Korea Emerges as a Key Hub for Low Earth Orbit Satellite Communication

Starlink, OneWeb, and Others Prepare to Launch Domestic Services

This June, global satellite communication companies will enter a fierce competition over the Korean sky. Following SpaceX's 'Starlink' and Eutelsat OneWeb's 'OneWeb,' Amazon's 'Project Kuiper' has thrown down the gauntlet in the domestic market, making the battle for dominance in low Earth orbit satellite communications increasingly visible.

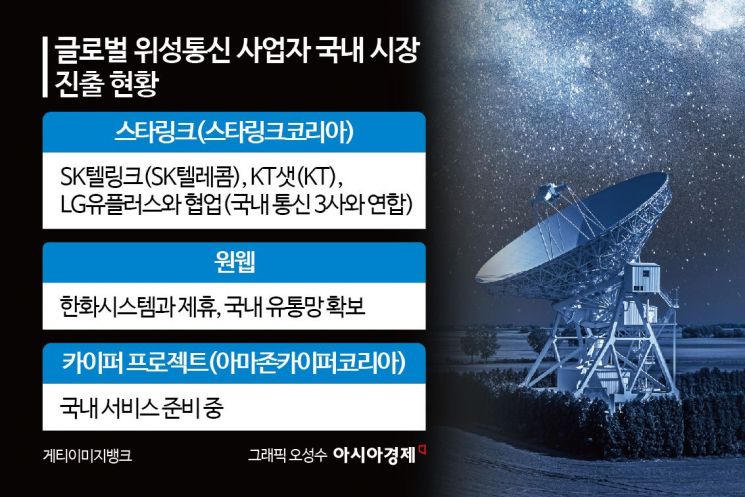

Starlink, led by Starlink Korea, has partnered with SK Telecom subsidiary SK Telink, KT subsidiary KT Sat, and is also collaborating with LG Uplus. Eutelsat OneWeb's OneWeb has secured a domestic distribution network through Hanwha Systems, signaling a direct confrontation with Starlink. Recently, Amazon established Amazon Kuiper Korea and is accelerating preparations for domestic service. With alliances forming between the three major telecom companies and global corporations, the domestic market has become a battleground where multiple satellite networks collide.

Korea is attracting attention as a key hub for low Earth orbit satellite communications due to its world-class communication infrastructure and strategic location connecting the Asia-Pacific region. Especially, Korea, with its densely populated urban areas and coexisting island and mountainous terrains where building base stations is difficult, is considered an ideal market to prove the effectiveness of low Earth orbit satellite communications. Global companies appear to be using the Korean market to verify their technology and business models before expanding to neighboring countries.

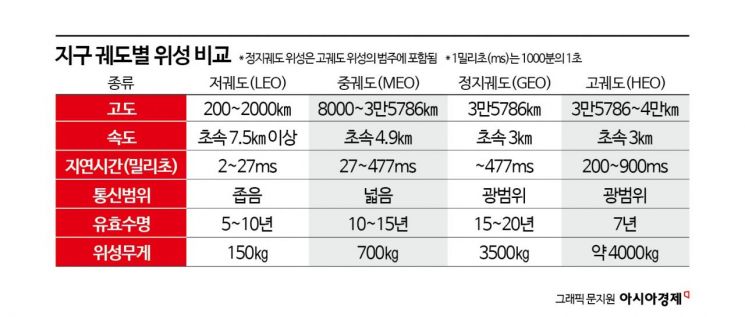

Low Earth orbit satellite communication operates through thousands of satellite constellations positioned at altitudes between 200 and 2,000 km, enabling ultra-high-speed data transmission. Compared to traditional geostationary satellites, it offers shorter signal round-trip times, lower communication latency, and significantly reduced launch costs, making it a promising next-generation communication infrastructure.

Notably, with about 30% of the global population still lacking internet access, the ability to connect regions where submarine cables are difficult to reach presents enormous market potential. Since it is directly linked to critical infrastructures such as military, disaster response, and space navigation, competition over securing frequencies and orbital slots is intensifying. Some analyses suggest that more than 500 satellites are needed to reliably cover the entire Korean peninsula.

Considering the security and industrial importance, securing a certain level of domestically produced satellite communication networks is inevitable. However, the reality is challenging. The sky is already near saturation, and more than 70,000 satellites, including Starlink and China's Guowang (國網) project, are scheduled to be launched into low Earth orbit by 2030.

Since frequencies and orbital slots are allocated on a first-come, first-served basis, there are calls to proactively advance launch plans even if delayed. Fortunately, the Ministry of National Defense is planning to launch a minimum of 10 to a maximum of 100 satellites. It is now time to provide comprehensive support not only for technology acquisition but also for ecosystem development and industrial infrastructure.

On the 1st of this month, the government promulgated an amendment to the Radio Waves Act Enforcement Decree, establishing the institutional foundation necessary for service launch. The amendment focuses on introducing low Earth orbit satellite communication services and simplifying terminal installation procedures. Companies that complete technical verification such as conformity assessments can begin full-scale service as early as June. Ryu Jemyung, Director of Network Policy at the Ministry of Science and ICT, stated, "Government-level approval procedures are expected to be completed by May," adding, "Service launch depends on the readiness of the operators."

This competition is not merely about launching services but serves as a signal flare in the battle for leadership in the satellite-based communication ecosystem. Domestic companies are also actively entering this trend. Satellite communication antenna specialist Intellian Technologies has signed supply contracts with OneWeb and Australia's Telstra based on its flat-panel antenna technology and is establishing itself as a key technology supplier in the LEO satellite era.

Low Earth orbit satellite communication is emerging as infrastructure that goes beyond simple communication technology, reshaping inter-country connection structures and the direction of global information flow. Who will dominate the communication networks in the sky? The fierce battle between corporate strategies and national policies begins now, in Korea.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)