Retirement Pension Seminar

Currency Exposure and Domestic Bond Investments Defend Against Downturn

Enhancing Performance Through Return and Volatility Management

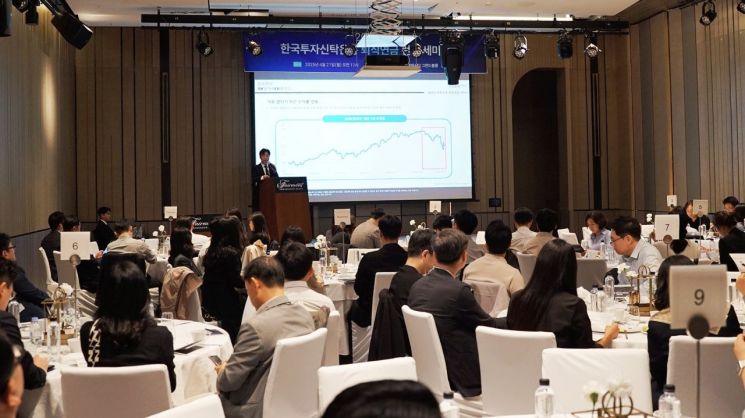

On the morning of April 21, Korea Investment Management held the '2025 Retirement Pension Seminar' for retirement pension providers at the Fairmont Ambassador in Yeouido, Seoul.

In the first session, Seo Jaeyoung, Head of the Solutions Management Division at Korea Investment Management, explained the recent performance and management strategy of the Korea Investment TDF Araseo ETF Focus Fund. Since the beginning of this year, domestic TDF performance has been sluggish due to a decline in the global stock market and sharp fluctuations in bond yields. Despite the overall downturn, the main factors that enabled the Korea Investment TDF Araseo ETF Focus Fund to defend against a drop in returns were its currency exposure strategy and investments in domestic bonds.

Seo also discussed the outlook and management plans for each investment asset class. Despite concerns over stock market volatility, he predicted that global equities, including those in the United States, and domestic bonds would outperform. He added that the fund will not only focus on returns but also on managing volatility, aiming to achieve superior risk-adjusted returns over the long term.

In the next session, Je Minjeong, Head of the Global Quantitative Management Division at Korea Investment Management, introduced the Korea Investment Income Stocks ETF Accumulation Fund. This fund is the third product in the Korea Investment ETF Accumulation Fund Series, following the Korea Investment US Nasdaq+ ETF Accumulation Fund and the Korea Investment Global New Growth ETF Accumulation Fund. The fund aims to deliver high distribution yields, low volatility, and stable regular income by diversifying investments in covered call, high-yield, high-dividend, and bond ETFs that are expected to provide high dividend yields or demonstrate strong dividend consistency.

The fund operates as an EMP (ETF Managed Portfolio) fund, with the portfolio manager directly selecting and managing the ETFs. The redemption cycle is set at four business days (three business days after redemption request), enhancing liquidity for investors. In addition, to meet the diverse needs of investors, the fund is offered in four types: monthly dividend, reinvestment, hedged, and unhedged, with a total of four sub-funds launched.

Oh Wonseok, Executive Director in charge of pensions at Korea Investment Management, stated, "We will continue to communicate with providers regarding retirement pension funds and consistently introduce fund products tailored to investor needs." He added, "It is meaningful to share our expertise and introduce a variety of investment solutions to both retirement pension providers and investors through this seminar."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.