Surpassing Last Month's Growth in Just 13 Business Days

Household Loans Expected to Increase Further Due to Phase 3 DSR and Falling Market Interest Rates

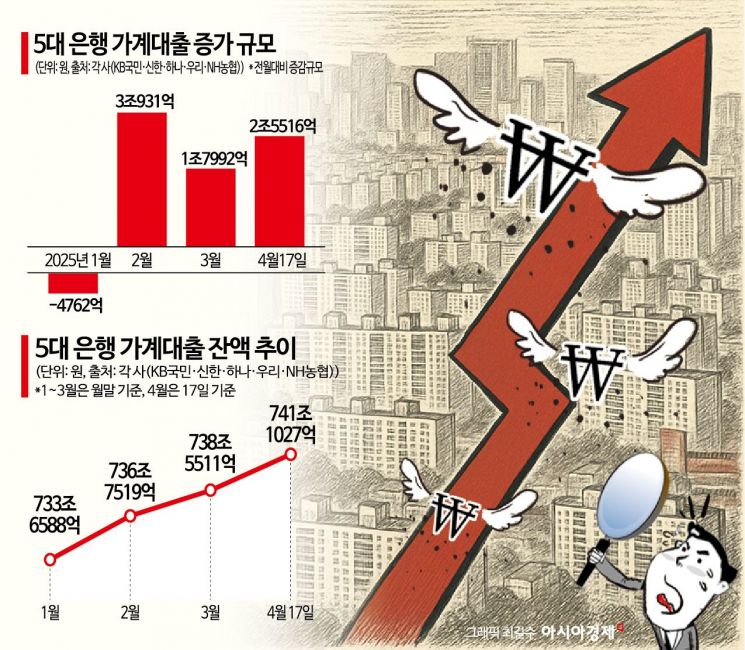

Household loans, which had previously slowed, increased by 2.5 trillion won from April 1 to 17. This is about 1.5 times greater than the increase recorded in the previous month (March 1?31). Credit loans also rose by more than 1 trillion won. The surge is believed to be due to the lifting of the Land Transaction Permission System (Toheje), with related loans being reflected in earnest in April and May after a time lag. In particular, with the third phase of the stress-based Debt Service Ratio (DSR) set to take effect in July, the pace of household debt growth is expected to accelerate even further.

According to the financial sector on April 21, the outstanding balance of household loans at the five major commercial banks (KB Kookmin, Shinhan, Woori, Hana, and NH Nonghyup) stood at 741.1027 trillion won as of April 17. This represents an increase of 2.5516 trillion won compared to the end of March (738.5511 trillion won). In just 13 business days, the increase has already surpassed the previous month's rise of 1.7992 trillion won. At this rate, there are concerns that the increase could exceed even that of February (+3.0931 trillion won), when new semester moving demand was particularly strong.

Both mortgage loans and credit loans are on the rise. During the same period (April 1?17), mortgage loans amounted to 587.1823 trillion won, up 1.5018 trillion won from the previous month (585.6805 trillion won). If this trend continues, the monthly increase in mortgage loans is expected to surpass the previous month's growth of 2.3198 trillion won.

The increase in credit loans is especially steep. As of April 17, the outstanding balance of credit loans at the five major banks was 102.6658 trillion won, up 1.0595 trillion won from the end of the previous month. Household credit loans had been declining for four consecutive months since November last year, but have now turned to an increase this month.

The sharp rise in household loans is mainly attributed to expectations of interest rate cuts, as well as the impact of the lifting of the Toheje in February. This is because there is typically a one to two month time lag between a home transaction and loan approval. In fact, according to the Ministry of Land, Infrastructure and Transport, the number of home transactions in February was 50,698, a 32.3% increase from the previous month. In particular, apartment sales in Seoul (4,743 transactions) surged by 46.7% compared to the previous month (3,233 transactions).

There are also projections that the implementation of the third phase of the stress-based DSR in July, combined with a decline in market interest rates leading to lower lending rates, will further stimulate demand for household loans. According to the Korea Federation of Banks, the Cost of Funds Index (COFIX) for new loans in March, announced on April 15, stood at 2.84%. This is a decrease of 0.13 percentage points from the previous month, marking a decline for six consecutive months since October last year. As a result, commercial banks that use COFIX as a benchmark for variable-rate mortgage loans immediately reflected the lower rates from April 16.

The third phase of the DSR, set to take effect in July, is another variable. Under this phase, a stress rate of 1.5 percentage points will be applied to mortgage loans, credit loans, and other loans at both banks and secondary financial institutions. Consequently, loan limits are expected to decrease by about 50 million won compared to current levels, which could lead to a rush of borrowers seeking loans before the new rules take effect.

An official at a major commercial bank said, "Since the beginning of this year, we have been closely monitoring the increase in loans by implementing daily monitoring." The official added, "However, with the impact of the Toheje now being reflected in loan coefficients starting this month, the increase in loans is expected to be more pronounced in April than in the previous month."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)