'Ranked No. 2 for 20 Years': The History of Hyundai Motor Group's Entry into India

Developing India-Specific Vehicles: Hyundai's Thorough Localization Strategy

Maintaining Second Place in the World's Third-Largest Auto Market

Developing Engines for India's Tropical Climate... Improving Residual Vibration

Santro Rises to No. 1 in Small Cars Through Complete Localization

Kia's Differentiated Premium and SUV Strategy from Hyundai

Hyundai and Kia Achieve a Combined 20% Market Share in India

"Hyundai Motor created an entirely new vehicle specifically for India. By doing so, they demonstrated respect for the market and boosted the pride of Indian consumers."

Park Hanwoo, former president of Kia, analyzed the secret behind Hyundai Motor Group's success in the Indian market in this way when we met earlier this year. Park is an expert on India, having worked at Hyundai Motor's Indian subsidiary for about ten years since 2003, eventually serving as head of the subsidiary. As a key figure in Hyundai's entry into India, he recalled, "When I was active, Chairman Chung Mongkoo always began his first field management of the new year in India," adding, "He always said he felt good whenever he visited India. India has always been a strong pillar for Hyundai Motor."

As Park noted, the Indian market was a key factor that enabled Hyundai Motor Group to rise to third place in global sales. In 2017, when Hyundai's market share plummeted in China?its main emerging market?due to the THAAD (Terminal High Altitude Area Defense) dispute, India quickly filled the gap. In 2022, India surpassed Japan to become the world's third-largest automotive consumer market. This was due to a growing middle class, supported by India's massive population of 1.4 billion and steady growth in per capita GDP.

As of last year, the Indian passenger car market stood at 4.3 million units. By 2030, it is expected to easily exceed 6 million units. The country's vast consumer market, low labor costs, and government-led support for manufacturing have all contributed to its growing competitiveness as an automotive production hub. The recent intensification of US-China trade tensions, which has highlighted production risks in China, has also worked in India's favor. Global brands such as Hyundai, Kia, Toyota, Suzuki, Renault, and MG are building plants and expanding production capacity locally.

Indian national flag and Hyundai flag hanging at Hyundai Motor's Chennai plant in India. Photo by Hyundai Motor

Indian national flag and Hyundai flag hanging at Hyundai Motor's Chennai plant in India. Photo by Hyundai Motor

'Ranked No. 2 for 20 Years': The History of Hyundai Motor Group's Entry into India

Currently, Hyundai Motor Group has established a production system in India with a capacity of 1.2 million units. The Hyundai Chennai plant has a capacity of 800,000 units, while the Kia Anantapur plant can produce 410,000 units. With the addition of the Pune plant, acquired from GM, which has a capacity of 200,000 units, Hyundai Motor Group will have a local production capacity of 1.5 million units in the second half of this year.

When Hyundai entered India in 1996, it established its subsidiary with 100% ownership, becoming the first foreign automaker to independently enter the Indian market. Previously, Japanese brand Suzuki had already become a household name by forming a joint venture with local company Maruti. Hyundai's challenge was to achieve thorough localization as a foreign brand without the help of a local partner. On the other hand, 'independent entry' meant Hyundai could operate its business without outside interference, allowing for greater control over costs and quality.

Hyundai built cars that thoroughly reflected the needs of Indian consumers. New models developed in Korea were redesigned for the Indian market and launched almost simultaneously in both Korea and India. Competing Japanese brands typically released new models in Japan first, then sold them in Southeast Asia two to three years later, and finally brought them to India. Essentially, they would introduce outdated models with only cosmetic changes to India after the new car cycle had ended elsewhere. Hyundai, however, took a different approach. Park said, "While Japanese competitors brought Southeast Asian versions or models near discontinuation to India, we developed locally tailored vehicles based on the latest models released globally, making cars specifically for India. We wanted to send a clear message that India is an extremely important market for us."

