Growth Outlook Slashed Again in Three Months

Sharp Revision from 1.6% to 0.8%

The Korea Development Institute (KDI), a state-run research institute, has sharply lowered its forecast for South Korea's economic growth rate this year from 1.6% to 0.8%. Expectations for the South Korean economy, which relies on export-driven growth, are declining amid worsening trade conditions due to the tariff war triggered by Trump.

On May 14, Jung Kyucheol, Director General of KDI’s Economic Outlook Office, stated, “This year, the South Korean economy is showing signs of slowing growth due to sluggish exports caused by deteriorating trade conditions.” He also projected that next year, as the decline in international oil prices narrows and domestic demand shows a moderate recovery, the economy will grow by 1.8%.

KDI initially forecasted this year’s economic growth at 2.0% (in November last year), then revised it downward to 1.6% in February, and now has lowered it further to 0.8%. The institute diagnosed that, compared to the previous year, growth would be 0.3% in the first half and 1.3% in the second half, indicating a pattern of “slow in the first half, recovery in the second half.” As a result, the annual growth rate is expected to remain in the low 0% range.

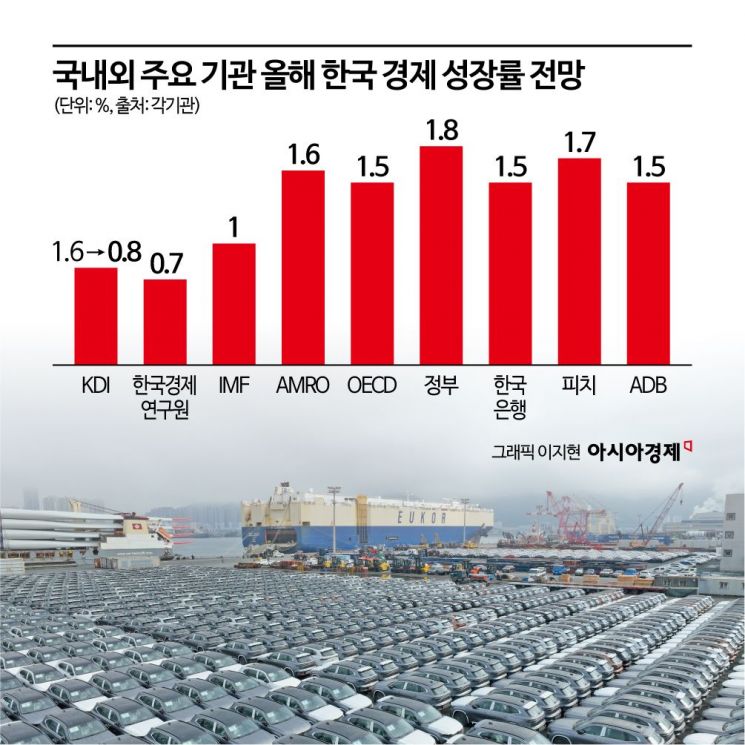

This forecast is significantly lower than those of major domestic and international institutions, such as the International Monetary Fund (IMF, 1.0%), the Organisation for Economic Co-operation and Development (OECD, 1.5%), the Bank of Korea (1.5%), and the ASEAN+3 Macroeconomic Research Office (AMRO, 1.6%).

Major global investment banks are also lowering their outlooks for the South Korean economy, with JP Morgan at 0.5%, Citigroup at 0.6%, and HSBC at 0.7%, effectively accepting a 0% range growth as a given.

KDI assessed that domestic demand has not shown any visible signs of recovery due to continued psychological contraction caused by political instability and heightened external uncertainties. Exports are slowing down despite the recent strength in semiconductors, as other industries remain sluggish. Looking ahead, KDI expects that export conditions will worsen further due to U.S. tariff increases.

Jung stated, “As the United States has raised tariffs on a wide range of items, and related uncertainties have expanded to an unprecedented level, export conditions are expected to deteriorate rapidly.”

KDI suggested that it would be desirable to implement an accommodative policy stance, such as lowering interest rates, in response to the economic slowdown. The institute emphasized that monetary policy should be more accommodative to reduce downward pressure on prices that could result from weakened domestic and external demand.

Regarding fiscal policy, KDI warned that, considering the managed fiscal deficit of 86.4 trillion won (3.3% of GDP), the government budget is already somewhat expansionary, and any further increase in government spending should be approached with caution.

KDI also recommended that efforts to reform the economic structure should be pursued in parallel, taking into account the declining potential growth rate. Jung emphasized, “The potential growth rate of our economy is estimated to be in the high 1% range, and it is expected to fall to around 0% in the 2040s. In this situation, efforts to improve productivity?such as easing entry barriers and labor market rigidity?are necessary.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.