Exports and Domestic Demand Both Weaken

Impact of Deferred HBM Demand and Weakened Sentiment

Shadow of Low Growth Deepens

Bank of Korea Signals Downward Revision of This Year’s Growth Rate

In the first quarter of this year, South Korea's economic growth rate fell short of expectations and experienced negative growth. This marks the weakest quarterly growth in two years and three months (nine quarters). As both domestic and external uncertainties intensified, economic sentiment weakened, and the construction sector performed worse than anticipated, leading to slowdowns in both domestic demand and exports. Temporary factors, such as large-scale wildfires and deferred demand for high-bandwidth memory (HBM), also contributed to the negative growth. Even in the second quarter, the sluggish recovery in domestic demand and the anticipated export downturn due to tariff shocks originating from the United States suggest that it will be difficult for the economy to avoid a hit to this year’s growth.

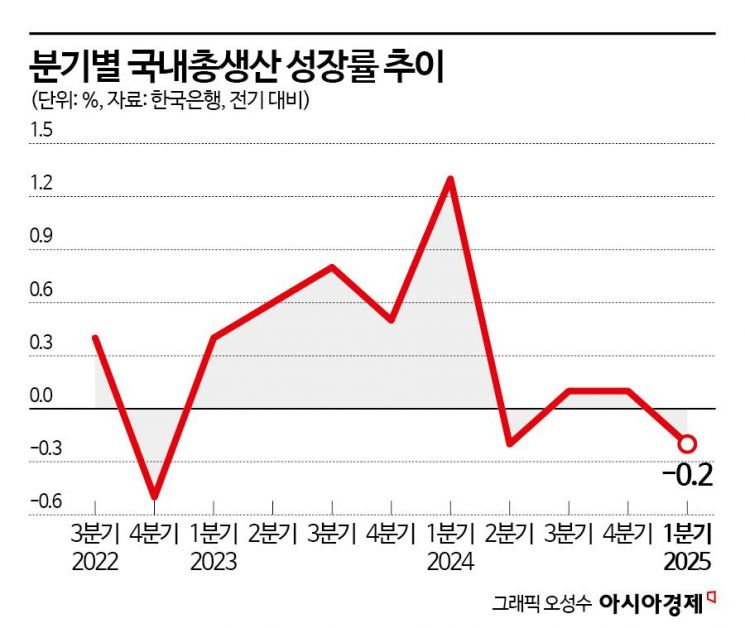

The Bank of Korea announced on April 24 that the preliminary real gross domestic product (GDP) growth rate for the first quarter of this year decreased by 0.2% compared to the previous quarter. To the second decimal place, the figure is -0.24%. This is significantly below the 0.2% increase projected by the Bank of Korea in its economic outlook in February, and it is the lowest level in two years and three months since the fourth quarter of 2022 (-0.5%). South Korea has returned to negative growth for the first time in three quarters since the second quarter of last year (-0.2%).

Exports and Domestic Demand Both Weaken... Impact of Deferred HBM Demand and Weakened Sentiment

Both exports and domestic demand were weak in the first quarter of this year. Exports declined as chemical products and other items fell, and domestic demand also recorded overall negative growth in construction investment, facility investment, private consumption, and government consumption.Exports decreased by 1.1% due to declines in chemical products, machinery, and equipment. This marks another quarter of negative growth following the third quarter of last year. Temporary factors such as deferred HBM demand played a role. Imports fell by 2.0%, mainly due to decreases in energy items such as crude oil and natural gas. This is the first negative growth in four quarters since the first quarter of last year (-0.4%).

Domestic demand was generally sluggish. Construction investment has remained deeply negative for four consecutive quarters. In the first quarter, construction investment fell by 3.2% from the previous quarter, mainly due to building construction. The continued decline in construction investment was attributed not only to delayed recovery in investment sentiment, but also to poor construction performance resulting from reduced project starts, suspension of some projects, and unusual factors such as cold waves and heavy snowfall disrupting construction progress. Facility investment also decreased by 2.1%, mainly in machinery such as semiconductor manufacturing equipment, as investment sentiment weakened due to increased uncertainty in U.S. trade policy. Private consumption decreased by 0.1% as spending on services such as entertainment, culture, and healthcare remained weak. Government consumption also fell by 0.1% due to reduced expenditures on health insurance benefits.

Looking at the contribution to growth by expenditure component in the first quarter, the weakness in domestic demand was evident. The contribution of domestic demand to growth was only -0.6 percentage points. Construction investment (-0.4 percentage points) and facility investment (-0.2 percentage points) were the main drivers of the negative contribution from domestic demand. This is a continuation of the negative contribution from the previous quarter (-0.2%).The contribution from net exports (exports minus imports) was 0.3 percentage points, the same as in the previous quarter. By economic agent, the private sector contributed -0.3 percentage points to GDP growth, while the government contributed 0.1 percentage points, mainly through investment. The government’s construction investment was attributed to the concentrated execution of the social overhead capital (SOC) budget in the first half of the year.

Lee Dongwon, Director General of the Economic Statistics Department 2 at the Bank of Korea, said, "Initially, we expected a recovery in the first quarter, with economic sentiment improving in February and March after weakness in January due to ongoing political uncertainty, fewer working days, and worsening weather conditions such as heavy snowfall. We also anticipated strong growth in high-performance semiconductors. However, in reality, the degree of political uncertainty was greater than in previous experiences, and the period was much longer. In March, external uncertainty increased due to the announcement of U.S. tariff policy. In this situation, the economic sentiment index fell again in March, and economic activity did not meet expectations," he said.He also explained that exportswere affected by weakened demand as buyers waited for new products.

