Super-Aging Society Becomes Key Topic for Structural Reform Discussions

Governor Lee Changyong Emphasizes Importance of Defining Elderly Poverty

"Following the issues of extremely low birth rates and the college entrance system, the key topic for this round of structural reforms is the problem of super-aging."

Lee Changyong, Governor of the Bank of Korea, is delivering a welcoming speech at the joint Bank of Korea-KDI symposium held on the 15th at the KDI Conference Hall. Bank of Korea

Lee Changyong, Governor of the Bank of Korea, is delivering a welcoming speech at the joint Bank of Korea-KDI symposium held on the 15th at the KDI Conference Hall. Bank of Korea

Lee Changyong, Governor of the Bank of Korea, stated in his welcoming speech at the joint Bank of Korea-KDI symposium held at the Korea Development Institute (KDI) in Sejong City on the 15th, "Since December last year, Korea has entered a super-aged society. The problem is not only that aging is progressing rapidly, but also that it is accompanied by poverty."

As of 2023, the elderly poverty rate in Korea is about 40%. This is the highest level among the member countries of the Organisation for Economic Co-operation and Development (OECD). Governor Lee emphasized, "When discussing the issue of elderly poverty, it is essential to clarify the definition of poverty." He explained, "The OECD's elderly poverty rate is a 'relative poverty rate,' which refers to the proportion of people aged 66 and older whose income is less than 50% of the median income of the total population." He further noted that, since this is based on disposable income, or income actually available for living expenses, even those with substantial assets such as real estate are classified as poor in the statistics if those assets are not converted into living expenses.

Governor Lee pointed out, "Although some are classified as elderly poor based on disposable income, those who could escape poverty by converting their assets into pensions amounted to about 1.22 million people as of 2021, which is about 37% of the elderly poor." He added, "A desirable policy direction would be to help these individuals liquidate their assets so they can resolve the issue themselves." He stressed, "I hope the discussions at this symposium will serve as a foundation for developing sustainable solutions to improve the quality of life for the elderly."

Meanwhile, in the first session of the symposium, discussions focused on the current state of elderly poverty and responses to it, based on the reality that many are classified as poor despite owning assets due to insufficient cash flow. Lee Seunghee, Associate Research Fellow at KDI, analyzed the poverty situation among the elderly and demonstrated that if avenues for asset liquidation are opened, many elderly people could escape poverty.

Next, Hwang Indo, Head of the Financial and Monetary Research Division at the Bank of Korea's Economic Research Institute, continued the discussion by focusing on how to specifically implement asset liquidation, particularly through reverse mortgages. According to survey results, 35-41% of homeowners aged 55 and older expressed willingness to enroll in a reverse mortgage, which is an encouraging indicator of strong demand among the elderly. If this demand is realized, annual cash flow of 34.9 trillion won would be generated. Even if only half of this is spent, it would create 17.4 trillion won in private consumption annually. Hwang stated, "With improved cash flow among the elderly, more than 340,000 seniors could escape poverty."

The second session addressed more fundamental ways to increase income through labor. The proportion of people aged 65 and older who remain economically active is more than twice the OECD average. Han Yosep, Research Fellow at KDI, pointed out the instability of employment among the middle-aged and older population, and emphasized that in order to alleviate this, it is necessary to reduce the excessive seniority-based wage system.

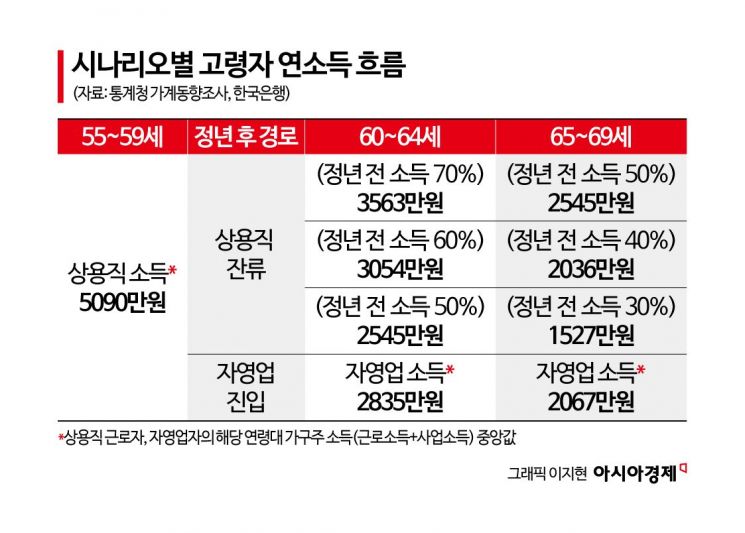

Lee Jaeho, Deputy Head of the Macroeconomic Analysis Team at the Bank of Korea's Economic Research Department, focused on self-employment among the various forms of labor. He presented findings showing that, after age 60, remaining as a regular employee with a 40-60% reduction in salary yields similar or even higher earnings compared to starting a self-employed business at that age. He explained that, after retirement, those aged 60-64 who continue as regular employees earn 60% of the income of regular employees aged 55-59, and those aged 65-69 who work part-time earn 40% of the income of regular employees aged 55-59. This income flow is similar to that of those who enter self-employment after retirement. Lee emphasized, "Considering the high transition and initial startup costs and increased income volatility associated with self-employment, retirees have a strong incentive to choose regular employment if continued employment is guaranteed, even if their income is lower than before."

Since last year, the so-called "second baby boom" generation, born between 1964 and 1974 and numbering 9.54 million, has begun to retire. Many are turning to self-employment due to limited options, prompting calls for a swift strengthening of "post-retirement re-employment" systems. If this trend continues, the number of elderly self-employed people, who are concentrated in vulnerable sectors such as parcel delivery and quick services, and who tend to have lower profitability and higher debt ratios, is expected to surge to 2.5 million by 2032, posing risks to financial stability and economic growth. Among new self-employed individuals aged 60 and older, 35% earn less than 10 million won in annual operating profit. Lee emphasized, "To reduce the entry of the elderly into self-employment and expand stable wage employment opportunities, retirement age extension through 'post-retirement re-employment' should be implemented."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.