KB Asset Management's exchange-traded fund (ETF), the 'RISE Berkshire Portfolio TOP10 ETF,' is celebrating its first anniversary by holding a special event starting April 28.

Listed in February last year, the RISE Berkshire Portfolio TOP10 ETF is a product that tracks the investment portfolio of Berkshire Hathaway. It implements the investment strategy of the "legendary investor" Warren Buffett in the form of an ETF.

Berkshire Hathaway is an insurance and investment holding company acquired by Buffett in 1965. It currently manages approximately 450 trillion won in assets and is considered one of the most influential global investment groups.

Amid rapidly increasing market volatility this year, the RISE Berkshire Portfolio TOP10 ETF has shown relatively stable performance.

While the S&P 500, the leading U.S. index, posted a return of -12.3% since the beginning of the year, the RISE Berkshire Portfolio TOP10 ETF recorded a smaller decline of -8.9% over the same period. Looking at the one-year return, the RISE Berkshire Portfolio TOP10 ETF posted 20.6%, outperforming the S&P 500's 3.8%. The ETF is being recognized for capturing both defensiveness and profitability.

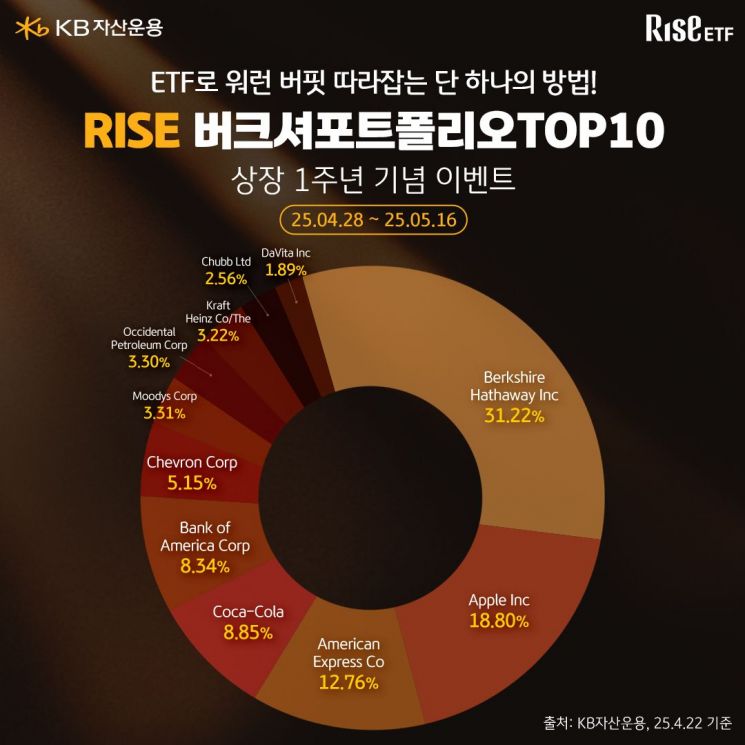

This is attributed to the RISE Berkshire Portfolio TOP10 ETF's unique value stock-centered portfolio, which is composed mainly of Berkshire Hathaway's core holdings and demonstrated strong resilience during volatile market conditions.

According to the Bloomberg Billionaires Index released on April 5, Buffett is the only one among the world's top 10 richest people whose assets increased since the beginning of the year. In addition, Buffett's move to raise his cash holdings to a record high ahead of the stock market plunge is being highlighted again, drawing renewed attention to his long-term investment philosophy among investors.

No Areum, head of the ETF Business Division at KB Asset Management, said, "Warren Buffett's investment principle is to invest long-term in high-quality companies without being swayed by short-term market trends," adding, "The RISE Berkshire Portfolio TOP10 ETF is the only domestic product that follows this strategy, making it highly recommended as a long-term pension investment portfolio."

The first anniversary event will run through May 16 and can be entered via the official 'RISE ETF' website. Participants in the quiz event will be entered into a drawing to win prizes related to companies in which Buffett has actually invested. Prizes include Apple AirPods 4th generation, Kraft Heinz sauce sets, and Coca-Cola sets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.