Bank of Korea: "2024 Payment and Settlement Report"

Market Value Assessment of Five Major Exchanges at End of Last Year

Regulatory Easing Expectations After Trump’s Election

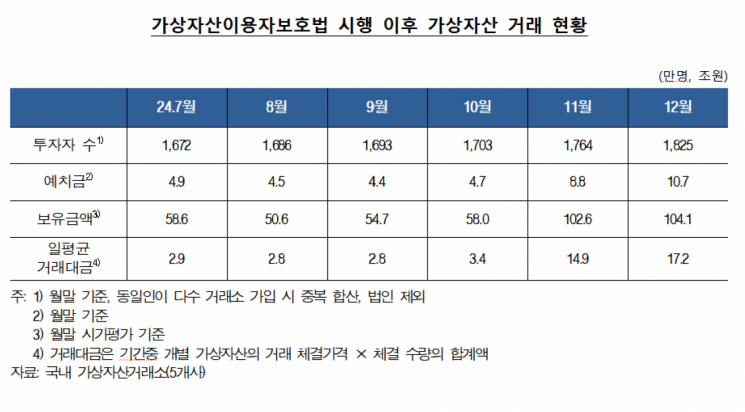

Since the implementation of the Virtual Asset User Protection Act last year, the virtual asset market has expanded significantly. After Donald Trump, who expressed a favorable stance toward virtual assets, was elected in the U.S. presidential election on November 24 of last year, expectations for regulatory easing contributed to a sharp increase in deposits, virtual asset holdings, and average daily trading volume.

According to the "2024 Payment and Settlement Report" released by the Bank of Korea on April 21, which covers the status of virtual asset trading following the implementation of the Virtual Asset User Protection Act, the number of investors holding registered accounts at the five domestic virtual asset exchanges stood at approximately 18.25 million as of the end of December last year. The analysis attributes the continuous increase in the total number of investors to the inflow of new investors, driven by improved investment sentiment in the virtual asset market during the second half of last year.

The amount of Korean won deposits held by domestic investors at the five exchanges was reported to be around 10.7 trillion won. As investment sentiment toward virtual assets improved due to rising virtual asset prices and increased trading volume, the amount of Korean won deposits, which serve as standby investment funds, also grew accordingly.

The total value of virtual assets held by the five exchanges (converted to market value) and the average daily trading volume were estimated at 104.1 trillion won and 17.2 trillion won, respectively. In particular, following Trump’s victory in the U.S. presidential election, the sharp rise in the prices of major virtual assets such as Bitcoin and the improvement in investor sentiment led to an expansion of new investments, resulting in a significant increase in both the value of virtual assets held and the average daily trading volume.

Meanwhile, the Virtual Asset User Protection Act, which took effect on July 19 of last year, requires virtual asset business operators, such as exchanges, to manage user deposits separately from their own assets in order to protect investors' assets. The Act also prohibits unfair trading practices such as market manipulation, and imposes liability for damages and administrative fines in case of violations.

The Virtual Asset User Protection Act grants the Bank of Korea's Monetary Policy Board the authority to request data submissions from virtual asset business operators if it deems it necessary for the implementation of monetary and credit policy, financial stability, or the smooth operation of the payment and settlement system in relation to virtual asset transactions. Based on this authority, the Bank of Korea has been receiving transaction data from the five major domestic virtual asset exchanges to monitor and analyze trends in the virtual asset market.

In addition, key discussions on virtual asset policy and regulations in South Korea are being led by the Virtual Asset Committee, which was established by the Financial Services Commission in November of last year. The committee is expected to address major issues related to virtual assets, such as the establishment of a regulatory framework for stablecoins and the second phase of legislative discussions on the Virtual Asset User Protection Act. Unlike general virtual assets, stablecoins have the characteristics of a means of payment and, if issued and circulated extensively as a substitute for legal tender, could negatively affect central bank policy operations such as monetary policy, financial stability, and payment and settlement. Therefore, a separate regulatory framework is deemed necessary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.