Philip Morris's Heated Tobacco Stick Market Share Reaches Double Digits for the First Time in Q1

Last Year's E-Cigarette Sales Up 8.3% Year-on-Year... Early-Year Sales Down 2.2%

KT&G Achieves Steady Growth in Tobacco Business in Q1

As the domestic tobacco market rapidly shifts from traditional cigarettes to e-cigarettes, Korea Philip Morris's market share for heated tobacco sticks has surpassed 10% for the first time. If this trend continues, Korea Philip Morris may see its e-cigarette market share overtake that of traditional cigarettes within the year.

According to Philip Morris International (PMI) on April 28, Korea Philip Morris's shipment volume of heated tobacco sticks in the first quarter of this year reached approximately 1.6 billion units, a 15.5% increase from the same period last year (about 1.4 billion units). In the overall domestic tobacco market, the market share of Korea Philip Morris's heated tobacco sticks (HTU), such as 'TEREA', rose to 10.1%, up 1.9 percentage points from the previous year's 8.2%, crossing into double digits. This figure significantly exceeds PMI's global market share for heated tobacco sticks during the same period, which was 5.7%.

Since the beginning of the year, Korea Philip Morris has been making an all-out effort to accelerate the shift to e-cigarettes in the domestic market through aggressive portfolio expansion. In February, the company officially launched the new heated tobacco device series 'IQOS Iluma Ai', and this month expanded the sales network of the new stick 'SENTIA' nationwide. As a result, the pace of transition to e-cigarettes in the domestic tobacco market is relatively faster compared to other countries. In fact, according to PMI's first-quarter data, only Japan and Italy have a higher market share of e-cigarettes in their total tobacco markets than Korea.

With the rapid growth of heated tobacco products, Korea Philip Morris's overall market share in the domestic tobacco market in the first quarter of this year rose to 21.5%, up 1.1 percentage points from 20.4% in the same period last year. In contrast, the domestic shipment volume of traditional cigarettes in the first quarter was about 1.8 billion units, a 13.4% decrease from approximately 2 billion units in the same period last year. This is the highest negative growth rate among all PMI sales countries.

As a result, during this period, Korea Philip Morris's market shares for e-cigarettes and traditional cigarettes in the domestic tobacco market narrowed to 10.1% and 10.4%, respectively. At this pace, it is expected that within the year, the market share of e-cigarettes will surpass that of traditional cigarettes for Philip Morris.

With the strong performance of e-cigarettes, PMI's first-quarter revenue (USD 9.3 billion) and operating profit (USD 3.5 billion) increased by 5.8% and 9.4%, respectively, compared to the same period last year. While the sales volume of traditional cigarettes grew by only 1.1%, the sales volume of e-cigarettes increased by 12.0%. Jacek Olczak, CEO of PMI, stated, "Our smoke-free business has achieved organic growth rates of over 20%, accounting for 42% of our total net revenue," and added, "The management is confident that we will continue to deliver positive results despite the uncertain global economic environment."

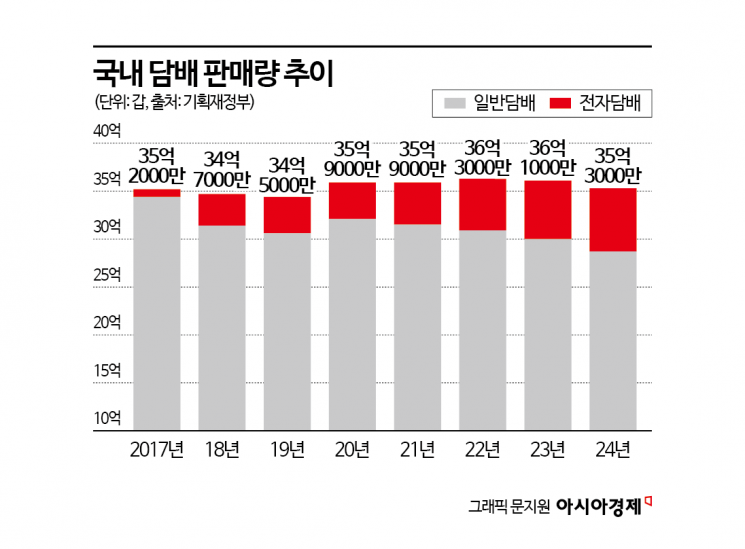

In recent years, the domestic tobacco market has been rapidly reorganizing from traditional cigarettes to e-cigarettes. According to the Ministry of Economy and Finance, the total domestic tobacco sales volume last year was 3.53 billion packs, a 2.2% decrease from 3.61 billion packs the previous year. Domestic tobacco sales peaked at 3.63 billion packs in 2022 and have declined for two consecutive years since 2023. When including duty-free tobacco sales, the actual sales volume was 3.68 billion packs, a 1.7% decrease from the previous year.

Last year, the sales volume of traditional cigarettes was 2.87 billion packs, a 4.3% decrease from the previous year. This marks a decline for four consecutive years since 2021, dropping into the 2 billion pack range. In contrast, heated tobacco products reached 660 million packs, an 8.3% increase from the previous year. The share of e-cigarettes in the total market reached 18.4% last year. The proportion of e-cigarettes has shown a steady increase, rising from 2.2% in 2017, to 10.5% in 2019, 12.4% in 2021, 14.8% in 2022, and 16.9% in 2023.

Like Philip Morris, KT&G is also expected to post strong first-quarter results, mainly driven by its core tobacco business. According to financial information provider FnGuide, KT&G's first-quarter sales this year are projected to reach KRW 1.4234 trillion, a 10.2% increase from the same period last year. Operating profit is also expected to rise by 13.9% to KRW 269.4 billion.

In the domestic market, KT&G's performance growth is expected to be led by e-cigarettes (NGP). At the end of last year, the company completed the launch of upgraded versions of its three 'Lil' platform e-cigarette devices (Solid, Hybrid, Able), reorganizing its device lineup. Recently, KT&G has also strengthened its growth momentum by launching a new stick product, 'Mix Bonathum', thereby reinforcing both its device and stick portfolios.

On the other hand, in overseas markets, traditional cigarettes are expected to play the leading role. Kim Taehyun, a researcher at IBK Investment & Securities, predicted, "With favorable exchange rate trends continuing, exports have remained strong, particularly in the Middle East and Central and South America, while overseas subsidiaries have seen robust sales centered on Indonesia and Kazakhstan." KT&G is expected to maintain its growth in the overseas traditional cigarette business for the time being, driven by expansion into new countries and the growth of its direct business operations.

On April 22, the company completed the construction of a new factory in Almaty, Kazakhstan, expanding its key production base to target the Commonwealth of Independent States (CIS) and Europe. Including Kazakhstan, KT&G now operates factories in a total of four countries: Turkiye, Indonesia, Russia, and Kazakhstan.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.