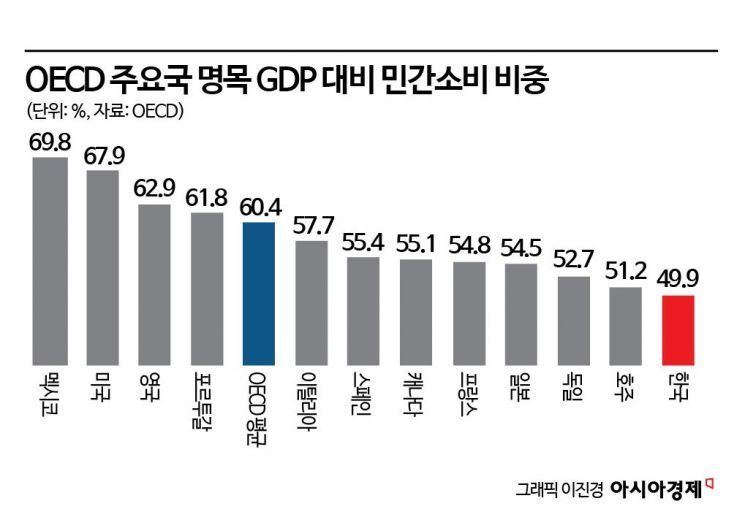

South Korea's Private Consumption Ratio to GDP at 49.9%, Lowest in the OECD

Even Lower Than Japan's 54.5%; OECD Average Stands at 60.4%

Decline in Households' Real Purchasing Power Due to Inflation and Worsening Consumer Sentiment Are Key Factors

South Korea's ratio of private consumption to Gross Domestic Product (GDP) has been found to be among the lowest in the world. The country's sluggish consumption is even more pronounced than that of Japan, which experienced rapid population aging earlier. Experts point out that in order to fundamentally address weak consumption, it is necessary to increase the birth rate, implement structural reforms across the economy, and reduce household debt.

South Korea's Private Consumption Ratio to GDP at 49.9%, Lowest in the OECD

According to the Korea Development Bank Economic Research Institute on April 21, South Korea's nominal private consumption as a percentage of GDP stood at 49.9% in 2023, the lowest among member countries of the Organisation for Economic Co-operation and Development (OECD). Mexico recorded the highest ratio at 69.8%, followed by the United States at 67.9%, the United Kingdom at 62.9%, and Portugal at 61.8%. The OECD average was 60.4%. South Korea's figure was lower than those of Japan (54.5%), Germany (52.7%), and France (54.8%).

Private consumption, which refers to household spending on goods and services, accounts for the largest share of GDP and is therefore a key driver of a country's economic growth.

Since the COVID-19 pandemic, the growth rate of private consumption in South Korea has shown a gradual slowdown. From 2011 to 2019, the average annual growth rate of private consumption was 2.52%, but over the most recent seven quarters, it dropped significantly to an average of 0.99%. Between 2001 and 2024, the average annual growth rate of real GDP was 3.46%, while that of real private consumption was 2.57%, meaning private consumption grew at only about 74% of the GDP growth rate.

The main reason for sluggish private consumption is the decline in households' real purchasing power, which has resulted from consumer prices persistently rising above the target level (2.0%) due to factors such as higher import prices and oil prices after COVID-19. The continued increase in the base interest rate since the second half of 2021, aimed at stabilizing the sharply rising prices after the pandemic, has also contributed to the slowdown in private consumption.

More fundamental causes include a decline in the potential growth rate due to low birth rates and an aging population, a decrease in the propensity to consume due to increased savings for retirement, and the burden of high household debt.

Due to low birth rates and an aging population, the working-age population has been steadily declining since 2020, which has become a major factor restricting consumption. The sharp decrease in the working-age population lowers the potential growth rate, making a rebound in consumption difficult in the future.

There are also concerns about the gradual decline in the average propensity to consume, as increased savings for retirement have led to a decrease in consumption. As people save more for their later years due to longer life expectancy, the growth rate of consumption expenditure has fallen below the average annual growth rate of disposable income, and the average propensity to consume has continued to decline.

Decline in Households' Real Purchasing Power Due to Inflation and Worsening Consumer Sentiment Are Key Factors

With household debt remaining at a high level, the burden of interest payments has increased and households' ability to spend has diminished, further restricting the growth of private consumption. South Korea's household debt ratio is significantly higher than the OECD average. Analysts point out that the increase in the burden of principal and interest repayments due to excessive debt reduces households' real disposable income, thereby dampening private consumption.

In the end, experts argue that these fundamental problems must be addressed in order to improve private consumption in the long term. Among these, actively increasing the birth rate is cited as the top priority. Creating quality jobs, stabilizing housing prices, and expanding support for childcare were highlighted as key measures to boost the birth rate.

To overcome the decline in the contribution of labor to growth due to a shrinking working-age population, it is necessary to improve the overall structure of the economy by enhancing capital productivity and the quality of human capital. The government should also continue efforts to reduce household debt so that the household debt-to-GDP ratio, currently over 90%, can be lowered to around 80%.

Ryu Yongok, a senior researcher at the Korea Development Bank Economic Research Institute, stated, "It is not easy to fundamentally block the long-term trend of declining private consumption. However, if the birth rate increases, the overall economic structure is improved, household debt is reduced, and the living stability of single-person households is achieved, the slowdown in private consumption can be minimized."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)