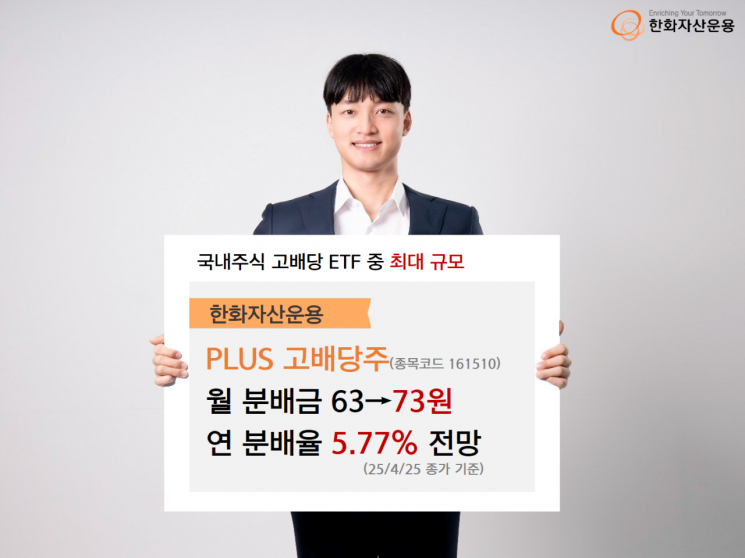

Hanwha Asset Management announced on April 29 that it will increase the monthly per-share distribution of the 'PLUS High Dividend Stocks' Exchange Traded Fund (ETF) from 63 KRW to 73 KRW starting in May.

With this increase, the dividend growth rate of the PLUS High Dividend Stocks ETF reaches 15.9%. Based on the closing price on April 25, the monthly distribution rate is 0.48%, and the annual distribution rate is 5.77%. The increased distribution will be paid to investors holding the 'PLUS High Dividend Stocks' ETF as of May 28, with payments starting in early June. The increased monthly distribution of 73 KRW will be paid consistently every month until April next year.

The PLUS High Dividend Stocks ETF is the largest dividend ETF investing in domestic stocks. As of April 25, its net asset value stood at 680.3 billion KRW, with rapid inflows of capital. From the beginning of the year through April 25, individual net purchases amounted to 153.7 billion KRW.

Since the first distribution in 2013, the PLUS High Dividend Stocks ETF maintained an average annual dividend growth rate of 10.1% for 11 years until the introduction of monthly distributions in 2024. After switching to a monthly distribution in May last year, it paid a consistent monthly distribution of 63 KRW. With the recent increase, the dividend growth rate has reached a higher level of 15.9% compared to the past. This reflects both the confirmed year-end dividends of the ETF's holdings last year and the projected dividend outlook going forward.

Hanwha Asset Management explained that even when compared to the 'Schwab US Dividend Equity (SCHD)' ETF, which is considered a leading US dividend growth ETF, the PLUS High Dividend Stocks ETF is highly competitive in terms of both dividend growth rate and yield. While SCHD maintains an annual dividend yield of around 3-4%, the PLUS High Dividend Stocks ETF is expected to offer a yield in the upper 5% range following the distribution increase. The ETF continues to raise its distributions each year, and is thus considered to have superior competitiveness in dividend growth rate compared to SCHD.

Along with the increased distribution, investors can also benefit from the compounding effect of reinvesting distributions. Taking distribution reinvestment into account, the PLUS High Dividend Stocks ETF delivered returns of 19.7% over the past year and 41.6% over three years. The five-year return reached 140.9%, outperforming the KOSPI 200, which recorded 50.6% over the same period, by approximately 90 percentage points (P).

Kim Jungsub, Head of the ETF Business Division at Hanwha Asset Management, explained, "The stock price trend of high dividend stocks has become even more robust recently, as various dividend activation policies are being reviewed, including amendments to the Commercial Act and reductions in dividend tax rates." He added, "The PLUS High Dividend Stocks ETF will provide the optimal investment opportunity for investors seeking predictable cash flows, based on its two pillars of annual dividend growth of over 10% and fixed monthly distributions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.