After Tariff Exemptions for Smartphones, U.S. Reverses Course

Semiconductor Industry: "U.S. Announcements Are Unpredictable"

High Tariff Risk Remains

Some Expect Exemptions Due to Impact on U.S. Big Tech

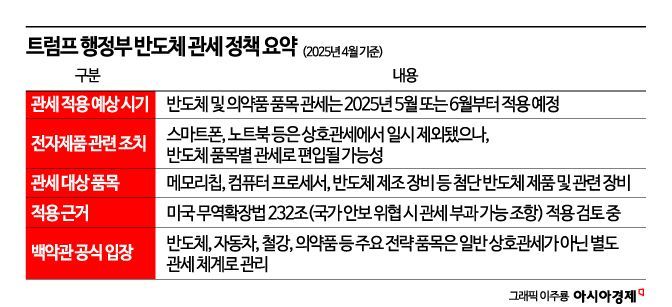

The United States has once again hinted at the possibility of imposing tariffs on semiconductors, increasing anxiety within the domestic related industries. Previously, it was announced that tariff exemptions would apply to finished products containing semiconductors, such as smartphones and computers, but just two days later, a tariff imposition policy was revealed. The domestic industry responded, saying, "President Trump's statements are unpredictable and his stance changes frequently," and "fatigue is growing."

According to the related industry on the 14th, the Donald Trump administration will announce the tariff policy for semiconductors by item on that day. However, no specific policy has been disclosed so far. Lee Chang-han, former vice chairman of the Korea Semiconductor Industry Association, said, "At this point, we cannot be certain whether tariffs will be imposed on semiconductors," adding, "Companies are also unable to predict whether they need to build additional semiconductor factories in the U.S." He further noted, "Since the semiconductor industry mainly operates on a made-to-order demand basis, if tariffs increase, the price burden of the products themselves will also rise."

There are also remarks that government-level responses are becoming increasingly important. Kim Moon-tae, head of the Industrial Policy Team at the Korea Chamber of Commerce and Industry, stated, "We have no choice but to rely on the government's trade response and negotiations." In fact, major semiconductor companies including Samsung Electronics and SK Hynix have expressed that it is difficult to immediately adjust investment or supply chain strategies until the method of tariff application becomes clear.

Recently, the exclusion of some electronic products from the mutual tariff application announced by U.S. Customs has acted as a factor that can alleviate immediate burdens. The U.S. Customs and Border Protection (CBP) classified finished products such as memory modules and solid-state drives (SSD) as items excluded from mutual tariffs. As a result, not only Samsung Electronics but also Apple, Dell, Nvidia, and TSMC are expected to temporarily avoid tariff burdens.

However, the possibility remains that semiconductors will be classified as a separate item and become subject to high tariffs. On April 13 (local time), President Trump stated on his social media platform Truth Social, "I never announced tariff exemptions last Friday (April 11)," adding, "These products are subject to the existing 20% fentanyl tariff and are simply being moved to a different tariff category."

There is also analysis that the policy direction indicates the U.S. government's intention to pressure actual manufacturing reshoring. Shin Won-kyu, invited research fellow at the Korea Economic Research Institute, analyzed, "Ultimately, the goal is decoupling from China," and "It seems to be giving time to move manufacturing bases to the U.S. rather than China." This is interpreted as a strategy to induce tariff avoidance by relocating semiconductor production bases to the U.S.

On the other hand, there is also a forecast that the possibility of semiconductors being excluded from high tariffs cannot be ruled out. Lee Tae-gyu, senior research fellow at the Korea Economic Research Institute, said, "For now, tariff exemptions have been granted for electronic components," adding, "I think various exemption regulations will be established for various reasons after 90 days." He diagnosed that "since there is little semiconductor production in the U.S. and imposing tariffs on other countries is expected to provoke opposition from U.S. big tech companies, it is highly likely that semiconductor items will ultimately be exempted."

When trade consultations between Korea and the U.S. begin in earnest, the actual imposition and scope of tariffs may vary depending on political and diplomatic variables. The industry plans to prepare various response scenarios until the U.S. administration's official announcement is made.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.