"Continuous Efforts to Enhance Independence and Shareholder Value"

The National Pension Service, the second-largest shareholder holding a 6.67% stake in Coway, voted in favor of the introduction of a cumulative voting system at Coway's regular shareholders' meeting last month.

On the 14th, activist fund Align Partners (Align) stated, "According to the National Pension Service's shareholder rights exercise disclosure, the National Pension Service exercised its voting rights in favor of Align's shareholder proposal (Agenda Item 2-1) to introduce a cumulative voting system at Coway's 36th regular shareholders' meeting held on the 31st of last month."

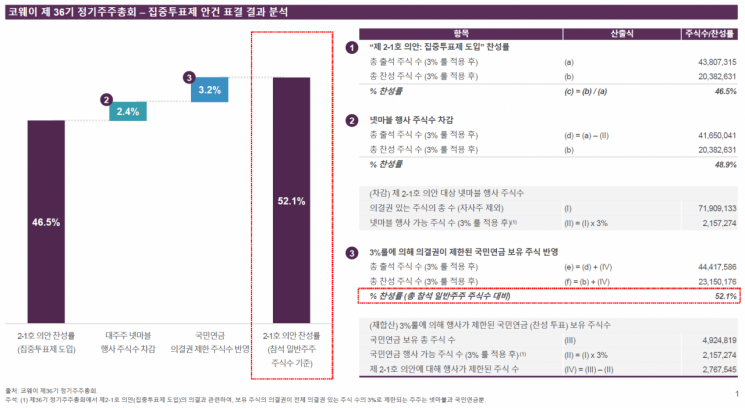

According to Align's analysis, not only the National Pension Service but also 52.1% of the general shareholders, excluding the major shareholder Netmarble who attended this Coway regular shareholders' meeting, voted in favor of Align's shareholder proposal to introduce the cumulative voting system.

Regarding this analysis, Lee Chang-hwan, CEO of Align, said, "Coway's management stated through the media that the rejection of the cumulative voting system proposal immediately after the shareholders' meeting was because 'shareholders judged that the current board operation sufficiently ensures independence and transparency, making it suitable for continuous corporate growth and enhancement of shareholder value.' However, this misinterprets the shareholders' intentions."

CEO Lee added, "The fact that the majority of general shareholders, including the National Pension Service, supported the shareholder proposal to introduce the cumulative voting system strongly demonstrates many shareholders' desire for improving the independence of Coway's board and enhancing shareholder value. Based on the strong support confirmed at this shareholders' meeting, Align will continue its efforts to enhance the independence of Coway's board and increase shareholder value."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.