationwide shift to a downward trend." The Board added, "For jeonse and monthly rent, tenant demand is being maintained mainly in school districts and newly built complexes. In contrast, older complexes are showing a downward trend, resulting in a flat trend for jeonse and a narrowing increase for monthly rent."

Sejong, which had recorded negative figures until the previous month, posted a 0.25% increase, marking a turnaround. This is the first time in 17 months, since December 2023, that Sejong's comprehensive housing sale price index has risen on a monthly basis.

Last month, the nationwide comprehensive housing jeonse price (0.03%→0.00%) was flat. The rate of increase in Seoul (0.17%→0.09%) and the metropolitan area (0.10%→0.05%) narrowed, while the decline in regional areas (-0.03%→-0.05%) widened.

Nationwide comprehensive housing monthly rent rose by 0.05%, continuing its upward trend. In Seoul, the phenomenon of "jeonse turning into monthly rent" appeared due to worsening conditions for jeonse loans, resulting in a 0.10% increase. The metropolitan area rose by 0.09%, and regional areas by 0.01%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.