Special Feature [False Claims, Staged Accidents... That Money Was My Insurance Premium]

2-1 Even Traffic Accidents Were Scripted

Perpetrators and Victims Collude in Insurance Fraud

Juvenile Detention Center Friends Commit Insurance Fraud and Even Use Drugs

2-1 Even Traffic Accidents Were Scripted

Perpetrators and Victims Collude in Insurance Fraud

Juvenile Detention Center Friends Commit Insurance Fraud and Even Use Drugs

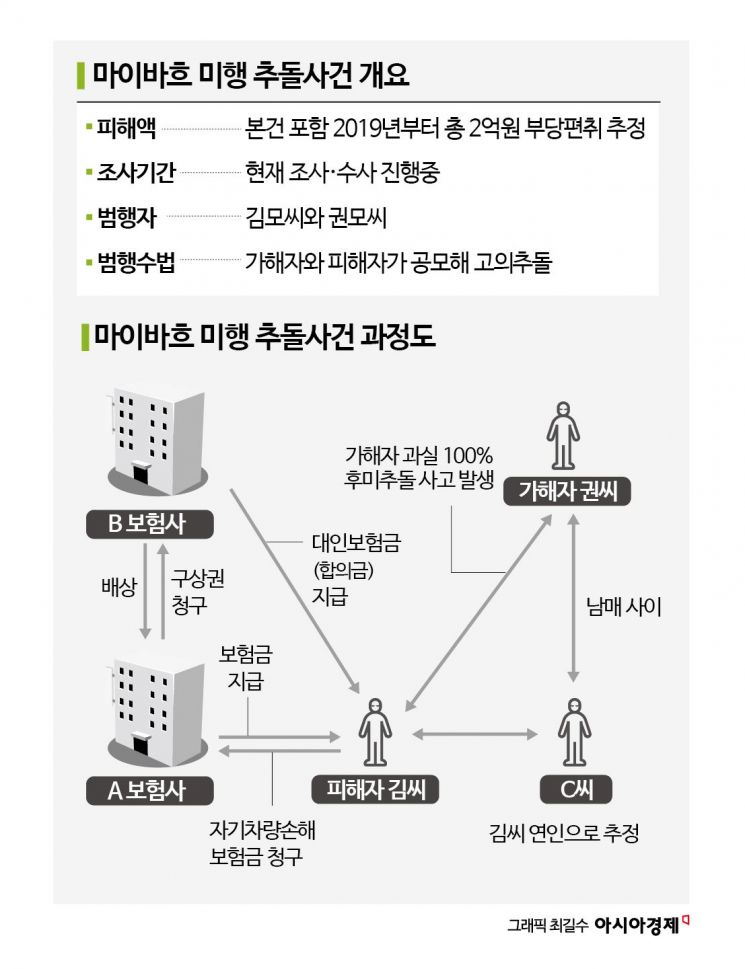

Asia Economy has been investigating the reality behind "staged traffic accidents designed like a scripted play." These include insurance fraud schemes where perpetrators and victims collude, suspicious accidents involving even private detectives, and unexpected twists revealed through exposed relationships. The investigation uncovered the true face of insurance fraud hidden beneath the surface of "traffic accidents." An exclusive report on an accident in the rural mountains of Yeongwol was part of this ongoing effort.

"The victim's statement doesn't match the scene at all. This seems suspicious. Also, this person claims to be a private detective."

On February 14, a car accident was reported to H Insurance. The location was a back road in Sansol-myeon, Yeongwol-gun, Gangwon Province. When the auto insurance investigator from H Insurance arrived at the scene through the snow and met the victim, there were several suspicious points. The investigator immediately requested assistance from the company’s Special Investigation Unit (SIU) for insurance fraud.

Even to the SIU, which includes many former police officers, the accident seemed dubious. The victim, a man in his 40s identified as Mr. Kim, who claimed to be a private detective, said he was rear-ended and fell off a cliff while tailing someone. The SIU noted that the victim’s car was a high-end Maybach worth about 100 million won. Normally, someone conducting surveillance would use a domestic, mid- or low-priced car to avoid drawing attention, but Kim used a top-tier foreign car with poor fuel efficiency. The scene had been hit by about 30cm of heavy snow two days prior, leaving icy roads, and there was no CCTV coverage.

