Following Samsung Biologics Last Year, Another "Emperor Stock" Expected This Year

Samyang Foods Poised to Become an Emperor Stock with Share Price Nearing 960,000 Won

Hanwha Aerospace Settles in the 800,000 Won Range, Raising Expectations

Market Expectations for Both Stocks Already at Emperor Stock Levels

Last year, Samsung Biologics' stock price surpassed 1 million won, marking the first emergence of an "Emperor Stock" on the KOSPI in two years and four months. This year, the trend is expected to continue, with Samyang Foods on the verge of breaking the 1 million won mark, and Hanwha Aerospace, which has reached the 800,000 won range, also considered a candidate.

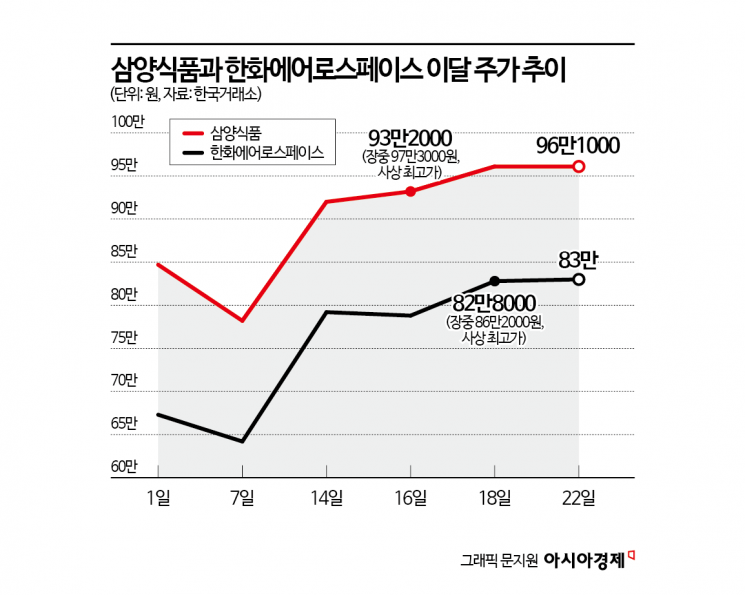

According to the Korea Exchange on the 23rd, Samyang Foods closed at 961,000 won on the previous day, up 0.42%. On April 16, its intraday price climbed to 973,000 won, setting a new all-time high and moving ever closer to 1 million won. On April 7, when global stock markets experienced a sharp decline, Samyang Foods also plummeted, briefly falling below 800,000 won, but quickly recovered its share price afterward.

Expectations for Samyang Foods to become an Emperor Stock have grown, with target prices in the 1 million won range being set as early as December last year. In April alone, four securities firms raised their target prices for Samyang Foods. KB Securities raised its target price by 19.3% to 1.05 million won, while Shinhan Investment raised it by 28% to 1.1 million won. Kyobo Securities increased its target from 970,000 won to 1.02 million won, and Daishin Securities raised its target from 900,000 won to 1.2 million won. Shinhan Investment researcher Cho Sanghoon explained, "We raised our target price by 28% compared to the previous estimate, reflecting upward revisions in export performance forecasts due to improved regional mix and a stronger dollar," adding, "While the valuation is somewhat burdensome, it is noteworthy that high growth continues as the company enters the early stages of expanding overseas momentum."

Strong performance is supporting the stock price rise. According to financial data provider FnGuide, the consensus for Samyang Foods' first-quarter results this year (the average forecast by securities firms) is sales of 494.8 billion won, up 28.29% from the same period last year, and operating profit of 103.1 billion won, up 28.71%. Securities firms expect Samyang Foods' first-quarter results to meet market expectations. Daishin Securities researcher Jung Hansol stated, "Samyang Foods' first-quarter results are expected to meet consensus, with sales of 486.3 billion won and operating profit of 102.4 billion won," adding, "Within exports, which account for 80% of total sales, the company continued to improve its regional mix by focusing on high-priced markets such as the United States and China. Favorable exchange rates, cost stabilization, and overall SG&A management are expected to restore profitability to the 20% range, and the company is likely to record its highest-ever quarterly operating profit."

Hanwha Aerospace has also settled into the 800,000 won range this month, further fueling expectations of it becoming an Emperor Stock. On April 7, in the aftermath of "Black Monday," Hanwha Aerospace fell to the 640,000 won range, but like Samyang Foods, it subsequently rebounded sharply and entered the 800,000 won range. On April 18, its intraday price climbed to 862,000 won, setting a new all-time high. Hanwha Aerospace has risen 154.21% so far this year. Last year, it rose 153.51%, which was less than Samyang Foods' 254.17% increase, but this year, its upward trend is much steeper than Samyang Foods, which has risen 25.62% year-to-date.

This year, securities firms have also been releasing target prices for Hanwha Aerospace in the 1 million won range. Last month, BNK Investment & Securities raised its target price for Hanwha Aerospace from 650,000 won to 1 million won, and this month, Kyobo Securities raised its target from 800,000 won to 1 million won. Korea Investment & Securities adjusted its target price upward by 58.5% to 1.3 million won. Jang Namhyun, a researcher at Korea Investment & Securities, evaluated Hanwha Aerospace as "still undervalued considering its clear earnings growth led by the land defense sector and the widest export pipeline coverage among defense companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.