Baemin Begins Charging Takeout Commission on April 14

Slight Decline in Both Users and Merchants

Coupang Eats, the Second-Largest Player, Sees Growth and Closes in on Baemin

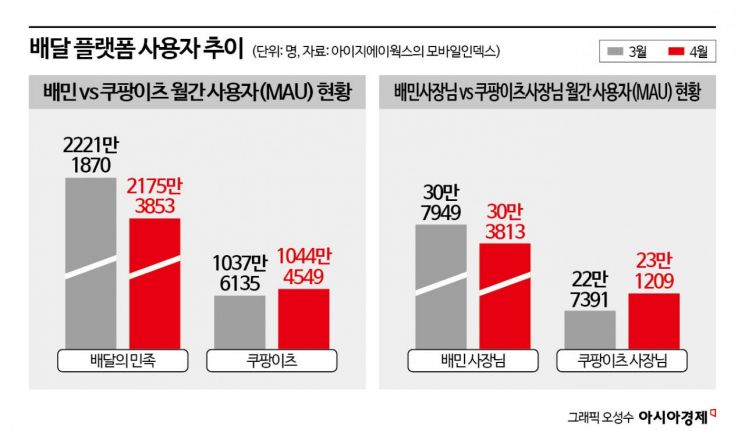

According to mobile index data from IGAWorks, a data platform company, as of April, Baemin, Coupang Eats, and Yogiyo recorded monthly active users (MAU) of 21.75 million, 10.44 million, and 4.86 million, respectively. Compared to the previous month, Baemin’s user base shrank by about 460,000, marking three consecutive months of decline since January this year. Coupang Eats, on the other hand, increased its user base by approximately 68,000 month-over-month, maintaining steady growth. Compared to the same period last year, Baemin’s user numbers have remained almost unchanged, while Coupang Eats has added more than 3.6 million users?a growth of about 53% in terms of user scale. Although Baemin still holds a dominant lead in the market, industry observers note that a sense of crisis is spreading due to Coupang Eats’ aggressive pursuit.

What stood out last month was the contrasting decisions made by Baemin and Coupang Eats regarding the introduction of takeout commission fees. Baemin decided to start charging a commission for takeout orders, ending a free policy that had lasted for more than five years. The commission was implemented starting April 14. In contrast, Coupang Eats extended its free takeout order commission policy?which was originally set to end in March?by another year. The MAU and other market indicators from last month represent the first results following these policy changes.

Baemin’s decision to introduce takeout commission fees, despite some resistance from restaurant owners, was based on the belief that the free policy had hindered investment and slowed the growth of takeout services. By revitalizing takeout, Baemin expected to attract new users who do not overlap with its delivery customers and to improve restaurant partners’ profitability. To this end, Baemin committed to a marketing investment of 30 billion won to promote takeout and revamped its app to make takeout orders easier. While last month’s decline in Baemin’s user numbers may be attributable to temporary or seasonal factors, the results have so far fallen short of expectations.

Looking at the number of participating merchants, Baemin’s strategy has not immediately gained traction in the market. Last month, the MAU for “Baemin Sajangnim” and “Coupang Eats Sajangnim”?the management apps used by merchants on Baemin and Coupang Eats?were 303,800 and 231,200, respectively. Compared to the previous month, the number of Baemin-affiliated merchants dropped by about 4,100, while Coupang Eats added approximately 3,800 merchants during the same period.

However, the general consensus in the industry is that it is too early to judge the success or failure of Baemin’s takeout activation strategy based solely on the initial market response. An industry official commented, “Baemin’s focus on takeout is a strategic move, as it has determined that relying solely on food delivery makes it difficult to achieve sustainable growth or differentiate its services. Since this is still the early stage of implementation, we need to continue monitoring the impact on the market.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.