Sales of Top 3 Food Ingredient Marts Double or Triple in 10 Years

'Loss Leader' Products and 'Monthly Discounts' Used in Price Marketing

Experts Say "Proper Regulation Is Needed"

Food ingredient marts exploiting loopholes in current laws have grown significantly over the past few years, raising complaints from small business owners. This is due to the entrenched structure where food ingredient marts dominate distribution channels by leveraging their relatively superior financial power. Experts point out that the size of food ingredient marts has already reached the level of large supermarkets, calling for regulatory measures.

A food ingredient mart located within a traditional market in Gangseo-gu, Seoul. Photo by Yoon Dong-ju

A food ingredient mart located within a traditional market in Gangseo-gu, Seoul. Photo by Yoon Dong-ju

Small Business Owners Crying Over 'Loss Leader' Products

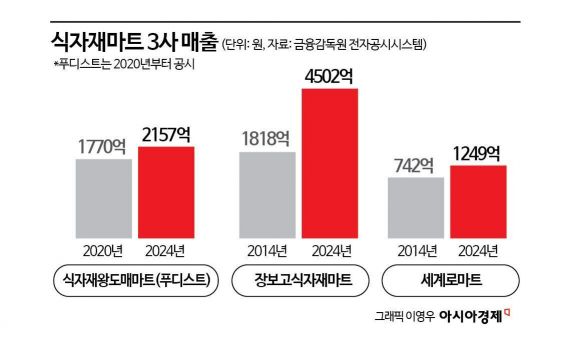

According to the Financial Supervisory Service's electronic disclosure system on the 11th, the sales of the three major food ingredient marts (Foodist, Jangbogo Food Ingredient Mart, and Segyero Mart) have increased by about 2 to 3 times over the past decade. Jangbogo Food Ingredient Mart's sales last year were 450.2 billion KRW, up 147.6% from 181.8 billion KRW in 2014, and during the same period, Segyero Mart's sales grew from 74.2 billion KRW to 124.9 billion KRW, an increase of 68.3%. This contrasts with the declining performance of large supermarkets and corporate-type supermarkets (SSMs) due to the rise of online shopping and economic downturn.

Food ingredient marts refer to stores handling groceries with a floor area between 1,000㎡ (302 pyeong) and less than 3,000㎡ (907 pyeong). Originally, they were distribution stores aimed at supplying food ingredients at low prices to restaurant operators, but by emphasizing direct delivery from production areas and low prices, they have expanded their size and now have established themselves as distribution stores that threaten large supermarkets. An industry insider said, "Operators have recognized for at least 5 to 6 years that the competitiveness of food ingredient marts has surpassed that of large supermarkets and SSMs," adding, "Currently, in terms of capital, store area, and parking facilities, they are practically close to large supermarkets."

The problem is that the rapid growth of food ingredient marts is causing increasing damage not only to nearby merchants but also to small distribution business owners. Food ingredient marts lower consumer prices by contracting with local small and medium-sized wholesalers rather than large corporations to receive bulk supplies of meat, seafood, and other food ingredients. Initially, this had the effect of coexisting with small wholesalers and revitalizing the market, but the situation reversed as food ingredient marts gradually launched aggressive price marketing targeting general customers. So-called 'loss leader products' (products stacked on display stands and sold at prices up to 20% cheaper than the market) and 'monthly discounts' are representative examples.

Small distribution business owners complain that in recent years, as private brand (PB) products of large supermarkets have expanded and the number of suppliers has decreased, they have no choice but to comply with the unreasonable delivery price demands of food ingredient marts. Ms. Yeo (54), who runs an egg distribution business in Gimpo, Gyeonggi Province, said, "Even though exports to the U.S. are increasing and domestic egg supply is limited, food ingredient marts sell a carton of eggs at 2,890 KRW, which is lower than the farm price," adding, "Eggs cannot be stored for long, and if I cannot find a supplier, the loss is greater, so I comply with delivery at absurdly low prices."

The worries of nearby merchants are equally deepening. Food ingredient marts are not subject to regulations under the current Distribution Industry Development Act and Large-scale Distribution Business Act because their store area is less than 3,000㎡ and sales do not exceed 100 billion KRW. Therefore, they can operate 24 hours a day, year-round, regardless of twice-monthly holidays or bans on late-night operations, and they are not obligated to prepare standard contracts with their suppliers. Recently, food ingredient marts have expanded their reach through dawn delivery services like Coupang and Kurly. Mr. Kim (65), who sells fruits and vegetables at a traditional market in Seongbuk-gu, Seoul, said, "Within a 5 km radius of where a food ingredient mart has opened, fruits, vegetables, and eggs simply do not sell."

"Consumer Prices Will Eventually Normalize"

Small business owners have also begun to collectively voice their demands for regulation of food ingredient marts. On the 9th, the Small Business Federation held a forum on regulating food ingredient marts together with the Democratic Party's National Small Business Committee, urging legislative amendments. Kang Jong-seong, chairman of the Korea Egg Industry Association, stated, "Food ingredient marts constantly engage in sales with loss leader products, forcing deliveries below cost," adding, "They cause suppliers to suffer through demands for entry fees worth hundreds of millions of won, exclusive delivery demands, and various abuses such as demands for bribes from store managers." Although 22 bills regulating food ingredient marts were proposed in the 21st National Assembly and 15 bills in the 22nd National Assembly, they remain stalled.

The Korea Federation of Micro Enterprise held a forum on the "Problems and Improvement Measures of Regulatory Blind Spots in Food Material Marts" at the National Assembly on the 9th, together with the Democratic Party of Korea and the National Micro Enterprise Committee. Korea Federation of Micro Enterprise

The Korea Federation of Micro Enterprise held a forum on the "Problems and Improvement Measures of Regulatory Blind Spots in Food Material Marts" at the National Assembly on the 9th, together with the Democratic Party of Korea and the National Micro Enterprise Committee. Korea Federation of Micro Enterprise

Professor Jeong Se-eun of the Department of Economics at Chungnam National University pointed out, "Food ingredient marts have already reached the level of large supermarkets in terms of capital and sales power, but there are no regulations," adding, "If these expanded food ingredient marts drive nearby merchants and distributors to bankruptcy and monopolize the market, consumer prices will eventually normalize, and later, consumers may bear the full burden of price increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.