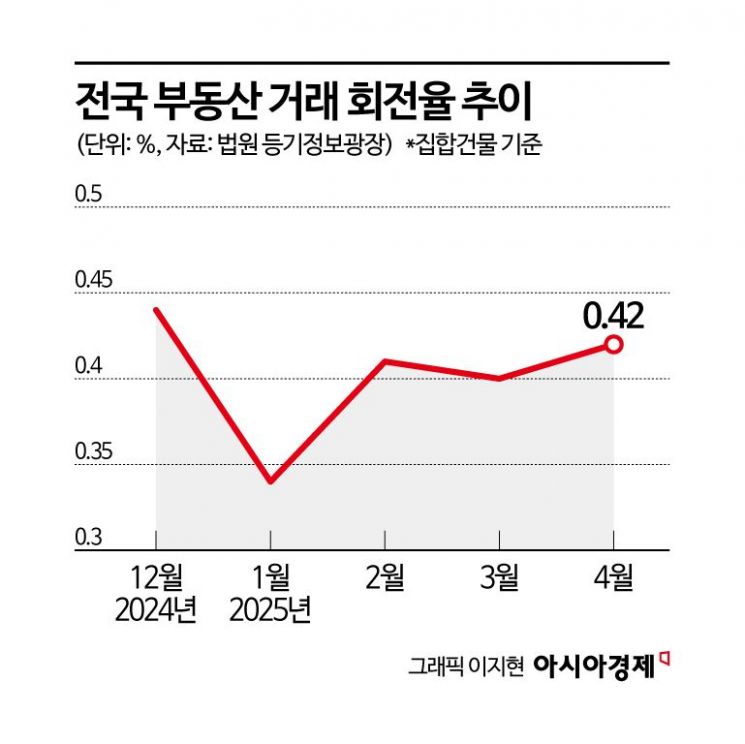

Last Month's Nationwide Real Estate Transaction Turnover Rate at 0.42%

Rising Trend Since January’s 0.34%... Incheon Records Highest at 0.66%

As the spring moving season arrives, real estate transactions are beginning to pick up. There are projections that this trend could gradually strengthen, due to factors such as political stability and potential benchmark interest rate cuts.

According to the Court Registration Information Plaza on May 13, last month’s nationwide transaction turnover rate for collective buildings?such as officetels, apartments, multiplex housing, and row houses?stood at 0.42%. The transaction turnover rate is calculated by dividing the number of real estate properties that changed ownership by the total number of properties, then multiplying by 100. This figure is used to compare the level of activity in the real estate sales market.

The transaction turnover rate has been on the rise this year. After reaching 0.44% in December 2023, it dropped to 0.34% in January 2024. However, it rebounded to 0.41% in February and 0.40% in March, returning to the December 2023 level. Compared to April 2023, when the rate was 0.46%, the gap has narrowed to just 0.04 percentage points.

By region, Incheon recorded the highest transaction turnover rate at 0.66%. This is 0.2 percentage points higher than the national average of 0.42%. It is analyzed that transactions have increased in Incheon, where prices are relatively lower even within the Seoul metropolitan area. According to the Korea Real Estate Board, Incheon’s comprehensive housing sales price index fell by 0.59% from January to March this year. During the same period, the overall Seoul metropolitan area saw a 0.08% increase. Daegu followed Incheon with a turnover rate of 0.62%.

The net inflow of population into Incheon also contributed to the activation of real estate transactions. In the first quarter of this year, Incheon recorded the highest net migration among cities and provinces, with 11,091 people. This is about 1.8 times higher than Seoul (6,129 people) and about twice as high as Gyeonggi Province (5,588 people).

Seoul recorded the lowest turnover rate at 0.29%. The decline was influenced by a decrease in apartment transactions after the re-designation of land transaction permission zones in March. In addition, the comprehensive housing sales price index in Seoul rose by 0.74% in the first quarter of this year, and as home prices soared, buyer sentiment weakened.

Experts predict that this trend will continue for the time being. In the market, there are expectations that the Bank of Korea’s Monetary Policy Board will cut interest rates this month. In the first quarter of this year, real gross domestic product (GDP) recorded negative growth at -0.246%. During the Monetary Policy Board meeting in March, the benchmark interest rate was held steady at 2.75% per annum, but a possible rate cut was hinted at. In addition, the won-dollar exchange rate, which had threatened the 1,500 won level last month, has since stabilized, further raising the possibility of a rate cut. If interest rates fall, it would have a positive impact on real estate buying sentiment.

Yoon Sumin, a real estate specialist at NH Nonghyup Bank, said, "In the case of Seoul, rather than new buyers entering the market due to rising prices, existing property owners are mainly trading up to different properties. As overall interest rates and mortgage rates decline, real estate transactions are expected to increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.