Audit Hours and Costs Rise Amid Increasingly Complex Accounting Standards

Soaring Audit Fees... Only Accounting Firms Benefit from 'Standard Changes'

It has been revealed that major domestic insurance companies have borne audit fees exceeding 30 billion won for two consecutive years following the introduction of the International Financial Reporting Standard 17 (IFRS17) in 2023. Frequent changes in accounting standards have increased the volume of accounting work, leading to higher related costs.

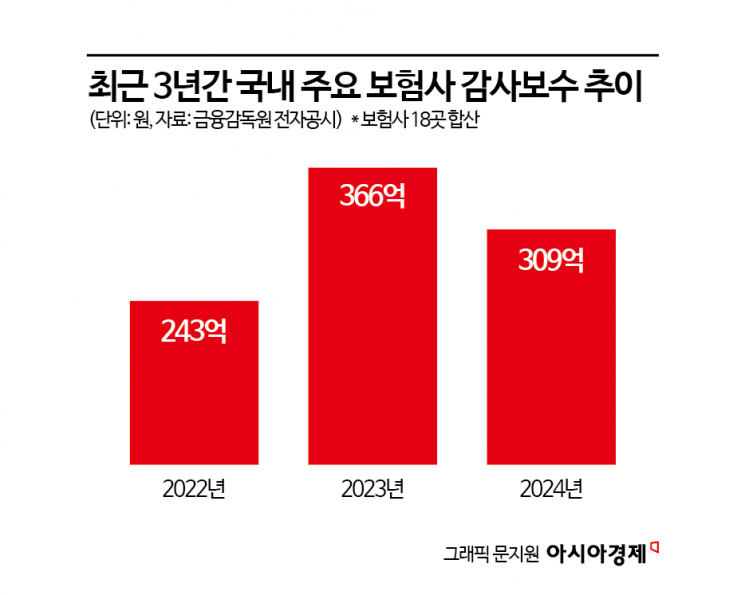

According to the business reports of 18 major domestic insurance companies (9 life insurers and 9 non-life insurers) listed on the Financial Supervisory Service's electronic disclosure system as of May 2, 2025, these insurers paid a total of 36.6 billion won in audit fees in 2023 and 30.9 billion won in 2024, surpassing 30 billion won for two consecutive years. In 2022, the year before the introduction of IFRS17, the total was 24.3 billion won, but costs increased significantly after the new standard was implemented. The total accounting service costs, including both audit and non-audit services, were 46.5 billion won in 2023 and 39.5 billion won in 2024.

