Complex Bioprocesses Combining Biology and Chemistry

Precision Directly Impacts Efficacy and Safety

Stringent Quality Control Required

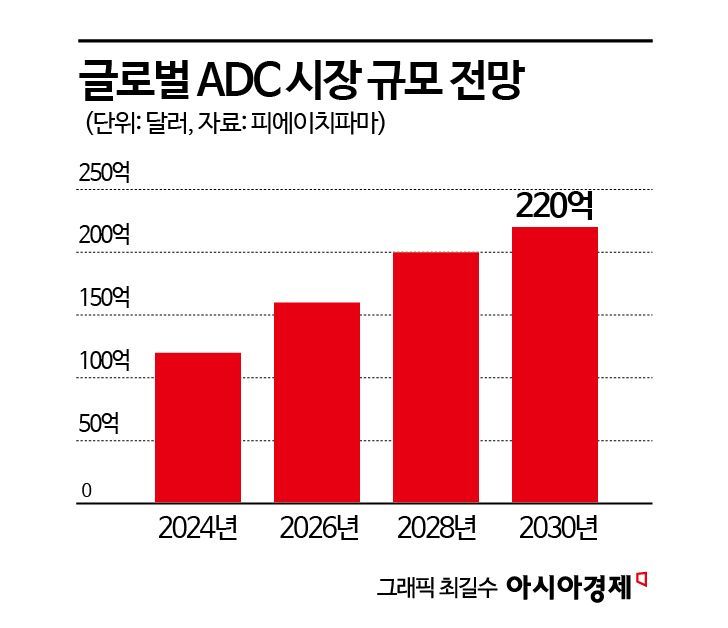

As antibody-drug conjugate (ADC) therapies are emerging as a core modality in the global anticancer drug market, the ADC CDMO (Contract Development and Manufacturing Organization) market, which handles outsourced production of these therapies, is also experiencing rapid growth.

According to industry sources on May 15, Daiichi Sankyo's "Enhertu," an ADC therapy used for breast cancer treatment, is estimated to cost around 2.3 million KRW per vial (prior to health insurance coverage), while "Trodelvy" is estimated at about 1.6 million KRW. Given that the conventional antibody drug "Herceptin" is priced at around 900,000 KRW, ADC therapies are more than twice as expensive.

An industry representative explained, "The prices of pharmaceuticals and active pharmaceutical ingredients (APIs) can vary significantly depending on the type of drug, its indications, manufacturing process, and contract conditions." The representative added, "The unit price for ADC APIs is expected to be on average two to three times higher than that of conventional antibody drugs."

ADC is a complex biopharmaceutical in which a cytotoxic drug is conjugated to a targeted antibody via a linker. The antibody precisely recognizes cancer cells, and the cytotoxic drug, attached via the linker, is released inside the cell to destroy the cancer. Thanks to this therapeutic mechanism, ADCs are gaining attention as next-generation anticancer drugs with higher efficacy and selectivity compared to existing cancer treatments.

ADC contract manufacturing involves more than five complex steps, including antibody production, drug synthesis, linker development, conjugation, and purification. While antibody CDMOs mainly focus on biological processes such as protein culture, purification, and filtration, ADC CDMOs must also incorporate organic chemistry-based drug synthesis, linker development, and conjugation technologies. In short, "convergent technology" that combines biological and chemical processes is required. In particular, the drug-to-antibody ratio (DAR) and the precision of the conjugation site directly affect efficacy and safety, making quality control standards especially stringent.

Due to the handling of highly toxic drugs, specialized facilities are essential, unlike general antibody production plants. These include dedicated clean rooms that meet Occupational Exposure Limit (OEL) standards, independent isolation spaces, and toxic waste management systems. As a result, the costs of establishing and operating production lines are inevitably much higher compared to antibody CDMOs.

According to global market research firm Frost & Sullivan, the ADC market is expected to grow at an average annual rate of 30% to reach $65 billion (approximately 91 trillion KRW) by 2030. In particular, as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are expanding approvals for precision anticancer therapies, including ADCs, market expansion is expected to accelerate even further.

Since ADCs command high pipeline unit prices and margins vary greatly depending on production complexity, this area is highly profitable for CDMOs. An industry representative explained, "Among biopharmaceuticals, ADCs are a high value-added field in terms of both technological capability and profitability."

In response, global CDMO companies are establishing dedicated ADC production lines to secure early market leadership. Samsung Biologics completed an ADC production facility in December last year, equipped with a 500-liter conjugation reactor and one purification line, and began full-scale operations in March this year. Lotte Biologics also completed an ADC production facility in March, featuring a 1,000-liter conjugation reactor and integrated production and purification lines, and is expected to begin full-scale production next month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.