KB Kookmin Bank Further Lowers Non-Face-to-Face Mortgage Loan Rates

As Benchmark Rate Falls, Both Lending and Deposit Rates Decline

Rates Expected to Continue Falling for the Time Being

As expectations for a benchmark interest rate cut grow, mortgage loan rates at commercial banks continue to decline. With the Bank of Korea increasingly likely to further lower its benchmark rate due to sluggish economic conditions, there are forecasts that the previously slow decline in lending rates will accelerate going forward.

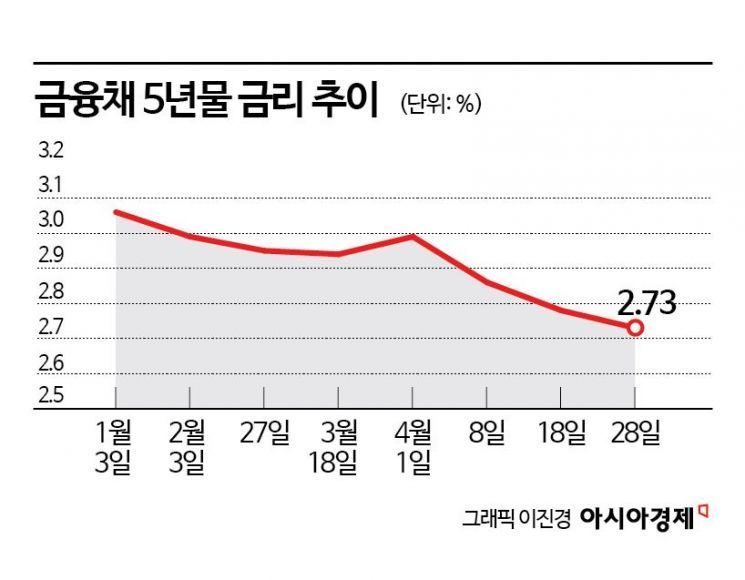

According to the financial sector on April 29, KB Kookmin Bank announced the previous day that it had reduced the interest rate on its non-face-to-face mortgage product, "KB Star Apartment Mortgage Loan" (mixed/periodic), by 0.04 percentage points from the previous week to 3.60%. If an electronic contract is used, a preferential rate of 0.2% is applied, bringing the mortgage loan rate down to 3.40%. The interest rate for the KB Star Apartment Mortgage Loan, which was in the low 4% range at the beginning of the year, has recently been dropping noticeably. A KB Kookmin Bank official stated, "As the financial bond rate, which serves as the basis for determining lending rates, has fallen, mortgage loan rates have also declined." The five-year financial bond rate has fallen from 3.06% at the beginning of the year to 2.73% as of the previous day.

As financial bond rates fall, not only KB Kookmin Bank but also most banks, including Shinhan Bank, Hana Bank, and Woori Bank, are seeing declining mortgage loan rates. Hana Bank's five-year fixed (mixed) mortgage loan rate dropped by about 0.05 percentage points over the past week, while Shinhan Bank's rate fell by about 0.04 percentage points during the same period.

The financial sector expects that mortgage loan rates will continue to fall for the time being, driven by the Bank of Korea's additional benchmark rate cuts. As the domestic economy contracted in the first quarter, there is growing speculation in the market that the Bank of Korea may lower the benchmark rate as early as next month to support the economy. With the domestic economic downturn persisting, there is also a possibility that the current 2.75% benchmark rate could fall to the low 2% range by the end of the year. A Hana Bank official said, "As key rates used to determine lending rates, such as the Bank of Korea's benchmark rate and financial bond rates, continue to fall, there is a high possibility that mortgage loan rates will decline further."

As the benchmark rate falls, not only lending rates but also deposit and savings rates are trending downward. According to the Korea Federation of Banks, the highest interest rate for regular deposits at the four major banks is currently in the mid-2% range per annum. Deposit rates, which were in the mid-3% range at the beginning of the year, have been steadily declining.

However, there are criticisms that the decline in deposit and savings rates is outpacing the decline in lending rates, leading to concerns over excessive interest margins for banks. In the first quarter, domestic banks recorded their highest-ever profits, largely due to the widening gap between lending and deposit rates. A financial sector official explained, "As the benchmark rate falls, bank rates overall are continuing to decline," and added, "The slow pace of the drop in lending rates is partly due to the financial authorities' request for banks to manage loans, following volatility in housing prices caused by the controversy over lifting land transaction permit zones in the first quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.