'Courtyard Marriott Seoul Namdaemun' Sale Begins

Euljiro Tower Preferred Bidder Selection Underway

20 Real Estate Assets to Be Sold This Year

Focus Returns to Core Business Amid Real Estate Downturn

Record Overseas Sales... Full-Scale Investment in Factories

KT&G is accelerating its reduction of highly profitable real estate operations. The company is liquidating non-core assets to secure cash and focus on its main business, tobacco. In particular, as domestic sales decline due to anti-smoking policies and a decreasing population, KT&G is concentrating on establishing overseas factories. With the expansion of its overseas cigarette business as a mid- to long-term vision, the company is focusing all its efforts on increasing production bases and improving market accessibility.

According to industry sources on April 24, KT&G has sent out requests for proposals (RFPs) to real estate consulting firms and accounting firms for the sale of the 'Courtyard Marriott Seoul Namdaemun' hotel. The Courtyard Marriott Seoul Namdaemun is a four-star hotel operated by Sangsang Stay, in which KT&G holds a 100% stake. As a prime hotel in Seoul, the estimated sale price is in the range of 100 billion to 200 billion KRW.

The company is also pursuing the sale of the KT&G Euljiro Tower located in Jung-gu, Seoul. KT&G has selected Samjong KPMG as its advisor and is in the process of selecting a preferred bidder. Last year, the company sold the Bundang Tower in Seongnam, Gyeonggi Province to Pebblestone Asset Management for 127.4 billion KRW. This sale generated a profit of over 50 billion KRW, as KT&G had purchased Bundang Tower from Richmond Asset Management in 2018 for 68.5 billion KRW, selling it about six years later.

The sale of non-core assets is part of the company’s value enhancement plan announced last year. At that time, KT&G declared its intention to expand its three core businesses (overseas cigarettes, heated tobacco products, and health supplements), stating that the necessary funds would be raised by restructuring low-yield and non-core assets. The company also announced a specific plan to dispose of 57 real estate assets by 2027. According to this plan, KT&G is expected to sell an additional 20 real estate assets this year.

The prolonged slump in the real estate market is another reason why the company is accelerating the disposal of non-core assets. Since 2015, KT&G has actively expanded its real estate business, investing in various properties to manage cash generated from its tobacco business. Investments included Starfield Suwon, Gwacheon Knowledge Industry Center, and Cheongna Medical Complex Town development projects. As a result, the company’s real estate business became a cash cow, recording sales of 744.7 billion KRW by 2020. However, as market conditions worsened, sales declined to 607.1 billion KRW in 2022, 550.1 billion KRW in 2023, and 361.3 billion KRW last year.

An industry insider explained, "KT&G was well-known as a major player in real estate investment. Its profitability was so high that there were even suggestions the company was focusing more on real estate than its main business. However, as the real estate market deteriorated recently, the company has been significantly reducing its investment scale."

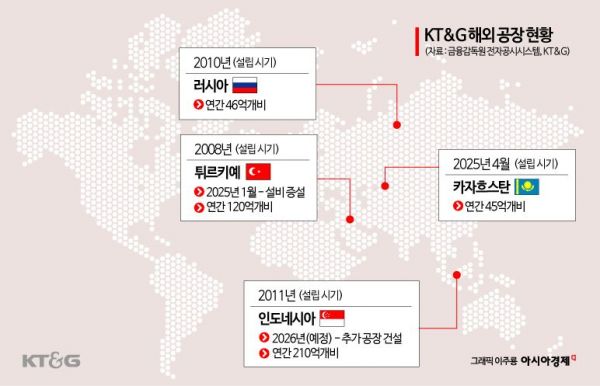

KT&G plans to use the cash secured through real estate sales to drive growth centered on its core business. A representative example is the expansion of overseas factories. In January this year, the company expanded its plant in Turkiye, increasing its floor area by 1.5 times to a total of 25,000 square meters, and added two state-of-the-art production lines, bringing the total to four. This enables KT&G to produce up to 12 billion cigarettes annually at this facility.

Recently, KT&G established a new factory in Kazakhstan, which will serve as a production base for the Eurasian market. The new plant in Almaty Province, Kazakhstan, has a total floor area of 52,000 square meters and is equipped with three production lines, allowing for an annual output of 4.5 billion cigarettes. The company is also continuing to invest in overseas business expansion, including plans to build another new factory in Indonesia next year.

The outlook for overseas markets is also positive. Last year, KT&G achieved record results in its overseas cigarette business, with annual sales volume up 10.3%, revenue up 28% (1.4501 trillion KRW), and operating profit up 84.2%. Overseas cigarette sales volumes have steadily increased, from 38.8 billion units in 2021, to 49.4 billion units in 2022, and 53.2 billion units in 2023. The export share of KT&G's total sales rose from 29.69% in 2023 to 34.23% last year.

Shim Eunju, a researcher at Hana Securities, analyzed, "The active expansion into new markets such as Africa and Latin America, as well as the strong growth of the Indonesian subsidiary, are positive factors. This year, cigarette exports (exports plus overseas subsidiaries) are estimated to increase by 17.2% compared to the previous year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)