By industry, the weakness of manufacturing and construction was pronounced. Manufacturing declined by 0.8%, mainly in chemicals, chemical products, machinery, and equipment. Construction fell by 1.5%, mainly in building construction. In contrast, agriculture, forestry, and fisheries increased by 3.2%, led by fisheries, and electricity, gas, and water supply rose by 7.9%, mainly in gas, steam, and air conditioning supply. In services, finance and insurance, and information and communications increased, but transportation, wholesale and retail, and accommodation and food services declined, leaving the sector at the same level as the previous quarter.

There are expectations that the second quarter will see improvement, mainly in private consumption, compared to the first quarter. Lee said, "Sentiment is likely to improve compared to the first quarter, and with the presidential election coming up in June, there are factors that could increase spending, especially among non-profit organizations. While a rapid recovery in construction investment is unlikely, if public sector investment increases, it could help ease the investment slump." He also noted that although there was a temporary adjustment in facility investment this quarter, the medium-term outlook is the most favorable, so a return to positive growth is possible.

Lee Yoonsu, professor of economics at Sogang University, said, "Looking at the first quarter growth rate, domestic demand fell significantly in consumption, and construction was also weak. However, since construction is more sensitive to political uncertainty, it may improve after the presidential election." He also saw the possibility that consumption could improve as political uncertainty diminishes.

Shadow of Low Growth Deepens... Bank of Korea Signals Downward Revision of This Year’s Growth Rate

The growth outlook after the second quarter remains bleak. This is because sluggish domestic demand has yet to show signs of recovery, and there are widespread concerns that exports will also lose momentum due to the tariff shock triggered by U.S. President Donald Trump.

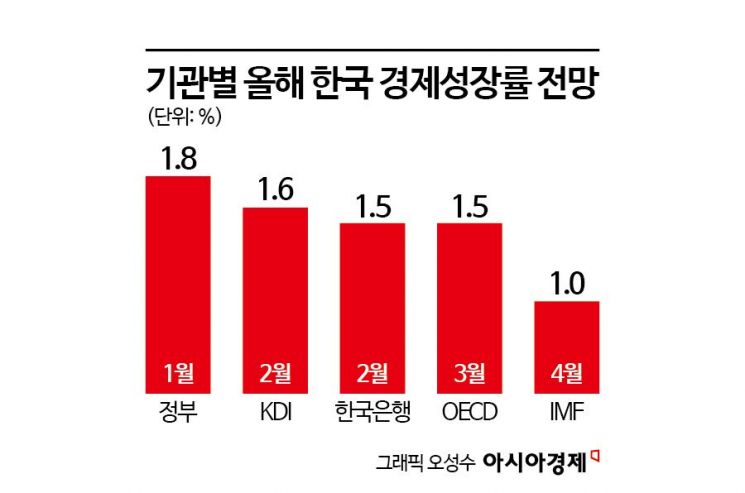

The International Monetary Fund (IMF) recently lowered its forecast for South Korea’s growth rate this year from 2.0% to 1.0% in its World Economic Outlook. More investment banks (IBs) are predicting growth in the 0% range. The Bank of Korea also projected 1.5% growth for this year in its February economic outlook, but has already indicated that a downward revision is inevitable in its next forecast announcement in May. Bank of Korea Governor Rhee Changyong pointed out at a press briefing after the Monetary Policy Board meeting on April 17, "Given the U.S. tariff policy, the scenario assumed in February’s outlook was too optimistic."

There is a consensus that exports, which offset weak domestic demand last year, are bound to take a hit this year. Sohn Jongchil, professor of economics at Hankuk University of Foreign Studies, said, "Exports are expected to remain difficult. Although tariff uncertainty may decrease in the future, there is a high possibility that the global economy will remain weak, as not only South Korea but also Europe, Japan, and the United States are all revising their growth rates downward." He predicted that the contribution of exports to growth would decline further. Professor Lee also noted, "Some exports were shipped in advance before tariffs were implemented, so things could deteriorate as early as the second quarter. If the U.S. economy slows due to tariffs and the U.S.-China tariff dispute lasts longer than expected, both South Korea’s exports to the U.S. and China could decline." However, he added that it remains to be seen whether the semiconductor sector, which is not in bad shape, can offset the losses. He also argued that in tariff negotiations, securing a favorable position is more important than simply concluding talks quickly.

There is also analysis that additional fiscal policy from the government is needed to boost domestic demand.Professor Sohn said, "Recovery should come through boosting domestic demand and consumption, and in this regard, I expect the new government to take a more active fiscal defense policy."He also said that an extra budget (supplementary budget) is necessary, as it could be used not only to stimulate domestic demand but also to cushion the impact on export companies depending on the outcome of tariff negotiations. Kim Jinil, professor of economics at Korea University, said "The 12 trillion won figure is the government’s minimum estimate. It is true that a larger supplementary budget is needed," he said, "but ultimately, political considerations over which sectors to allocate more funds to will influence the outcome." Professor Lee also commented, "Given the size of this supplementary budget, it is likely that there will be another one under the new government," adding, "However, since it involves borrowing, excessive frequency or scale should be carefully considered."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)