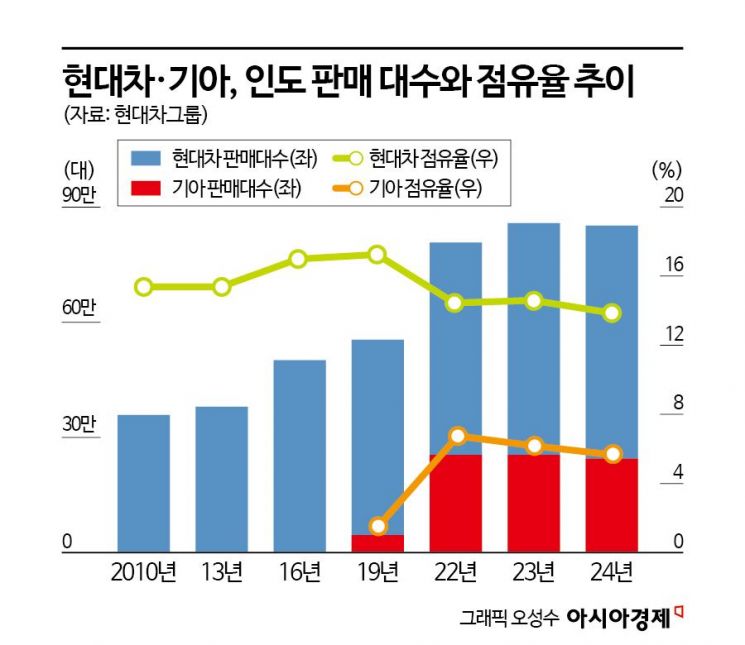

Thanks to its thorough localization strategy, Hyundai has maintained its position as the No. 2 player in the Indian passenger car market since the 2000s. After reaching a record-high market share of 17.3% in 2019, Hyundai has consistently maintained a share of around 15%. Excluding Maruti Suzuki?a joint venture between Japan and India with a 41% share?Hyundai is the top foreign single brand. Although its market share has dipped slightly recently, explosive growth in the Indian auto market has led to a surge in sales volume. Hyundai's sales in India grew from 350,000 units in 2010 to 600,000 units last year. Including Kia, Hyundai Motor Group now sells 850,000 vehicles annually in India, accounting for 14% of Hyundai and Kia's overseas sales.

Kia, which entered the market later than Hyundai, has fully benefited from the rapid growth of the Indian auto market. In its first year in 2019, Kia entered the market with a 1.5% share (45,000 units). Its premium brand strategy, focused on SUVs, resonated with the market, boosting its share to 6.7% in 2020. As of 2024, Hyundai and Kia's combined market share has reached 20%. By group, they rank second after Maruti Suzuki (41%), ahead of domestic brands Tata Motors (13%) and Mahindra (12%).

In October 2024, Hyundai Motor listed its Indian subsidiary on the local stock market. The capital raised from the Indian market alone amounted to 4.5 trillion won, marking the largest IPO in Indian stock market history. Hyundai declared its ambition to become even more closely integrated with Indian society and to be reborn as a truly Indian national company through the listing.

"Designed to Withstand India's Sweltering Heat": The Untold Story of Santro's Development

"When the Santro first appeared in 1998, most people thought its chances of success were very low." BVR Subbu, the first president of Hyundai Motor India, testified to the challenges in his book "Santro: The Car That Built a Company" (2017).

He played a leading role in the development and launch of the 'Santro' model, which achieved unprecedented success for Hyundai in the early Indian market. He recalled the moment he first saw the prototype, codenamed MX, at the Namyang R&D Center in 1997: "When I first saw the clay model based on the AtoZ, I was disappointed," he said. "I expressed to management that this design would not work in India and pointed out the need to improve the rear design."

