Emerging as an Alternative Stock Amid Market Uncertainty

Nearly 17% Rise This Month

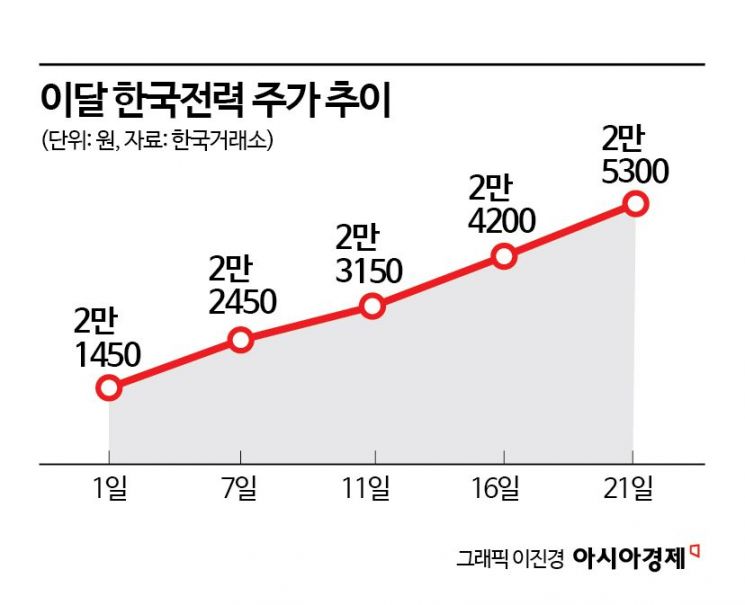

Share Price Recovers to 25,000 Won After 13 Months

Expectations for Earnings Improvement and Increased Dividends

Korea Electric Power Corporation (KEPCO) is emerging as an alternative stock amid an uncertain market, with its share price continuing to show strength. The perception of KEPCO as an alternative investment has attracted buying from both foreign and institutional investors, driving the stock price higher.

According to the Korea Exchange on April 22, KEPCO closed at 25,300 won the previous day, up 4.12%. This marks a new 52-week high and the first time the stock has surpassed 25,000 won in approximately 13 months since March of last year. KEPCO's share price has risen by nearly 17% so far this month.

Foreign and institutional investors have been leading the rally. Since the beginning of this month through the previous day, foreign investors have been net buyers of KEPCO, purchasing a total of 148.6 billion won, making it their largest acquisition. Institutional investors have recorded 13 consecutive days of net buying, acquiring 114.7 billion won during this period.

The influx of buying by foreign and institutional investors is attributed to KEPCO being perceived as an alternative stock amid heightened uncertainty caused by tariffs and other factors. Sung Jonghwa, a researcher at LS Securities, stated, "Since the announcement of reciprocal tariffs by the Donald Trump administration in the United States on April 2, the share prices of leading companies in major industries with significant U.S. export exposure have undergone sharp corrections due to concerns over uncertainty stemming from tariffs. Meanwhile, KEPCO's share price has shown a rare and strong upward trend." He added, "As a domestic-oriented stock, KEPCO is neutral to tariff effects and has effectively played the role of a defensive and alternative stock. It is important to consider the significant value of KEPCO as an alternative investment if market uncertainty persists."

Expectations for improved earnings and increased dividends are also contributing to the stock's rise. According to financial information provider FnGuide, KEPCO's consensus earnings estimate for the first quarter of this year (the average of securities firms' forecasts) is 24.5569 trillion won in revenue, up 5.43% year-on-year, and 3.8981 trillion won in operating profit, up 200.02%. The market expects KEPCO to meet or slightly exceed these estimates. Song Yurim, a researcher at Hanwha Investment & Securities, said, "We estimate KEPCO's first-quarter revenue at 24.6 trillion won and operating profit at 3.9 trillion won, slightly above consensus." She explained, "With the continued effect of last October's industrial electricity rate hike, an increased proportion of nuclear power generation, stabilization of fuel prices, and a decline in the system marginal price (SMP), profits are expected to show a marked improvement year-on-year." She added, "Since the first quarter is likely to see the largest profit improvement this year, if results meet market expectations, the visibility of an annual earnings turnaround will increase significantly."

The earnings growth trend is expected to continue. Researcher Sung Jonghwa analyzed, "KEPCO went through a dark period of nine consecutive quarters of operating losses from the second quarter of 2021 to the second quarter of 2023 due to a sharp rise in raw material prices. However, since recovering to an operating profit structure from the third quarter of 2023, KEPCO has established a foundation for stable revenue growth through intermittent but steady rate hikes. Continued stabilization of energy prices and improvements in the power generation mix are leading to stabilized operating costs and ongoing increases in operating profit, indicating a favorable earnings trajectory."

Expectations for increased dividends on the back of improved earnings remain valid. Choi Kyuhun, a researcher at Shinhan Investment & Securities, said, "Expectations for profit growth and increased dividends are rising as a favorable business environment takes shape." He added, "With continued stabilization of energy prices and exchange rates, the profit growth base for this year is becoming even more solid, and based on this, the dividend per share (DPS) is expected to increase from 213 won to 1,500 won."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.