US Big Tech Invests for Innovation, Korea Focuses on Service Improvement

Naver Invests Only 7.2%... Environmental Constraints Like Infrastructure Location Also Cited

It has been revealed that the investment ratio relative to revenue of major domestic tech companies such as Naver significantly lags behind that of American big tech companies like Meta. There is also a large gap in absolute investment amounts, with the proportion of investment relative to revenue being extremely low. As the era of artificial intelligence (AI) begins, early investment determines success or failure, raising concerns that the gap with overseas big tech companies will widen further.

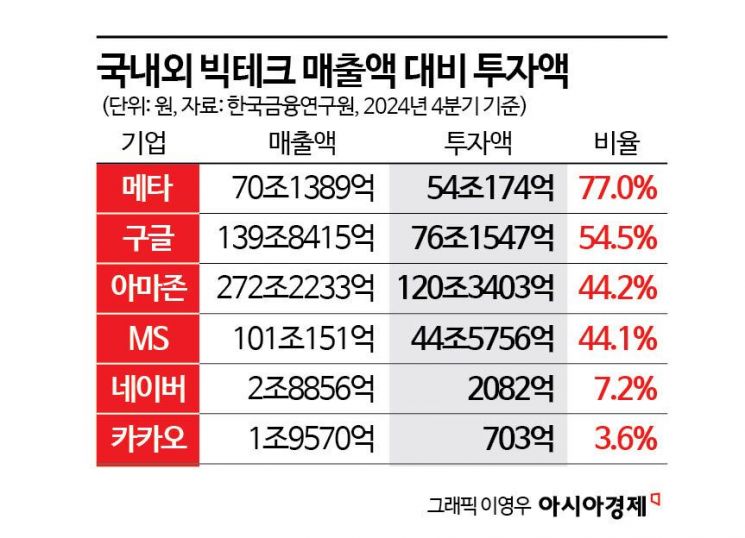

According to the Korea Institute of Finance's report "Investment in the AI Industry and the Role of Capital Markets" dated the fourth quarter of last year, the investment-to-revenue ratios of leading domestic tech companies Naver and Kakao were only 7.2% and 3.6%, respectively. In contrast, during the same period, Meta's investment accounted for 77% of its revenue. This means that for every 1 million KRW in revenue, 770,000 KRW is invested in AI enhancement. Google invested 54.5%, Amazon 44.2%, and Microsoft (MS) 44.1% of their revenues. The investment ratios of American big tech companies are more than ten times higher than those of domestic firms.

US Receives Investment for Innovative Technology Goals... Korea Focuses on Service Improvement, Lacking Justification for Investment

The investment amounts of US big tech companies have already reached an absolutely high level. According to the Financial Times (FT), the combined investment of Meta, Google, Amazon, and MS increased from $151 billion (approximately 219 trillion KRW) in 2023 to $246 billion (approximately 356 trillion KRW) in 2024. This year, it is expected to exceed $320 billion (approximately 463 trillion KRW). They are investing astronomical amounts while maintaining a high investment ratio.

Most of the massive investment is used to expand infrastructure such as building AI data centers. FT stated, "Big tech companies are building data centers and turning them into hubs concentrated with AI semiconductor ecosystems to compete for the leading position in large language models (LLM)." Citibank also analyzed that about 80% of these investments are focused on building AI data centers. The global market research firm Statista said last year that "the AI market will grow at an average annual rate of 20% from 2020 to 2030."

The bold AI investments by US big tech companies are driven by long-term strategies for technological innovation and market dominance. Kim Doo-hyun, a professor in the Department of Computer Engineering at Konkuk University, explained, "US big tech companies receive investments aimed at technological innovation," adding, "This creates justification for investments worth hundreds of trillions of KRW to develop technologies that do not yet exist in the world."

Experts say the large gap in investment ratios between domestic and overseas companies is due to significant differences in investment environments. Choi Byung-ho, a professor at Korea University's AI Research Institute, said, "While US companies aim for innovative technologies like Artificial General Intelligence (AGI), Korean companies take an approach focused on improving existing services," adding, "Domestic companies like Naver focus on enhancing their own services, so they relatively lack justification for comprehensive investments like US companies." He further noted, "Korean companies also face practical constraints in overseas expansion, concentrating more on Southeast Asia or the Middle East markets rather than the US or China."

Lee Ji-eon, a senior researcher at the Korea Institute of Finance, said, "There are almost no consortia in Korea capable of attracting infrastructure investments worth trillions of KRW, and domestic companies are unable even to attempt such investments," adding, "Even if high-performance graphics processing units (GPUs) necessary for AI development are secured, the lack of infrastructure such as power and cooling systems limits the actual usable space."

Korean Tech Companies Invest as Little as 'Coca-Cola' Level

He said, "The investment level of domestic tech companies like Naver and Kakao is similar to that of Coca-Cola (4.3%), which has already entered the 'mature' stage," adding, "Coca-Cola pursues high returns with minimal investment in a stabilized mature stage, but such a passive investment pattern in the 'emerging' AI industry could be a fatal weakness for securing long-term competitiveness."

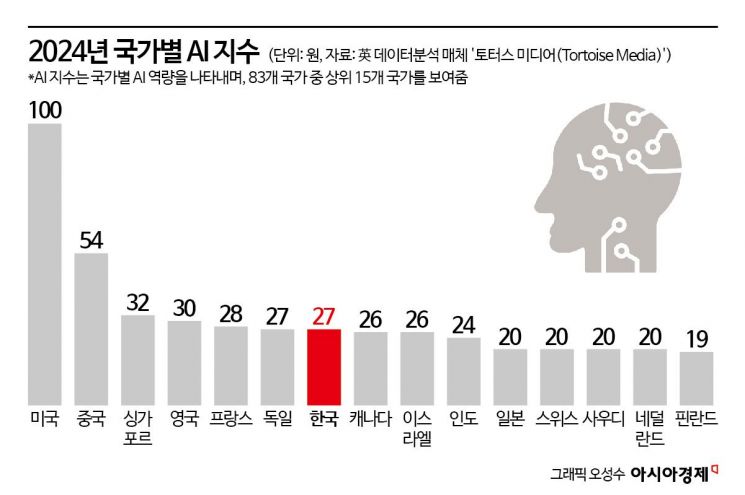

Looking at the AI index by country, South Korea's AI capabilities lag far behind. According to the 'Global Artificial Intelligence Index,' a representative indicator evaluating national AI competitiveness published by UK-based Tortoise Media in September last year, South Korea scored 27 points, ranking 7th. The top-ranked United States (100 points) and second-ranked China (54 points) were far ahead. The average score of the remaining countries excluding the US and China was 24 points, showing no significant difference.

Domestic tech companies plan to accelerate AI investments. A Naver representative said, "Following the establishment of an AI data center in Sejong last year, we will increase investments to enhance AI competitiveness this year by promoting 'On-Service AI.'" A Kakao representative said, "We made significant investments in 2023 while building data centers, but there was a base effect of reduction as the construction was completed last year," adding, "With the full-scale launch of new AI services, continuous investments will be made."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.