Negotiated Price Below 900 Billion Won After Talks With VIG

Woongjin to Raise Funds Through Perpetual Bonds and Acquisition Financing

Accelerating 'Total Life Care' in Education, IT, and Healthcare

Woongjin Group is set to acquire Preed Life, the largest funeral service company in South Korea.

According to industry sources on April 30, Woongjin's subsidiary WJ Life signed a share purchase agreement (SPA) on April 29 with private equity firm VIG Partners to acquire a 99.77% stake in Preed Life. The acquisition price is 883 billion won. Woongjin has already paid a deposit of 88.3 billion won, which is 10% of the total acquisition amount, and the acquisition will be finalized once the remaining balance is paid by the end of next month.

Woongjin secured exclusive negotiation rights in February and conducted due diligence for about five weeks. Afterward, the company reached an agreement with VIG Partners on the acquisition price and major terms, thereby concluding the acquisition process.

VIG Partners had initially expected Preed Life to be valued at 1 trillion won. However, during the final negotiations, the price was lowered to below 900 billion won. It appears that Woongjin focused on price negotiations, given its limited internal funding capacity and the expectation that a significant portion of the funds would need to be sourced externally. As of the end of last year, Woongjin's cash and cash equivalents totaled less than 50 billion won. Many in the industry expressed skepticism about the feasibility of this acquisition.

A Woongjin representative explained, "The funds for this transaction will be raised through existing assets and cooperation with external financial institutions, utilizing perpetual bond issuance and acquisition financing without a capital increase," adding, "We prioritized not worsening the company's financial structure, not burdening the market, and not decreasing shareholder value."

Woongjin plans to turn Preed Life into a "total life care platform" by linking it with its existing affiliate services in education, IT, leisure, beauty, and healthcare. The funeral service market is expected to grow at an average annual rate of 5% through 2029. A Woongjin official stated, "We expect that developing related products and expanding sales channels will enhance the profitability of affiliates such as Woongjin Thinkbig."

As of the end of last year, Preed Life was the number one company in the domestic funeral service industry, with advance payments totaling 2.56 trillion won. Since being acquired by VIG Partners in 2020, Preed Life has achieved its current dominant scale through mergers with other funeral service companies owned by VIG, such as Good Life.

Combining the proceeds from this sale and dividends paid over the past year, VIG Partners' total returns are expected to exceed 1 trillion won. When VIG acquired Preed Life, the purchase price reported in the market was in the range of 300 to 400 billion won.

On this day, VIG issued a press release stating, "We will recover more than four times our original investment," and added, "This sale marks the third exit from our third fund (700 billion won, established in 2016) and the first exit from our fourth fund (approximately 1 trillion won, established in 2020). Going forward, we will accelerate the investment recovery process for both the third and fourth funds."

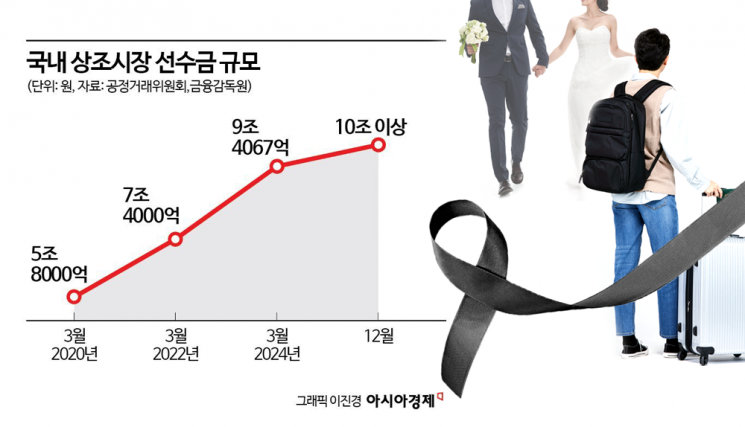

Woongjin's acquisition of Preed Life is expected to intensify competition in the funeral service market. According to the Fair Trade Commission, as of the end of March last year, the total amount of advance payments in the funeral service industry was 9.4486 trillion won. Over the following nine months, the top five companies attracted more than 620 billion won in advance payments, pushing the market past the 10 trillion won mark for the first time. The number of funeral service subscribers is also expected to surpass 9 million.

By company, as of the end of last year, Preed Life held the largest amount of advance payments at 2.5606 trillion won, followed by Boram Sangjo (1.549 trillion won), Kyowon Life (1.4545 trillion won), Daemyung Station (1.3982 trillion won), and The-K Yedaham (740.2 billion won).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)