Kim’s statement was also inconsistent. The door and windows of the victim’s car had numerous dents and scratches, as if made by a grip strengthener or similar tool. The SIU suspected this was an attempt to inflate repair costs and collect more insurance money. Kim claimed the marks were made when he kicked the door with his heel because it wouldn’t open after the accident. If this were true, the dents should have protruded outward from the inside, but the opposite was observed. In such a situation, rescue measures should have been taken, but Kim and the other driver simply exchanged contact information and called their respective insurance companies without any conversation, which was also suspicious.

If, as Kim claimed, it was a rear-end collision, the liability ratio would be 100%. Nevertheless, Kim contacted his own insurance company, not the perpetrator’s, and received insurance compensation first. The SIU became even more suspicious of insurance fraud at this point. This matched the pattern of insurance fraud where the perpetrator and victim collude to create a situation with 100% liability and then commit fraud.

Suppose individuals A and B conspire to commit insurance fraud. A, acting as the perpetrator, enrolls in comprehensive auto insurance with high property and personal coverage limits. B, as the victim, buys a cheap, used imported car about to be scrapped and adds own-damage coverage to the policy. After causing an accident with 100% liability on A, B contacts their own insurer and claims an insurance payout higher than the purchase price of the car. If repair costs exceed the insurer’s assessed vehicle value, the insurer pays out the full value as a total loss, exploiting the system. Since B’s insurer faces 100% liability, it pays out first without much scrutiny, then seeks full reimbursement from A’s insurer. B also collects a settlement (future medical expenses) from A’s insurer by claiming injury and then splits the insurance money with the accomplice after selling the car cheaply.

The SIU, having seen this method several times before, checked Kim’s past accident history. Since 2019, Kim had used cars as collateral for loans and, if the owner failed to repay, drove the car himself and claimed insurance payouts as the victim. The SIU also found evidence of about 200 million won in insurance fraud involving collusion, staged flood damage, and fabrication of accident details.

There was another twist. The perpetrator who rear-ended Kim, identified as Kwon, turned out to be the younger brother of Ms. C, who is believed to be Kim’s girlfriend. Kim had previously tried to process an insurance claim by enrolling in a spouse-only auto insurance rider with Ms. C, but it was unsuccessful. The two were also business partners in a loan shark operation and a private investigation agency. Nevertheless, Kim insisted he did not know Kwon, Ms. C’s brother. Strongly suspecting insurance fraud, H Insurance recently reported them to the Gangwon Provincial Police Agency.