The first-generation Santro, Hyundai Motor's local strategic model in India. Provided by Hyundai Motor

The first-generation Santro, Hyundai Motor's local strategic model in India. Provided by Hyundai Motor

The Santro was developed on the same platform as Hyundai's compact car, the Atos. The Atos had a boxy rear design with a straight drop-off. In contrast, the Santro lowered the roof height slightly and added curves to the rear, providing more space for rear passengers. In India, even small cars are packed with large families. Hyundai decided it was better to modify the design to secure as much space as possible in the second row. Although the Santro's roof was slightly lower than the Atos, it was still higher than competing models from other brands, offering ample headroom. Indian consumers, who often wear turbans, liked the tall Santro and nicknamed it the 'tallboy.'

The most critical aspect of the Santro's development was balancing engine and air conditioning performance. India's tropical monsoon climate means daytime temperatures often exceed 48°C, with road surface temperatures reaching 55°C. Even in major cities, road conditions are poor and traffic congestion is severe due to the sheer number of vehicles. Blasting the air conditioning to cool the sweltering cabin would slow the engine and reduce fuel efficiency. To address this, Hyundai focused on developing an engine that could deliver sufficient power with minimal gear shifting. They also standardized a relatively large 135cc air conditioning compressor for a compact car, significantly boosting cooling performance.

Another issue revealed by consumer research was the pronounced residual vibration in vehicles driven for more than a year. This discomfort was even greater in regions with poor road conditions. To address this, Hyundai reduced the distance between welding points to increase torsional rigidity and minimize body deformation. This required more than doubling the number of welding points, which increased both time and cost. Subbu recalled, "There was unanimous agreement within the team that this issue had to be fixed. From that point on, everyone started acting like a leader, and we became convinced that we could be the potential winner."

Debuting in 1998, the Santro started with a 9% share of the Indian small car market and grew to 25% the following year. In 2000, it overtook the Maruti Zen to claim the top spot in the small car segment. Thorough localization paid off not only in development but also in marketing. Hyundai hired Bollywood superstar Shah Rukh Khan as its brand ambassador, boosting brand recognition. As a result, Hyundai rose to second place in market share just six months after entering the Indian market.

"Differentiating from Hyundai": The Challenge Facing Latecomer Kia

"Building a factory was easier than differentiating our products. We had to think about how to create synergy in a market where Hyundai was already doing well. Kia needed a different breakthrough."

After returning from India after ten years, Park Hanwoo moved to Kia, serving as head of finance and then being appointed CEO in 2014. During his tenure as CEO, his top priority was Kia's entry into India. Starting in 2019, Kia operated a plant in Anantapur, Andhra Pradesh, with an annual capacity of 300,000 units. This plant produced local strategic models such as the Seltos, Sonet, and Carens. It also manufactured export vehicles for the Middle East, Africa, and Latin America, in addition to serving the Indian domestic market.

In some ways, setting up the factory was the easy part, as Kia could draw on the expertise Hyundai had accumulated over 20 years in India. However, differentiating Kia's brand from Hyundai proved more challenging than expected. Hyundai was already widely recognized for its market presence and product quality as the No. 2 brand. Kia had to take a strategic approach to ensure its brand image and product lineup did not significantly overlap with Hyundai's.

Thus, Kia chose 'premium' and 'SUV' as its key concepts. It pursued a more upscale strategy than Hyundai and focused on SUVs. To this end, Kia launched the Seltos, a premium SUV designed specifically for India. The Seltos featured a sophisticated design, luxurious interior finishes, an advanced infotainment system (with a 10.25-inch touchscreen in higher trims), and best-in-class safety features. This coincided with a shift in Indian consumer preference from small and compact cars toward SUVs. Kia's differentiation strategy was a perfect fit. Within two months of its launch, the Seltos became the best-selling SUV in India, and Kia surpassed a 6% market share in 2020. This was the fastest achievement of its kind among all brands. Park Hanwoo commented, "Looking back, Kia's timing in entering India just before the COVID-19 pandemic in 2019 was also ideal. Thanks to this, we were able to achieve a combined market share of 20% for the two brands, in line with the explosive market demand."

A salesperson is consulting with a customer at a Kia dealership located in Bengaluru, India. Provided by Kia

A salesperson is consulting with a customer at a Kia dealership located in Bengaluru, India. Provided by Kia

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)