Specific Model Outlined for Recognizing Paid-In Capital as Foreign Exchange Reserves

at the ASEAN+3 Finance Ministers and Central Bank Governors Meeting on May 4

"During discussions on a new funding structure for the Chiang Mai Initiative Multilateralization (CMIM), which serves as a regional financial safety net, the Bank of Korea, together with Bank Negara Malaysia, assumed the role of co-chair of the Technical Working Group. The ongoing discussions regarding the recognition of paid-in capital as part of foreign exchange reserves are expected to contribute to strengthening the credibility of the CMIM."

Changyong Lee, Governor of the Bank of Korea, made these remarks on May 4 (local time) after attending the 25th Korea-Japan-China Finance Ministers and Central Bank Governors Meeting and the 28th ASEAN+3 Finance Ministers and Central Bank Governors Meeting held in Milan, Italy.

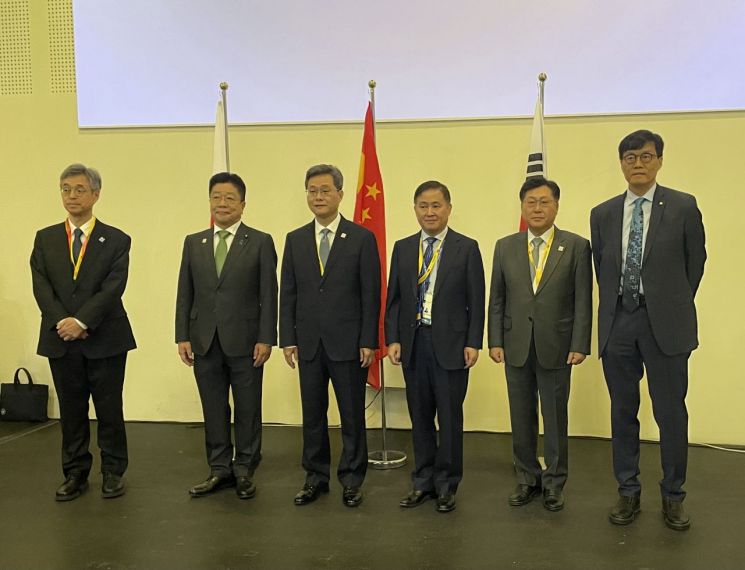

(From left) Ryuzo Himino, Deputy Governor of the Bank of Japan; Katsunobu Kato, Japanese Minister of Finance; Lan Foan, Chinese Minister of Finance; Pan Gongseng, Governor of the People's Bank of China; Ji Young Choi, Vice Minister of Strategy and Finance; and Changyong Lee, Governor of the Bank of Korea, are taking a photo after attending the Korea-Japan-China Finance Ministers and Central Bank Governors Meeting held on the 4th (local time) in Milan, Italy. Bank of Korea

(From left) Ryuzo Himino, Deputy Governor of the Bank of Japan; Katsunobu Kato, Japanese Minister of Finance; Lan Foan, Chinese Minister of Finance; Pan Gongseng, Governor of the People's Bank of China; Ji Young Choi, Vice Minister of Strategy and Finance; and Changyong Lee, Governor of the Bank of Korea, are taking a photo after attending the Korea-Japan-China Finance Ministers and Central Bank Governors Meeting held on the 4th (local time) in Milan, Italy. Bank of Korea

ASEAN+3 consists of the ten ASEAN member countries?Malaysia, Indonesia, Thailand, the Philippines, Singapore, Brunei, Vietnam, Laos, Myanmar, and Cambodia?along with Korea, Japan, and China. The 'Finance Ministers and Central Bank Governors Meeting,' which discusses cooperation in currency and financial sectors, has been held annually since 1999.

At this meeting, member countries focused on strengthening the CMIM, a $240 billion ASEAN+3 regional multilateral currency swap arrangement that functions as a regional financial safety net. Member countries agreed to focus on the IMF-type model, which is considered more likely to allow paid-in capital to be recognized as foreign exchange reserves, as the new funding structure for the CMIM, known as the Paid-In Capital (PIC) approach.

The Bank of Korea and Bank Negara Malaysia will serve as co-chairs of the Technical Working Group, which was established to ensure a smooth transition to the PIC model. Member countries welcomed the establishment of the Technical Working Group and highly valued the Bank of Korea's role in leading discussions on the recognition of paid-in capital as foreign exchange reserves and achieving significant progress.

Governor Lee assessed that these achievements would contribute to enhancing the credibility of the CMIM, and emphasized the need to make progress through a step-by-step approach, including reaching agreement among member countries on a specific model and holding further consultations with the IMF. Ministers and governors instructed that work should proceed on the key tasks necessary for the transition to the PIC model, based on the IMF-type approach.

Member countries established a Rapid Financing Facility (RFF) to provide swift financial support in the event of sudden external shocks such as pandemics or natural disasters. They also agreed to amend the CMIM agreement to expand the eligible freely usable currencies (FUC) available for this facility. The Rapid Financing Facility is a small-scale, short-term funding program designed to address crises caused by temporary external shocks such as natural disasters, with no ex-ante or ex-post conditionality. Eligible freely usable currencies include the US dollar, euro, yen, yuan, and pound sterling. Under the current CMIM framework, only the US dollar can be freely provided, but this will be expanded to include the Japanese yen and Chinese yuan. Member countries plan to conduct a simulation exercise this year to ensure the smooth operation of the newly established RFF.

Meanwhile, member countries projected that the regional economy would maintain solid growth and low inflation this year, but also agreed that high uncertainty remains due to factors such as economic fragmentation driven by rising protectionism, worsening global financial conditions, and a slowdown in growth among major trading partners. In response, they discussed securing fiscal policy space, making cautious adjustments to monetary policy, and maintaining exchange rate flexibility as a buffer against external shocks. They reaffirmed their support for the free trade system centered on the World Trade Organization (WTO), called for international organizations to play a greater role in policy recommendations, and agreed to further strengthen macroeconomic policy dialogue and financial cooperation among regional authorities.

Next year, the 26th Korea-Japan-China Finance Ministers and Central Bank Governors Meeting will be hosted by Korea (as chair), and the 29th ASEAN+3 Finance Ministers and Central Bank Governors Meeting will be co-hosted by Japan and the Philippines in Samarkand, Uzbekistan.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.