Transaction Volume Surges 98.7% Year-on-Year from January to April...

Strong Demand for New Apartments in Seoul

Dongdaemun and Gangdong Lead in Transactions...

Large Complexes Drive Activity

Gangnam 3 Districts and Yongsan See Deals Disappear after 'Toheoguyeok' Regulation

Popularity Expected to Continue as 'Supply Cliff' Worsens...

"Eoljuksin is a Structural Trend"

The 'Eoljuksin' (short for "even if I freeze to death, I want a new apartment") phenomenon in Seoul's apartment market has now spread to the trading of pre-sale and move-in rights. As the supply of new homes has dried up, making it difficult to find newly built apartments, the volume of pre-sale and move-in rights transactions has surged nearly twofold in just one year. However, transaction volumes have all but disappeared in areas designated as land transaction permit zones (known as 'Toheoguyeok'), such as the three Gangnam districts. Instead, a 'balloon effect' is emerging, with demand concentrating in neighboring areas or regions with favorable development prospects. There are growing calls for the government to introduce new supply measures to address the Eoljuksin phenomenon.

Large complexes in Dongdaemun and Gangdong lead transactions... Gangnam 3 districts and Yongsan see deals vanish after regulations

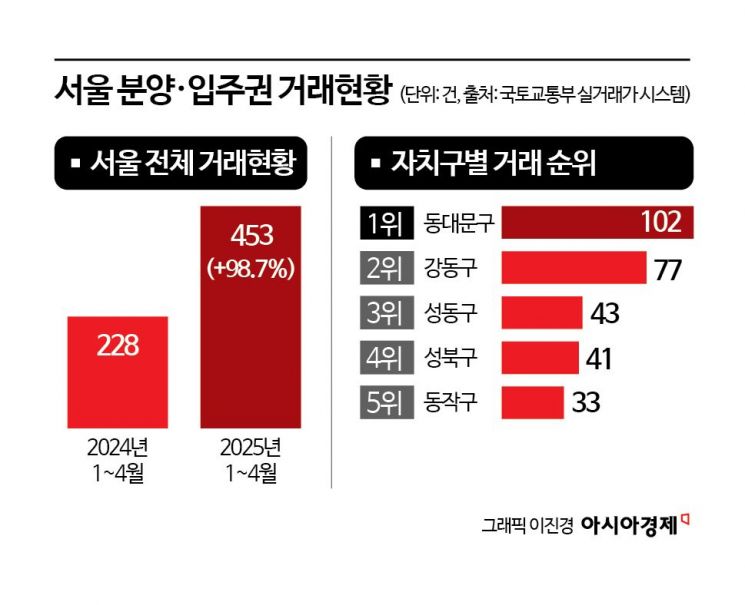

According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system on May 14, a total of 453 pre-sale and move-in rights transactions were recorded in Seoul from January to April this year. This represents a 98.7% increase compared to the same period last year, when there were 228 transactions. In 2023, there were 136 transactions during the same period. The number has been doubling each year at a rapid pace. Given that real estate transaction reports can be filed within 30 days, the actual number of deals is expected to be even higher. A move-in right refers to the right for a redevelopment or reconstruction association member to move into a new apartment, while a pre-sale right refers to the right for the general public to move into a new apartment through the subscription process.

By district, Dongdaemun-gu recorded the highest number of transactions at 102. In Dongdaemun-gu, transactions were active, especially around large complexes scheduled for move-in this year, such as 'Raemian La Grande' (3,069 units), 'Imun IPark Xi' (4,321 units), and 'Hwigyeong Xi Decentia' (1,806 units). Gangdong-gu ranked second with 77 transactions. In 'Olympic Park Foreon', the largest apartment complex in Korea with a total of 12,032 units, 64 transactions took place. Seongdong-gu (43), Seongbuk-gu (41), and Dongjak-gu (33) followed.

Record-high prices are also being reported consistently. There were 25 record-high transactions in January, 34 in February, 62 in March, and 27 last month. On April 25, a move-in right for a 95-square-meter unit in Olympic Park Foreon changed hands for 2.78 billion won, setting a new record. For the same unit size, transactions in January were around 2.55 billion won. This means the price rose by over 200 million won in just three months. On April 28, a move-in right for an 84-square-meter unit in 'Riversen SK VIEW Lotte Castle' in Jungnang-gu was sold for 1.2 billion won, about 80 million won higher than the previous peak.

In contrast, there have been no pre-sale or move-in rights transactions at all in Seoul's three Gangnam districts (Gangnam, Seocho, Songpa) and Yongsan-gu since March 24, when these areas were newly designated or expanded as land transaction permit zones. Before the regulation, the combined total for these four districts was 49 transactions. After the regulation, pre-sale right transfers and move-in right transactions for redevelopment or reconstruction in these areas became subject to permit requirements. A two-year mandatory residency obligation was also imposed. The regulatory burden has led to a disappearance of transactions.

'Eoljuksin' is a structural phenomenon... Popularity of pre-sale rights likely to continue as the 'supply cliff' worsens

The so-called 'new apartment thirst' has fueled demand for move-in and pre-sale rights. According to real estate information provider Real House, as of last year, Seoul had the highest proportion of apartments over 20 years old in the country, with 970,552 units, accounting for 59.5% of the total. Against this backdrop, the 'supply cliff' is accelerating. General pre-sales in Seoul are expected to reach only 6,523 units this year, a 33.8% decrease from a year ago. Annual move-in volume is also expected to plunge 47.6%, from 46,710 units this year to 24,462 units next year.

Due to strong 'Eoljuksin' demand in Seoul, even unsold new apartments are quickly being sold out after completion. 'The Sharp First World' in Jungnang-gu, which had unsold units at the end of last year, recently sold out through a first-come, first-served system. Other complexes that had unsold units at the time of sale, such as 'Hillstate Deungchon Station' in Gangseo-gu and 'Changgyeonggung Lotte Castle Signature' in Seongbuk-gu, have now also sold out. In Seocho-gu, all 29 reserved units in 'Maple Xi', scheduled for move-in next month, were sold within about a month through two rounds of bidding and first-come, first-served sales. Even though there is controversy over high pre-sale prices for 'Hillstate Mediale' in Eunpyeong-gu and 'Gocheok Prugio Hillstate' in Guro-gu, both launching this month, tens of thousands of people are flocking to the model homes.

Park Won-gap, Chief Real Estate Expert at KB Kookmin Bank, said, "Seoul has so few new apartments, and it is clear that the supply cliff will become even more severe after 2026, so the Eoljuksin demand is likely to continue in the pre-sale and move-in rights market for the time being." He added, "The current concentration of demand for new apartments is a structural trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.