Special Feature [False Claims, Staged Accidents... That Money Was My Insurance Premium]

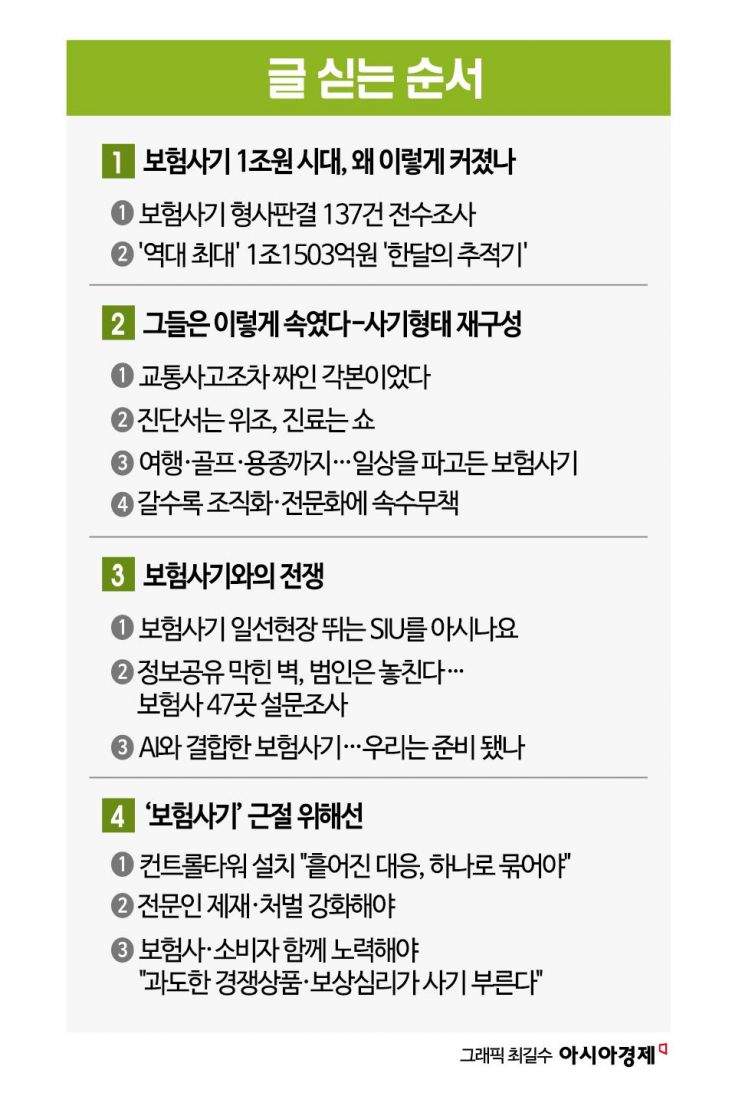

1. The Era of 1 Trillion Won in Insurance Fraud: Why Has It Grown So Large?

2. This Is How They Deceived Us - Reconstructing the Types of Fraud

3. The War Against Insurance Fraud

4. What It Takes to Eradicate "Insurance Fraud"

The amount of damages caused by insurance fraud has exceeded 1 trillion won for three consecutive years. Last year, it even set an all-time record. This enormous sum did not materialize overnight. Each false medical certificate, every fabricated accident, and each exaggerated treatment claim have accumulated to reach the figure of 1.1503 trillion won. The problem is that all these costs are ultimately passed on to honest insurance policyholders. As false claims and staged accidents run rampant, the losses suffered by insurance companies inevitably lead to higher premiums, and that burden falls on all of us.

The Economic and Financial News Department at Asia Economy recognizes the seriousness of this issue and seeks to closely examine the reality of insurance fraud through an in-depth special feature series. Reporters Choi Donghyun, Moon Chaeseok, and Oh Gyumin have meticulously analyzed hundreds of court rulings and real-life cases to track how the crime of insurance fraud operates and why it is evolving to become increasingly organized and sophisticated. The series also sheds light on structural problems that cannot simply be dismissed as the misconduct of a few brokers or medical institutions. The investigation offers a precise analysis of the current state of insurance fraud and reconstructs in detail the organized and intelligent methods used in these schemes.

This special feature goes beyond merely exposing the problem to ask what effective countermeasures exist and which institutional loopholes need to be addressed immediately. The coverage closely examines institutional responses, including the activities of the SIU (Special Investigation Unit) dedicated to insurance fraud, technological responses based on big data and artificial intelligence (AI), stronger penalties, and efforts to improve public awareness of insurance. The series also calls for the advancement of investigation and detection systems to eradicate insurance fraud, additional institutional improvements for swift and strict sanctions, the strengthening of sentencing guidelines for insurance fraud crimes, and the establishment of a control tower to bolster insurance fraud investigations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.