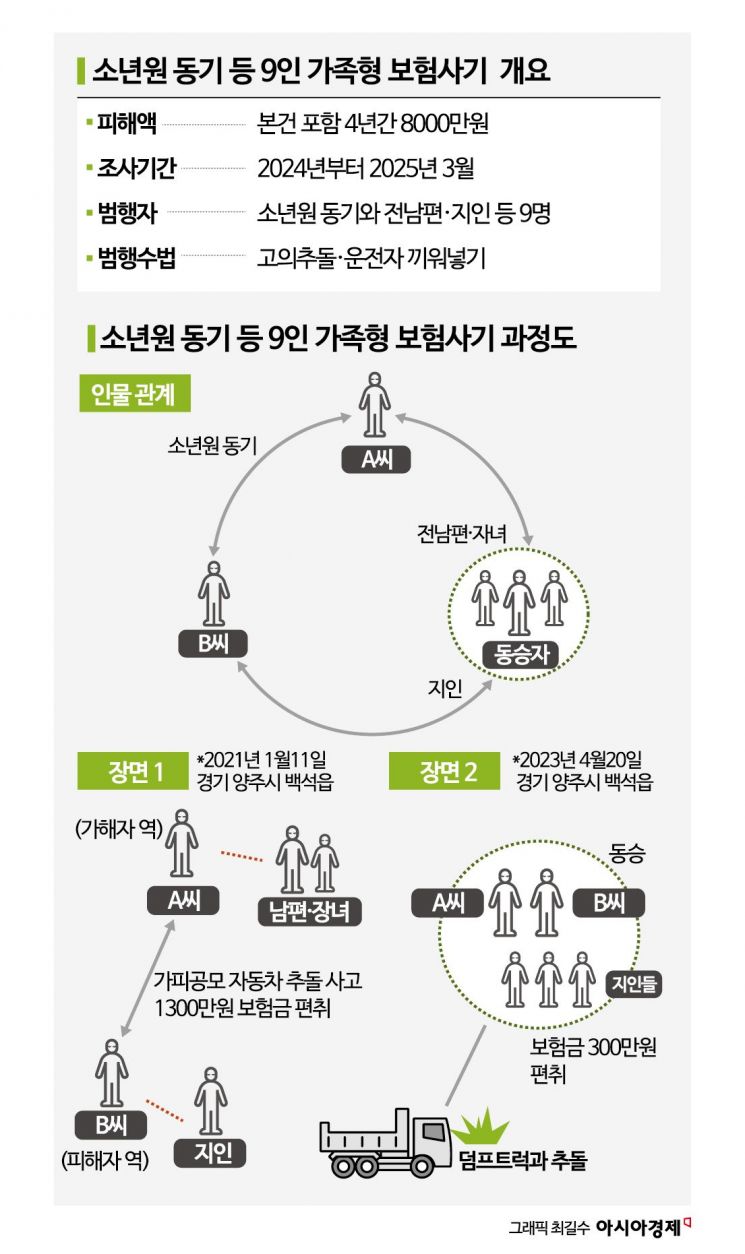

Friendship Gone Awry: Nine People, Including Ex-Husbands and Lovers, Conspire in Family-Style Insurance Fraud

Women A and B, both in their 30s, first met as teenagers in a juvenile detention center. They reunited in society and conspired to commit auto insurance fraud. A brought in her ex-husband and children, while B involved her lover and acquaintances as accomplices. By increasing the number of victims, they could maximize settlements and insurance payouts. In this way, a nine-member family-style insurance fraud ring was formed.

After successfully pulling off their first insurance scam in October 2020, the two former juvenile inmates became increasingly bold and sophisticated. They staged accidents anywhere, from roads to villa parking lots. They switched drivers or listed children who were not even present in the accident as victims. They also filed claims not only for auto insurance but also for general accident insurance.

On January 11, 2021, in Bokji-ri, Baekseok-eup, Yangju-si, Gyeonggi Province, A and B staged a deliberate accident. A claimed to the insurer that she was accompanied by her husband and two children (four people in total), while B claimed to have two people including an acquaintance, and both collected insurance payouts. The insurance money they fraudulently obtained from this accident amounted to 13 million won.

In 2021, A and B were perpetrator and victim, but on April 20, 2023, they suddenly appeared as passengers together. A was driving, with B and three others, and collided with a dump truck at the same location as the January 2021 accident. They collected 3 million won in insurance from this accident.

Using these methods, the group fraudulently obtained about 70 million won in insurance payouts over eight incidents in Yangju-si over approximately four years, up to July last year. Despite the minor nature of the accidents, they received excessive hospital treatment to secure large settlements. They exploited the industry practice of insurers offering high settlements to patients likely to require long-term hospitalization to encourage early settlements.

Major insurance companies, suspicious of these repeated fraudulent claims, requested an investigation from the Northern Gyeonggi Police Agency last year. Police investigations revealed that the group committed insurance fraud to cover living expenses and to purchase drugs (methamphetamine). Three of the nine members were found to have used drugs, resulting in one being detained and two released without detention last month. An official from the Northern Gyeonggi Police Agency stated, "Recently, there has been a sharp increase in insurance fraud involving drug use or illegal gambling among people in their 20s and 30s," adding, "A’s group will face harsher penalties due to prior convictions for similar offenses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.