GM's Annual Losses Reach $5 Billion, Nvidia Faces $5.5 Billion in a Quarter

"Uncertainty" Mentioned 9,000 Times in Earnings Reports... Concerns at Their Peak

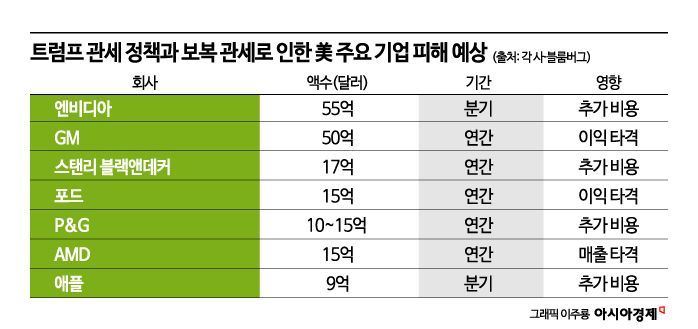

Bloomberg reported on May 8 (local time) that, due to President Donald Trump's trade war, American companies such as Apple and General Motors (GM) are expected to suffer damages amounting to tens of billions of dollars. In particular, many companies have not yet provided specific earnings forecasts and are conservatively estimating the impact of tariffs, raising concerns that the actual losses could be even greater.

The Trump administration imposed a 10% tariff on imports and slapped a "tariff bomb" of up to 145% on imports from China. In addition, tariffs have been placed on foreign steel, aluminum, automobiles, and other products.

Corporate concerns over the impact of tariffs have reached a peak. According to Bloomberg, the most frequently mentioned word during first-quarter earnings conference calls was "uncertainty." It appeared more than 9,000 times, surpassing even the frequency seen at the onset of the COVID-19 pandemic.

GM, the largest automaker in the United States, is among the companies hardest hit by tariffs. This is because vehicles produced in South Korea, Canada, and Mexico and imported into the United States have been subject to a 25% tariff. In addition, separate tariffs have been imposed on imported auto parts, dealing a blow to domestic factory production as well. GM stated that it expects to lose up to $5 billion (about 7.03 trillion won) in profits this year due to tariffs.

Ford also stated that its operating profit could decrease by about $1.5 billion this year because of tariff policies. Motorcycle manufacturer Harley-Davidson expects to incur costs of $175 million due to tariffs.

The U.S. government's export controls on artificial intelligence (AI) semiconductors to China are also expected to cause significant damage to the semiconductor industry. While Nvidia has not yet announced its results for this quarter, it revealed last month that the suspension of H20 chip exports to China would result in $5.5 billion in costs for this quarter. On May 6, AMD projected during its first-quarter earnings announcement that the policy would cause an annual revenue hit of $1.5 billion.

In addition, companies across various industries predicted negative impacts on their earnings due to tariffs. P&G estimated that annual costs would increase by $1 billion to $1.5 billion as a result of tariffs.

Tool manufacturer Stanley Black & Decker estimated that tariffs would have a total annual impact of $1.7 billion. Despite mitigating the impact through supply chain adjustments and price increases, the company still expects its profits to decrease by about 15% this year. Donald Allan, CEO of Stanley Black & Decker, said during a conference call on April 30, "Due to current tariffs, price increases in the U.S. market have become inevitable, and we implemented significant price hikes in April," adding, "We have informed customers that if tariffs remain at current levels, further price increases are likely to be necessary."

Additionally, Boeing expects manufacturing costs to increase by less than $500 million annually due to tariffs. Defense contractor RTX said it is preparing for an $850 million decline in operating profit. Honeywell International, GE Healthcare, and GE Aerospace each projected a $500 million hit this year, based on figures before supply chain adjustments and price increases are factored in.

Corporate executives have responded to tariffs in various ways, such as shifting production from China to other countries and accelerating raw material orders, in order to address rising costs. Amazon advanced some inventory purchases in the first quarter ahead of tariffs being imposed. Including additional costs related to customer returns, Amazon's first-quarter profitability declined by about $1 billion.

However, if the Trump administration's "tariff bomb" policy continues, the actual damage could be even greater. Bloomberg pointed out that "the advance warnings from major companies are likely underestimating the overall impact on net profits," adding, "Many companies have not yet provided specific guidance, and some are taking a wait-and-see approach." Furthermore, companies expected to be heavily affected by tariffs, such as Nvidia, Oracle, Home Depot, and Walmart, have not yet announced their results, and in some industries, such as online advertising, the full impact of tariffs will not be reflected until the end of this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.