Despite Outperforming Market Expectations, Stock Price Falls for Two Consecutive Days

GPM Decline and Early Reflection of European Market Expansion

Outlook for This Year Remains Bright... Brokerages Raise Target Prices

SiliconTwo's stock price is declining despite first-quarter results that exceeded market expectations. This is interpreted as being due to a decline in the gross profit margin (GPM) and the fact that expectations for the European and Middle Eastern markets had already been reflected in the stock price.

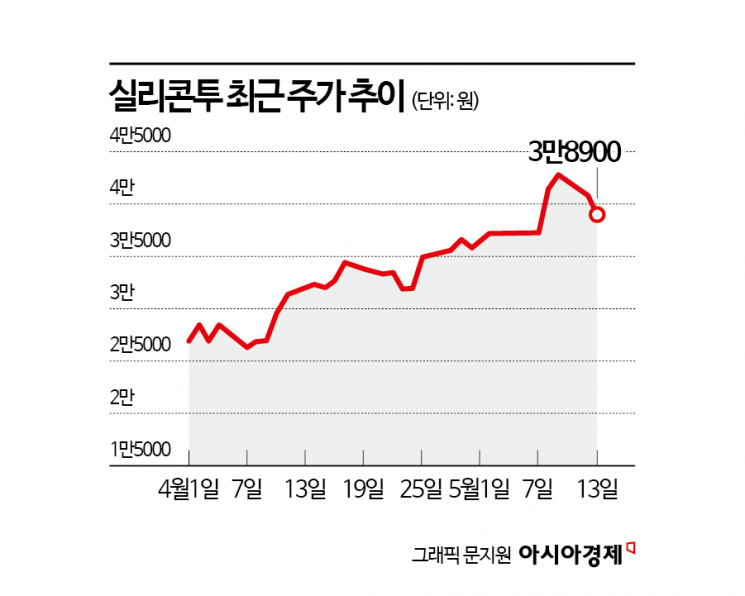

According to the Korea Exchange (KRX), SiliconTwo closed at 38,900 won on May 13. This marks two consecutive days of decline. On May 12, the stock fell by 4.81%, and the previous day it dropped by 4.19%.

On a consolidated basis, SiliconTwo posted first-quarter sales of 245.7 billion won and operating profit of 47.7 billion won. These figures represent increases of 63.9% and 62.1%, respectively, compared to the same period last year. These results surpassed market expectations. According to FnGuide, securities firms had projected SiliconTwo's first-quarter sales and operating profit at 196.1 billion won and 39.1 billion won, respectively.

Kwon Woojeong, a researcher at Kyobo Securities, commented, "This quarter, the share of European sales reached about 40% on a separate basis, far exceeding the approximately 12-15% share in North America and driving the results. The share in the Middle East also expanded to 10%, showing significant growth."

Park Eunjeong, a researcher at Hana Securities, also explained, "The record-breaking results were driven by the global expansion of demand for K-beauty, proactive market development, and superior operational capabilities. Over the past three years, growth momentum centered on the United States has been spreading to Europe, the Middle East, and other regions worldwide."

However, the stock price has been weak recently, declining for two consecutive days. One of the reasons appears to be the lower GPM. In the first quarter, SiliconTwo's GPM was 31.6%, down 0.8 percentage points from the previous quarter.

Kim Myungjoo, a researcher at Korea Investment & Securities, stated, "There may have been intensified competition in the U.S. market, discount sales of some inventory, and either a decrease in selling prices or an increase in purchase prices for certain brands depending on market conditions. It is worth noting that despite the continued strong dollar in the first quarter, the GPM for the first quarter of this year matched the level seen in the first half of 2022 (31.2%)."

The fact that performance expectations had already been reflected in the stock price is also seen as a factor. SiliconTwo's stock price, which was 25,750 won on March 4, rose to 42,650 won by May 11. This represents an increase of 65.63% during this period. Expectations for the European and Middle Eastern markets drove the stock price higher. Compared to the KOSDAQ, which fell from 737.90 to 722.52 over the same period, this is an overwhelming return.

However, the securities industry remains positive, expecting SiliconTwo's earnings improvement trend to continue. A total of five securities firms issued reports after SiliconTwo announced its results. Of these, three firms?Samsung Securities, Hana Securities, and Meritz Securities?raised their target prices. According to FnGuide, securities firms project SiliconTwo's sales and operating profit for this year at 888.3 billion won and 171.3 billion won, respectively, representing increases of 28.46% and 24.54% compared to the previous year.

Park Jongdae, a researcher at Meritz Securities, commented, "As the scale of European sales has far surpassed that of the U.S., expectations for global expansion have grown larger than concerns about intensified competition in the U.S. Demand for K-beauty globally is increasing much more than expected, and SiliconTwo is rapidly expanding its business territories. As the largest cosmetics trading vendor in Korea, SiliconTwo is expected to continue absorbing the global K-beauty momentum for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)