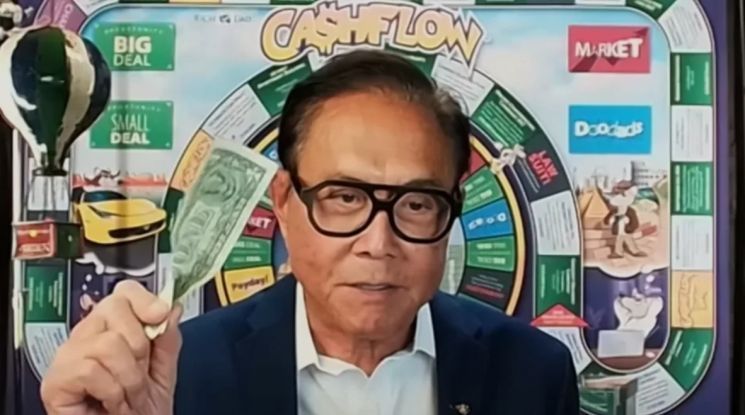

Robert Kiyosaki of "Rich Dad Poor Dad"

"Bitcoin to Reach $1 Million and Gold $30,000 in 10 Years"

As global stock markets experience significant volatility due to President Donald Trump’s tariff war, Robert Kiyosaki, the world-renowned author of the bestseller "Rich Dad Poor Dad," has once again advised that "now is the time to invest in Bitcoin and gold." He particularly emphasized, "By 2035, the price of Bitcoin will reach $1 million (approximately 1.4 billion KRW)."

On April 18 (local time), Kiyosaki stated on his X (formerly Twitter) account, "Even if you own just 0.5 Bitcoin (BTC) now, you can become wealthy in the future. This is the last chance to secure assets." He also predicted, "By 2035, the price of Bitcoin will reach $1 million."

Kiyosaki reiterated his stance that "investors should actively invest in gold and silver along with Bitcoin." He has consistently emphasized that people should hold gold, silver, and Bitcoin rather than financial products such as stocks and exchange-traded funds (ETFs). Kiyosaki stated, "I am confident that by 2035, the price of gold will reach $30,000 and the price of silver will reach $3,000."

Kiyosaki has consistently argued that Bitcoin, gold, and silver are key tools for defending against inflation and are long-term stores of wealth that can be preserved across generations. He pointed out that the ongoing liquidity supply by the US Federal Reserve, as well as excessive government spending, are accelerating the weakening of the US dollar. As a result, he believes the value of physical and digital assets is bound to surge in the long term. On April 2, Kiyosaki once again urged people to invest in gold, silver, and Bitcoin, stating, "Savers are losers."

Meanwhile, as of April 21, Bitcoin has been fluctuating around 122 million KRW, continuing a box-range trend. Despite hints that MicroStrategy, the largest Bitcoin-holding company in the US, may make additional purchases, the market remains sluggish. Bitcoin soared to $106,136 shortly after President Trump’s inauguration, but by April 9 of this year, it had dropped by as much as 28% to $76,273 compared to that peak.

In contrast, gold trading has surged to unprecedented levels. As US Treasury bonds and Bitcoin prices have stagnated, gold has been re-evaluated as the "only safe asset." According to the Korea Exchange, between the beginning of the year and April 18, the average daily trading value in the gold spot market (based on 1kg of gold) was 50.916 billion KRW. This represents a 341.85% increase compared to last year’s average daily trading value of 11.523 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.