April Consumer Sentiment Index at 93.8, Up 0.4 Points from Previous Month

Political Uncertainty Eases, but US Tariff Shock Persists

Difficult to Expect Upward Trend... Trade Talks and Economic Stimulus Policies Remain Key Factors

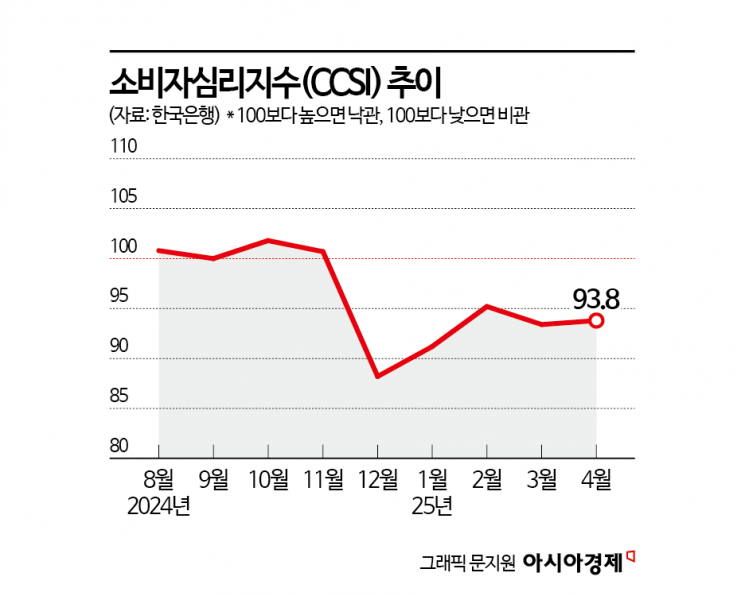

This month, the Consumer Sentiment Index (CCSI) showed only a slight rebound, remaining below the baseline of 100 for the fifth consecutive month. Although the impeachment of former President Yoon Suk-yeol has eased the domestic political uncertainty that had previously dampened consumer sentiment, it is difficult to expect an immediate upward trend surpassing the baseline. This is because the tariff shock originating from the United States is still ongoing, and concerns over Korea's low economic growth this year are deepening.

April CCSI at 93.8, up 0.4 points: "Political uncertainty has eased, but..."

According to the "April 2025 Consumer Survey Results" released by the Bank of Korea on the 23rd, the Consumer Sentiment Index (CCSI) for this month stood at 93.8, up 0.4 points from the previous month. Despite concerns over worsening global trade conditions and delayed domestic economic recovery, the CCSI saw a slight rebound within a month due to the easing of political uncertainty and expectations for future economic stimulus policies. The CCSI is a sentiment indicator calculated using six key indices that make up the Consumer Survey Index (CSI). With the long-term average set at a baseline value of 100, a reading above 100 indicates optimism compared to the long-term average, while a reading below 100 indicates pessimism.

The CCSI, which had consistently remained above 100 until November last year, plummeted to 88.2 in December 2024 as consumer sentiment cooled due to the 12·3 Martial Law crisis. It showed only a slight recovery in January and February of this year but remained below the baseline before falling again in March. This month, it also only rebounded by 0.4 points, staying in the 93 range. Lee Hyeyoung, head of the Economic Sentiment Survey Team at the Economic Statistics Department, said, "Consumer sentiment has not recovered to pre-martial law levels," adding, "There is lingering uncertainty over how trade negotiations with the United States will unfold and when and to what extent the government's economic stimulus policies will be implemented. Consumer sentiment will determine its direction as these factors become clearer."

Housing Price Outlook at 108... Up 3 points, but growth slows compared to previous month (6 points)

By sector, the Housing Price Outlook CSI (108) rose by 3 points from the previous month. Last month, the Housing Price Outlook CSI had surged by 6 points due to the lifting of the land transaction permit zone designation in Seoul in February, which led to a sharp increase in housing prices in the Gangnam area. Although the index continued to rise this month, the pace of increase slowed. The re-designation of land transaction permit zones last month and the government's household debt management measures are analyzed to have somewhat dampened expectations for further price increases. The Interest Rate Outlook CSI (96) rose by 4 points from the previous month, rebounding after a 7-point drop last month. This was due to weakened expectations for a base rate cut, driven by strengthened household loan management and increased exchange rate volatility. The Employment Opportunity Outlook CSI (76) also rose by 4 points compared to the previous month.

The Current Economic Assessment CSI, which compares the present to six months ago, fell by 3 points to 52 from the previous month. Analysts attribute this to the stronger-than-expected reciprocal tariffs imposed by the United States on Korea and other countries this month, as well as continued sluggish domestic demand. The Current Economic Assessment CSI, which started at 69 early last year and remained in the low 70s, plunged to 52 in December 2024 and has since stayed in the 50 range. In contrast, the Future Economic Outlook CSI, which forecasts the economy six months from now compared to the present, rose by 3 points to 73. This is attributed to the easing of political uncertainty and expectations for economic stimulus policies under the incoming administration.

The expected inflation rate for the next year is 2.8%, up 0.1 percentage points from the previous month, mainly due to a wider increase in consumer prices centered on processed foods. The expected inflation rates for three years and five years from now remained unchanged from the previous month at 2.6%. The main items expected to affect consumer prices over the next year were agricultural, livestock, and fishery products (52.5%), public utility charges (44.4%), and industrial products (38.3%). Compared to the previous month, the response ratio for industrial products increased by 7.1 percentage points, while the ratios for petroleum products (-5.2 percentage points) and public utility charges (-4.4 percentage points) decreased.

This survey was conducted from April 8 to 15, targeting 2,500 households in cities nationwide, with responses collected from 2,302 households.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)