SNE Research Releases Analysis Report on Supply Chain Management

of the Four Major Lithium-ion Battery Materials

The market share of Ecopro, one of Korea's leading cathode material companies, has plummeted from first place to sixth in just one year. Last year, lithium iron phosphate (LFP) accounted for 64% of the global cathode material market, once again confirming the dominance of LFP.

According to the "Q1 2025 Lithium-ion Battery (LIB) Four Major Materials Supply Chain Management (SCM) Analysis and Mid- to Long-term Market Outlook" report published by market research firm SNE Research on May 12, 2024, global demand (usage) for lithium secondary battery cathode materials reached 3.36 million tons, and shipments totaled 3.67 million tons. Compared to 2023, demand increased by 24%, and shipments rose by 16%.

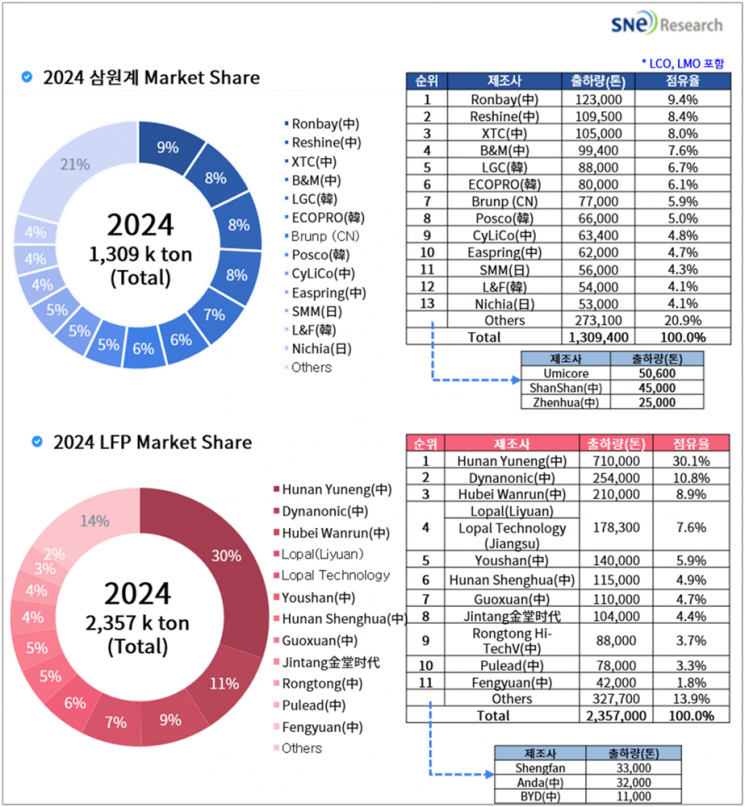

Among last year's cathode material shipments, LFP accounted for 2.357 million tons, representing about 64% of the total. The share of LFP cathode materials increased by 11 percentage points from 53% in the previous year.

In terms of total cathode material shipments?including both ternary and LFP types?China's Hunan Yuneng New Energy Battery Material shipped 710,000 tons, ranking first. Hunan Yuneng is a leading Chinese LFP cathode material manufacturer, supplying materials to major battery companies such as CATL, BYD, EVE Energy, and SVOLT.

For ternary cathode materials such as nickel cobalt manganese (NCM), nickel cobalt aluminum (NCA), lithium cobalt oxide (LCO), and lithium manganese oxide (LMO), China’s Ronbay Technology shipped 123,000 tons, ranking first. Next, Lishen ranked second with 109,500 tons, and XTC ranked third with 105,000 tons.

Korea’s LG Chem ranked fifth with 88,000 tons, while Ecopro (Ecopro BM and Ecopro EM) ranked sixth with 80,000 tons. Ecopro had ranked first in 2023 by supplying 120,000 tons. POSCO Future M supplied 66,000 tons, ranking eighth. L&F, which ranked fourth in 2023 with shipments of 85,000 tons, fell to twelfth place in 2024 with shipments of 54,000 tons.

Last year, the cathode material market saw declines in revenue and operating profit due to falling prices of metals such as lithium and nickel. As electric vehicle production and sales slowed, cathode material companies also slowed their production and capacity expansion. In contrast, Chinese companies continued to expand their production capacity amid concerns of oversupply, as LFP maintained its strong market position. With the increasing use of LFP in the electric vehicle and energy storage system (ESS) markets, Korea’s three major battery makers are also working to launch LFP ESS production lines ahead of schedule in response.

SNE Research stated, "While prices for NCM and LFP cathode materials are showing a marked downward trend, the development and expansion of production of high-voltage mid-nickel (Mid-Ni) ternary cathode materials is expected in the future." The firm also forecast, "With Chinese companies such as CATL and BYD continuously announcing the development and mass production of new products, technological and price competition will become even fiercer."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.