Sold All Kakao Shares Worth 413.3 Billion Won

Funds Secured for SK Broadband Acquisition

Six Years After Strategic Partnership in 2019

"Cooperation Expected to Weaken"... Both Companies Deny

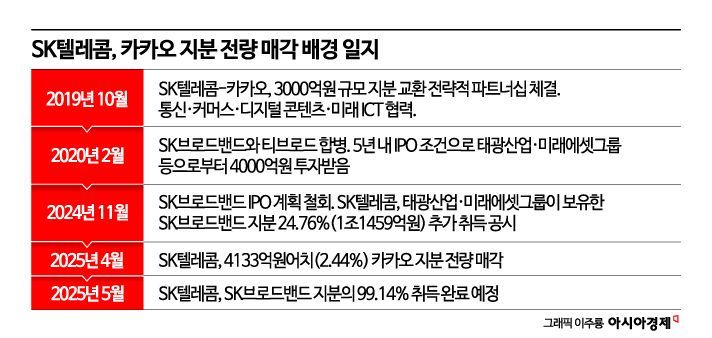

On April 25, SK Telecom sold its entire stake in Kakao, valued at 413.3 billion won, on the market. The company requires a total of 1.1459 trillion won to fully acquire SK Broadband as a wholly owned subsidiary, and the sale of its Kakao shares will partially fund this acquisition.

SK Telecom plans to accelerate future growth investments related to artificial intelligence (AI), such as data centers, once it completes the full acquisition of SK Broadband. In 2019, SK Telecom and Kakao entered into a strategic partnership and exchanged equity stakes, but with this sale, there are expectations that the cooperation between the two companies may become somewhat looser.

On this day, SK Telecom announced that it would sell its entire 2.44% stake in Kakao, worth 413.3 billion won, through an after-hours block deal. The number of shares sold is 10,818,510.

Securing Over 99% of SK Broadband Shares... AI Business Synergy

SK Telecom's complete sale of Kakao shares is aimed at raising funds to make SK Broadband a wholly owned subsidiary. By May 14, the company plans to acquire the SK Broadband shares held by Taekwang Industrial (16.8%) and Mirae Asset Group (8%). SK Broadband received a 400 billion won investment from Taekwang Industrial and Mirae Asset Group in 2020, when it merged with Tbroad and set a five-year target for an initial public offering (IPO). However, as the IPO plan was withdrawn, SK Telecom is now reacquiring those shares. This acquisition will require 1.1459 trillion won in funding. Once completed, SK Telecom will own 99.14% of SK Broadband. Going forward, SK Telecom and SK Broadband are expected to expand investments in growth potential businesses such as data centers and submarine cables.

With SK Telecom's complete sale of its Kakao stake, there is growing interest in the future of the two companies' partnership. In October 2019, SK Telecom and Kakao formed a strategic partnership and exchanged equity stakes worth 300 billion won. The companies stated that they would cooperate in four key areas: telecommunications, commerce, digital content, and future ICT.

The two companies mainly collaborated in content and ICT. KakaoPage, Kakao Webtoon, and KakaoT partnership products were offered on SK Telecom's subscription platform "T Universe," and SK Telecom participated as a managed service provider (MSP) for Kakao Cloud. In 2021, the two companies also jointly invested in startups through an ESG (Environmental, Social, and Governance) fund they co-established.

Essentially Competitors... Maintaining Surface-Level Cooperation

However, as the companies are essentially competitors in key business areas, the synergy has been evaluated as limited. The mobility sector, where SK Telecom's affiliate T Map Mobility and Kakao Mobility compete in areas such as maps and navigation, is a prime example. In commerce, 11st and KakaoTalk Gift and TokDeal are also in competition. In the AI sector, SK Telecom is focusing on its AI agent "A.Dot," which supports a multi-large language model (LLM), while Kakao is preparing a beta test for its AI service "Kanana" in the first half of this year.

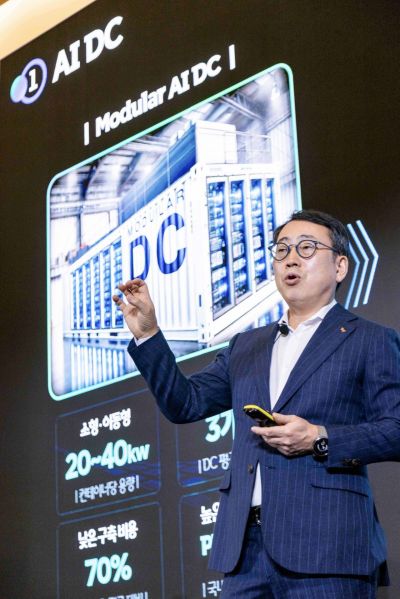

Yoo Youngsang, CEO of SK Telecom, is explaining the strategy to advance the AI business. Photo by Yonhap News Agency, provided by SK Telecom

Yoo Youngsang, CEO of SK Telecom, is explaining the strategy to advance the AI business. Photo by Yonhap News Agency, provided by SK Telecom

Regarding the partnership after the stake sale, an SK Telecom representative stated, "Close cooperation with Kakao, including cloud business collaboration and joint fund management, will remain unchanged." Kakao also stated that it has no plans to sell its current SK Telecom shares for the time being. Kakao currently holds shares in SK Telecom and SK Square through its subsidiary Kakao Investment. A Kakao representative explained, "We plan to continue our cooperative relationship with SK Telecom." However, the large-scale sale did have some impact on Kakao's stock price. At around 9 a.m. on this day, Kakao was trading at 37,450 won, down 5.07% (2,000 won) from the previous day.

If SK Telecom makes SK Broadband a wholly owned subsidiary, the pace of its AI business is expected to accelerate. SK Telecom is jointly pursuing its AI data center (AIDC), a key infrastructure and core business, with SK Broadband. SK Broadband has been in the data center business since its days as Hanaro Telecom and currently operates large-scale data centers in areas such as Gasan, Seoul. Recently, SK Telecom and SK Broadband purchased land in the Ulsan Mipo National Industrial Complex. It is known that a 100MW (megawatt) class AI data center (AIDC) will be established there. An SK Broadband representative explained, "SK Telecom will design new business models through the introduction and investment in cutting-edge AI technology, while SK Broadband will be responsible for land acquisition, construction, and the maintenance and management of the data center buildings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)