Number of Convenience Stores Declines for the First Time Last Year

Major Four Chains Operate 54,852 Stores

More Than 20 Fewer Stores Compared to Previous Year

CU and GS25 Slow Expansion Pace

7-Eleven and Emart24 Reduce Over 1,400 Stores

"Focus Shifts from Expansion to Profitability Improvement"

The number of convenience stores in South Korea decreased for the first time last year. After years of rapid growth in the offline retail market?driven by aggressive expansion and accessibility?convenience store chains are now downsizing as market saturation has led to declining profitability.

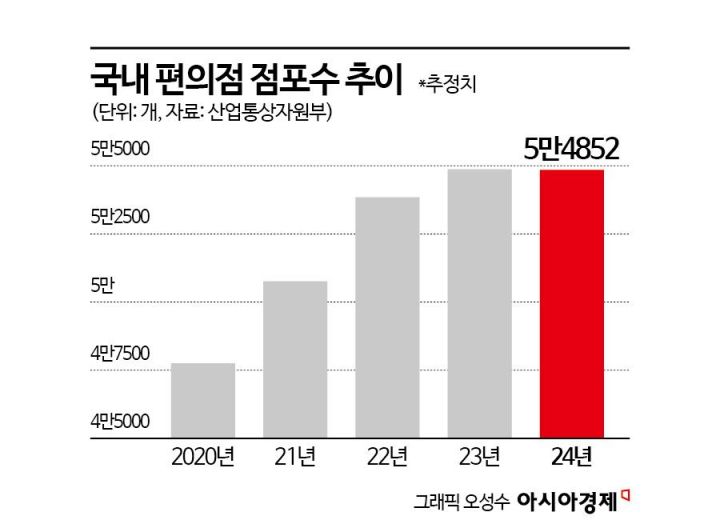

According to industry sources on April 22, based on data from the Ministry of Trade, Industry and Energy, the four major convenience store chains?CU, GS25, 7-Eleven, and Emart24?internally estimate that there were 54,852 convenience stores nationwide at the end of last year. This represents a decrease of more than 20 stores from the previous year’s 54,875. This marks the first contraction in store numbers in 36 years, since the opening of the first 7-Eleven Olympic branch in 1988, reversing a trend of annual increases of over 1,000 stores since the outbreak of COVID-19.

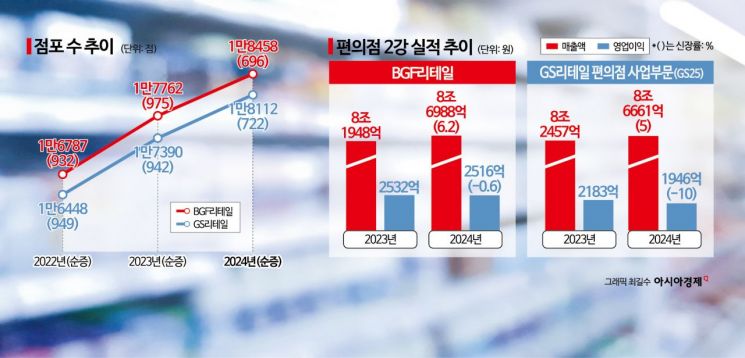

CU, operated by BGF Retail, and GS25, run by GS Retail, have been fiercely competing for the top spot and continued to increase their store counts, but the pace of expansion has slowed. CU added only 696 stores last year, reaching a total of 18,458, while GS25 increased by 722 stores to 18,112. Although both chains had previously expanded by nearly 1,000 stores annually, the growth rate of store numbers slowed sharply last year.

7-Eleven, operated by Korea Seven, reduced its store count by 978 to 12,152 as it restructured to improve profitability by closing low-efficiency locations. Emart24 also saw its number of stores decrease by 468 to 6,130.

An industry insider explained, "Even the leading companies are now focusing on qualitative rather than quantitative growth, selectively opening new stores in areas deemed highly profitable, or acquiring profitable stores from competitors when their contracts expire. As a result, since last year, the overall number of stores has declined as operators prioritize profitability."

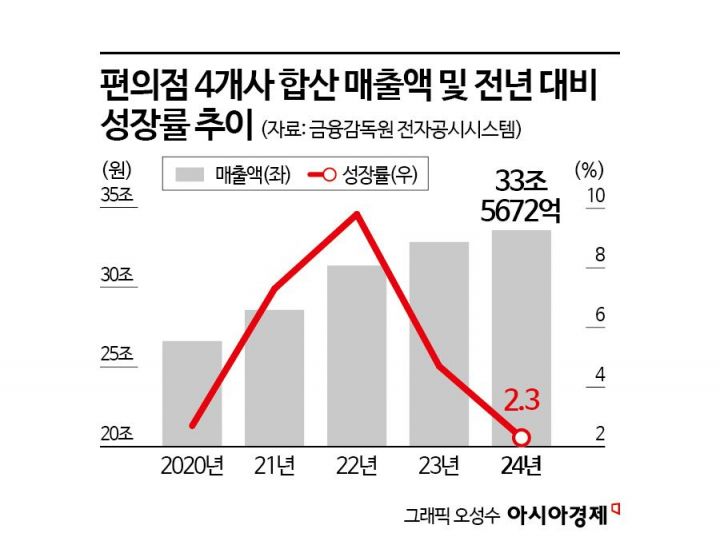

Last year, the convenience store market reached 33.5672 trillion won, growing by only 2.3% compared to the previous year. The sales growth rate, which was 9.8% in 2022, was halved to 4.7% the following year and has continued to slow.

The convenience store industry enjoyed a boost during the COVID-19 pandemic due to social distancing measures. As people sought to purchase daily necessities close to home, convenience stores surpassed large supermarkets in annual sales share among offline retailers for the first time in 2021. During this period, the industry expanded its footprint, capitalizing on the value-for-money trend amid high inflation, and for four consecutive months in the second half of last year, convenience stores overtook department stores to claim the largest share of offline retail sales.

However, this momentum has recently slowed. According to the Ministry of Trade, Industry and Energy, convenience store sales in February fell by 4.6% year-on-year, marking the first decline in about five years since February?March 2020. Sales decreased across all categories, with food down 5.4% and non-food items down 3.6%. Even during the Lunar New Year holiday in January, while department stores and large supermarkets posted double-digit sales growth, convenience stores managed only a 1.7% increase.

Profitability has also deteriorated. Last year, operating profit at CU and GS25 fell by 4.6% and 10.9%, respectively, to 230.4 billion won and 194.6 billion won. 7-Eleven and Emart24 posted operating losses of 84.4 billion won and 29.8 billion won, respectively, with losses widening. An industry official commented, "In a saturated market, there are limits to opening new stores in so-called 'prime' locations. Rather than simply increasing store numbers to boost sales as in the past, companies are now focusing on differentiation through specialized stores and private brand (PB) products, and on strengthening their fundamentals."

Meanwhile, the gap in the number of convenience stores between South Korea and Japan, which had narrowed to fewer than 100 stores as of the first half of last year, has widened again. According to the Japan Franchise Association, there were 55,736 convenience stores nationwide in Japan at the end of last year. During the same period, the combined total for the five major South Korean chains, including C-SPACE24, was 55,202?534 fewer than in Japan. The gap had narrowed to just 61 stores as of May last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.