Firm Response to Intentional Tax Evasion Involving Overseas Asset Concealment

29th Korea-Japan National Tax Commissioners' Meeting Held

Tax authorities of South Korea and Japan have agreed to enhance the effectiveness of information exchange and collection cooperation regarding high-value tax delinquents.

On the 15th, the National Tax Service (NTS) announced on the 16th that Commissioner Kang Min-su held a Korea-Japan National Tax Commissioners' meeting in Tokyo with Tatsuo Oku, Commissioner of the Japanese National Tax Agency, to discuss this matter.

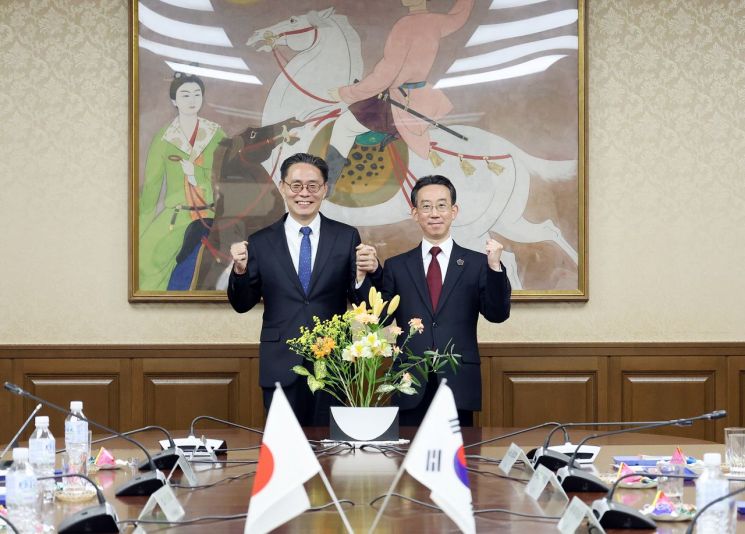

On the 15th, Kang Min-su, Commissioner of the National Tax Service (left), and Tatsuo Oku, Commissioner of the Japanese National Tax Agency, are taking a commemorative photo at the Korea-Japan National Tax Commissioners' meeting held in Tokyo. (Photo by National Tax Service)

On the 15th, Kang Min-su, Commissioner of the National Tax Service (left), and Tatsuo Oku, Commissioner of the Japanese National Tax Agency, are taking a commemorative photo at the Korea-Japan National Tax Commissioners' meeting held in Tokyo. (Photo by National Tax Service)

South Korea and Japan have been holding regular National Tax Commissioners' meetings since 1990. Especially this year marks the 60th anniversary of the normalization of diplomatic relations between Korea and Japan, and the NTS expects this to be an opportunity to advance the tax administration cooperation between the two tax authorities to a new level.

At this meeting, the Korea-Japan National Tax Services shared directions for tax administration operations and major tax issues, and discussed responses to changes in the tax environment.

The commissioners of both countries had in-depth discussions on South Korea's "property tracing investigations for high-value habitual tax delinquents" and Japan's "tax administration on new financial assets." In particular, they agreed to further activate the mutual agreement procedure under the Korea-Japan tax treaty, which resolves double taxation occurring to taxpayers due to tax assessments inconsistent with the tax treaty, through consultations between tax authorities. This aims to actively support the prevention and resolution of double taxation and other tax difficulties for companies operating in both countries.

Additionally, at this meeting, the Korea-Japan National Tax Commissioners agreed to take a firmer stance against deliberate tax evasion involving hiding assets overseas to establish tax justice, and recognized the need to enhance the effectiveness of collection cooperation between the two countries under the multilateral tax administrative cooperation agreement. Collection cooperation involves foreign tax authorities performing compulsory collection measures such as overseas asset inquiries, seizures, and auctions on behalf of the home country to more efficiently collect delinquent taxes.

An NTS official stated, "The strengthened cooperation between Korea and Japan is the result of efforts to enhance collaboration through meetings between the commissioners at the Asia-Pacific Tax Authorities Meeting and the OECD Tax Commissioners Meeting last year, as well as two subsequent 'Korea-Japan working-level meetings.' The NTS will continue to build an organic cooperative system between tax authorities to closely coordinate international cooperation and actively support Korean residents and companies operating overseas from a tax administration perspective through active tax diplomacy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.