Net Assets Reach 16.0246 Trillion Won as of May 13, Up 22% from End of Last Year

President Bae Jaekyu's Investment Philosophy Focused on US Tech Drives Growth

Since last year, the domestic exchange-traded fund (ETF) market has been growing rapidly, and the asset management industry is engaged in fierce competition to increase net asset size. Major ETF managers are seeking to expand their market share by launching products that attract investor interest or by emphasizing lower management fees compared to competitors. Korea Investment Management has been steadily increasing its net assets despite the intense competition.

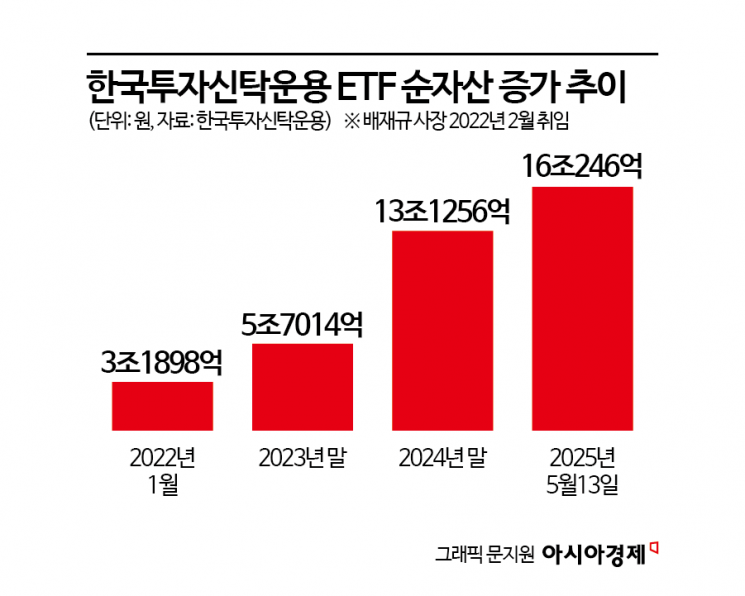

According to the financial investment industry on May 15, the total net asset value of the 96 ETFs managed by Korea Investment Management was 16.0246 trillion won as of May 13. This represents a 22% increase compared to 13.1256 trillion won at the end of last year.

Since President Bae Jae-kyu took office in February 2022, the company has strengthened its ETF division with tangible results. Just before President Bae’s appointment, the net asset value of Korea Investment Management’s ETFs was only 3.1898 trillion won. In just three years and three months, the figure has grown fivefold, a result attributed to President Bae’s investment philosophy that emphasizes long-term investment in future growth.

Reflecting President Bae’s investment philosophy, Korea Investment Management has focused on launching ETFs that invest in U.S. tech companies. The “ACE Tesla Value Chain Active” ETF, listed on May 16, 2023, has grown its net asset value to 1.1848 trillion won. Its one-year return has reached 54.7%. This is an active ETF that concentrates investments in Tesla, a U.S. electric vehicle company, and related value chain companies.

The “ACE US Big Tech TOP7 Plus” ETF, launched in September 2023, has posted a return of 69.2% since its listing. Its net asset value is approaching 700 billion won. The ETF includes companies such as Broadcom, Apple, Tesla, Microsoft, Meta, Amazon, Alphabet, and Nvidia. Leverage and inverse types have also been launched, allowing investors to choose according to their investment perspective.

The ACE Nvidia Value Chain Active ETF surpassed 200 billion won in net assets less than a year after its listing in June last year. Investors favor this ETF because it allows them to concentrate about 25% of investments in Nvidia.

Although tech stock prices have been undergoing corrections this year, the company believes that long-term growth will continue and has expanded its lineup of ETFs related to U.S. tech companies. On May 13, Korea Investment Management introduced the ACE US Dividend Quality ETF series, including the ACE US Dividend Quality ETF, ACE US Dividend Quality Bond Mix 50 ETF, and ACE US Dividend Quality + Covered Call Active ETF. These ETFs are designed to capture both stable dividend income and returns from the growth of constituent stocks.

Korea Investment Management identified strong demand for ETFs that can increase dividends over the long term as net asset value grows, and launched the US Dividend Quality ETF in collaboration with WisdomTree, a U.S. asset manager. This is also the first product that WisdomTree, which mainly operates in the U.S. and Europe, has launched in Asia.

President Bae expressed expectations that U.S. tech companies will drive change and growth for a considerable period going forward.

At the “ACE US Dividend Quality” ETF series listing seminar on May 13, he stated, “Tech companies are not just a temporary trend,” and added, “We have moved from an era where manufacturing led the world to an era dominated by technology.” He continued, “Just because you develop important technology does not mean you can make money; to profit from technology that drives change in the world, massive capital is required.” He explained, “There are not many companies that can invest trillions of won,” and added, “The big tech companies that lead the world are unlikely to change anytime soon.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.