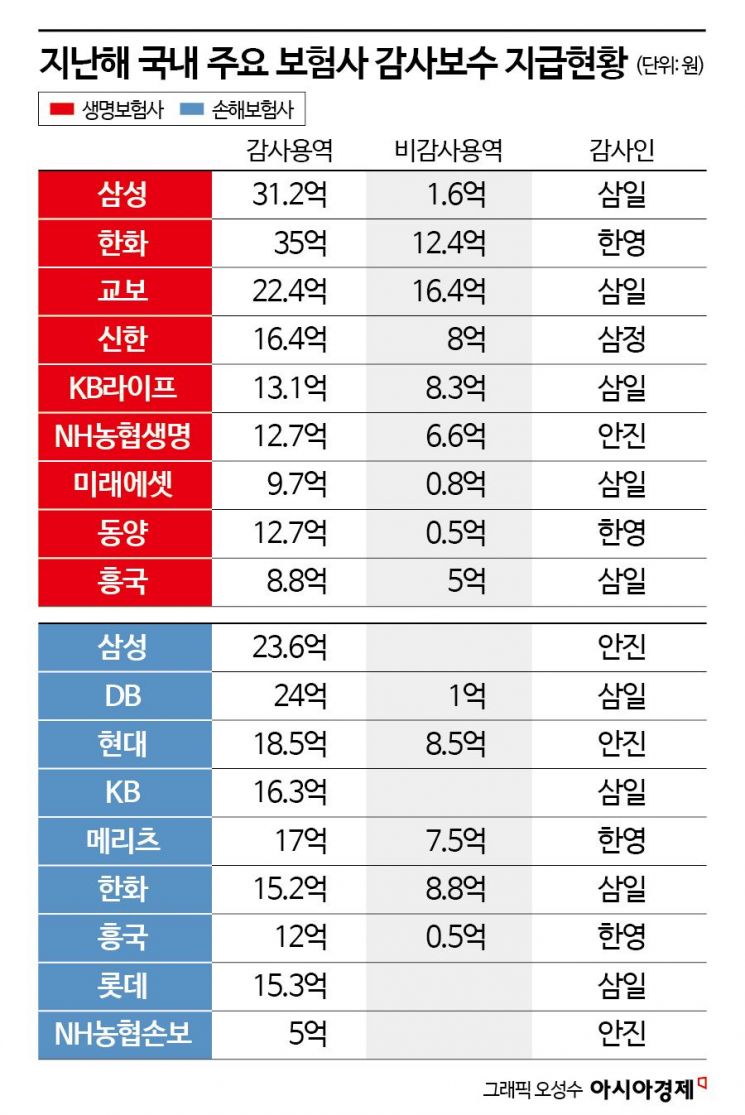

The company that paid the highest audit fee last year was Hanwha Life Insurance, with a total of 3.5 billion won. This was due to increased audit work related to internal accounting systems and overseas subsidiaries in Vietnam, Indonesia, and Japan. Hanwha Life Insurance also spent an additional 1.24 billion won on non-audit services, including verification reports for the capital adequacy ratio (K-ICS) and audits of variable insurance funds.

Samsung Life Insurance ranked second, paying 3.12 billion won in audit fees. Samsung Life Insurance bore costs for financial statement reviews and internal accounting system-related expenses. It also spent an additional 160 million won on non-audit services such as tax advisory work.

Among unlisted companies, Kyobo Life Insurance paid the highest audit fee at 2.24 billion won. This was due to costs related to IFRS17 audits and financial statement reviews. In addition to audit fees, Kyobo Life Insurance spent another 1.64 billion won on non-audit services, including K-ICS external verification contracts, policy re-evaluation of Kyobo brand usage fees, and sustainability report preparation services.

KB Life Insurance saw the largest year-on-year increase in audit fees, rising 20.1% from 1.09 billion won to 1.31 billion won. In contrast, Hyundai Marine & Fire Insurance experienced the largest decrease, with audit fees dropping 37.7% from 3.5 billion won to 2.36 billion won.

In general, audit fees are determined in proportion to audit hours. According to the insurance industry, the introduction of IFRS17 has significantly increased audit hours, resulting in higher audit fees. The core of IFRS17 is to evaluate liabilities at present value, which involves incorporating various actuarial assumptions and empirical statistics, such as discount rates, lapse rates, and loss ratios. An industry official stated, "As the verification of actuarial assumptions has become more time-consuming, there have been cases where additional costs were incurred beyond the originally contracted audit hours," adding, "Since a single figure used in these assumptions can alter performance results, the IFRS17 verification process is particularly demanding."

There were also opinions that audit work has increased because financial authorities have frequently changed detailed systems, such as accounting guidelines, since the introduction of IFRS17. A senior executive at an insurance company commented, "Last year, there were changes such as the guideline for lapse rates on no- and low-surrender value insurance, and this year, further changes such as the basic capital regulation are scheduled. Therefore, the burden of audit costs is unlikely to decrease," adding, "The biggest beneficiaries of the IFRS17 introduction are likely to be accounting firms."

Meanwhile, the audit contracts for the 18 insurance companies were monopolized by the Big Four accounting firms (Samil, Samjeong, Anjin, and Hanyoung). Samil handled nine companies, while Anjin and Hanyoung each handled four, and Samjeong handled one.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)