Banks Significantly Reduce SME Loan Volume

Banks Tighten Loan Screening Amid Rising Internal and External Uncertainties

Government Considers Easing Lending Regulations

Amid growing concerns over an economic downturn triggered by U.S.-imposed tariffs, the scale of bank loans to small and medium-sized enterprises (SMEs) has significantly decreased. Companies are tightening their belts by even reducing corporate card issuance, but banks are expected to further strengthen their loan screening for SMEs.

Banks Significantly Reduce SME Loan Volume

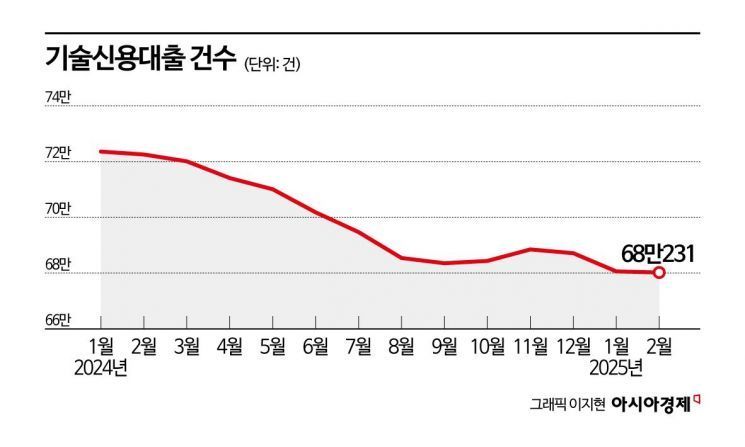

According to the Korea Federation of Banks on April 24, the number of technology credit loans issued by domestic banks as of February was 680,231, down by about 5.9% from 722,542 in the same period last year. The outstanding balance of technology credit loans also decreased by approximately 1.6% to 302.6 trillion won in February, compared to 307.5 trillion won in the same period last year.

Technology credit loans are funds provided by banks at relatively low interest rates to support SMEs with outstanding technology. Since their introduction in 2014, the scale has grown to account for more than 20% of all corporate loans. However, since the second half of last year, the supply of technology credit loans has started to decline in earnest, and with the exception of IBK Industrial Bank of Korea, most banks have reduced both the number of loans and the outstanding balance.

The cautious stance of banks toward corporate lending is also evident in statistics from the Bank of Korea. According to the Bank of Korea, the outstanding balance of corporate loans by domestic banks in March decreased by 2.1 trillion won from the previous month, totaling 1,324.3 trillion won. This is the first time since 2005 that corporate loans have recorded a negative figure in March. While loans to large corporations decreased by 700 billion won, loans to SMEs fell by 1.4 trillion won. A Bank of Korea official explained, "As internal and external uncertainties have increased, banks have reduced their SME lending operations, and an increase in the write-off of non-performing loans at the end of the quarter also had an impact."

The lending attitude of banks toward SMEs is expected to become even stricter in the second quarter. According to the Bank of Korea's second quarter Financial Institution Lending Behavior Survey, the lending attitude index for SMEs fell from 0 in the previous quarter to -6. A lower index indicates that banks are tightening their lending standards and reducing loan operations. The Bank of Korea analyzed that, due to increased uncertainty in the domestic and global economic environment, banks have strengthened their credit risk management, leading to a stricter lending attitude, especially toward SMEs in vulnerable sectors. In contrast, corporate loan demand is expected to rise, as companies are projected to require more working capital amid worsening economic conditions.

As the economy deteriorates and lending freezes, companies are tightening their belts by even reducing corporate card issuance. As of January, the number of credit cards issued by domestic corporations was 11,627,000, a decrease of 22,000 from the previous month. This is the first time in about seven years, since May 2018, that corporate card issuance has declined. The amount spent using corporate cards in January also fell by more than 2 trillion won from the previous month.

Concerns Grow Over SME Loan Defaults Amid U.S. Tariff Shock

The reduction in SME loans by banks is due to the higher risk of default compared to large corporations. The delinquency rate for SME loans, based on principal and interest overdue by more than one month at domestic banks, rose from 0.48% at the end of 2023 to 0.62% at the end of last year. The amount of overdue principal on SME loans at the five major commercial banks also increased from 3 trillion won in 2023 to 4 trillion won at the end of last year. It is interpreted that banks, concerned about a potential increase in SME loan defaults, are managing SME loans more strictly to prevent a decline in soundness indicators such as the Common Equity Tier 1 (CET1) ratio.

The government is also considering regulatory easing, such as lowering the risk-weighted asset (RWA) ratios for bank corporate loans, to support companies. If RWA regulations are relaxed, banks can increase riskier loans without negatively affecting their CET1 ratios. The intention is to ease lending regulations and give domestic companies more capacity to withstand the impact of U.S.-imposed tariffs. The Financial Services Commission has launched a "Capital Ratio Regulation Easing Task Force (TF)" and is currently gathering opinions from the industry.

However, there are concerns that even if regulations are eased, banks may not actively increase lending to SMEs. Even if more money is lent, the poor economic conditions may make it difficult to recover the funds later. A banking industry official said, "Although the government is encouraging banks to increase corporate lending, given the weakened financial health of companies, it remains to be seen whether banks will actually implement this in practice."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)