All Five Major Construction Firms See Sales Decline... Cost Ratios Drop for All Except Samsung C&T

DL E&C and Daewoo Engineering & Construction Post Over 30% Growth in Operating Profit... 'Profit Over Scale' Strategy Pays Off

"High-Cost Projects Cleared, Margin Recovery Accelerates... This Year Marks a Shift Toward Substance"

Although the five major listed construction companies in South Korea saw a slight decrease in their overall scale in the first quarter of 2025, they managed to maintain profitability. Despite unfavorable market conditions such as persistently high interest rates and a stagnant pre-sale market, their strategies to lower the cost ratio (the proportion of costs to sales) and defend profit margins proved effective to some extent. In particular, DL E&C and Daewoo Engineering & Construction led the recovery in profitability, each recording over 30% growth in operating profit. The strategy of prioritizing 'profit over orders' and 'substance over scale' has begun to be clearly reflected in the quarterly results of construction companies.

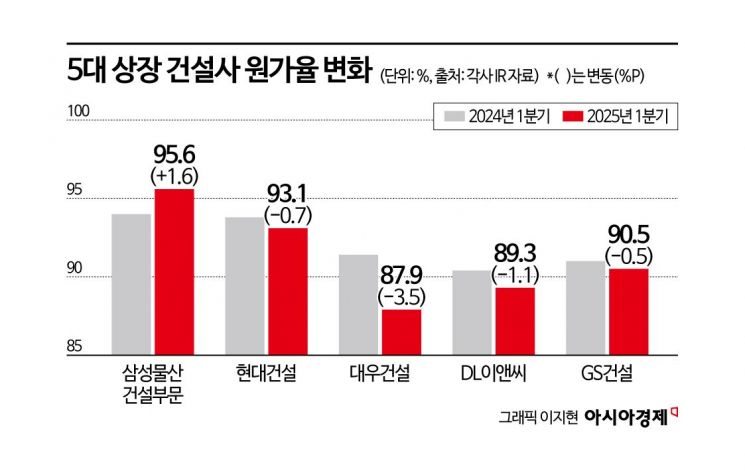

According to the first quarter 2025 business reports disclosed on the Financial Supervisory Service's electronic disclosure system on May 7, all five major construction companies?Samsung C&T Engineering & Construction Group, Hyundai Engineering & Construction, Daewoo Engineering & Construction, DL E&C, and GS Engineering & Construction?reported a decline in sales compared to the same period last year. However, except for Samsung C&T, the cost ratio decreased across the remaining four companies. Daewoo Engineering & Construction lowered its cost ratio from 91.4% to 87.9%, and DL E&C from 90.4% to 89.3%. Hyundai Engineering & Construction and GS Engineering & Construction also improved their cost ratios by 0.7 percentage points and 0.5 percentage points, respectively, thereby maintaining profitability.

This improvement in cost ratios translated into actual profit indicators. DL E&C posted an operating profit of 80.9 billion won, a 32.97% increase year-on-year, while Daewoo Engineering & Construction recorded 151.3 billion won, marking a 31.79% rise in operating profit. Both companies demonstrated a tangible recovery in profitability. GS Engineering & Construction reported an operating profit of 70.4 billion won, similar to the previous year, and Hyundai Engineering & Construction, despite a 14.8% decrease, still maintained a high profit level at 213.7 billion won.

The construction division of Samsung C&T underperformed. Its cost ratio rose slightly from 94.0% to 95.6%, and operating profit plummeted by 52.8%, from 337.0 billion won in the previous year to 159.0 billion won. However, analysts note that due to the high proportion of long-term overseas projects in its business structure, quarterly performance fluctuations can be significant, and robust annual profitability is still expected.

Looking at sales, all five major construction companies experienced a decline compared to the previous year. Samsung C&T recorded 3.62 trillion won, a decrease of 35.1%. Hyundai Engineering & Construction saw a 12.7% drop from 8.5452 trillion won to 7.4555 trillion won. Daewoo Engineering & Construction was tallied at 2.0767 trillion won (-16.5%), DL E&C at 1.8081 trillion won (-4.4%), and GS Engineering & Construction at 3.0629 trillion won (-0.3%). While the overall scale remained sluggish, the industry assesses that the shift toward profit-focused management has partially taken hold, strengthening their defensive capabilities.

Kim Saeryeon, a researcher at LS Securities, stated, "Since last year, as apartment occupancy volumes peaked out, overall housing sales have declined. As projects that began in 2021 are being completed in sequence, construction projects that previously had poor margins are now entering a phase of profitability improvement." She added, "As the period when high construction material prices could not be reflected in construction costs has passed, the trend of profitability recovery has gradually emerged since the last quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.