US 10-Year Treasury Yield Surpasses 4.4%

Stabilizes Within a Day After Mutual Tariff Waiver Announcement

Concerns Persist Despite US Treasury's Explanation of "Normal Movements"

Recently, the yield on the US 10-year Treasury bond surged sharply but stabilized after the US government announced on the 9th (local time) a global mutual tariff waiver excluding China. However, the $29 trillion (42,195 trillion KRW) US Treasury market, considered a global safe asset, has also been shaken by the impact of mutual tariffs, causing ongoing anxiety among financial investors.

As of 7:50 a.m. on the 10th (Korean time), the yield on the US 10-year Treasury bond stood at 4.349%. It had surged to around 4.454% the previous night, but calmed down within a day after President Donald Trump announced a mutual tariff waiver for the world excluding China.

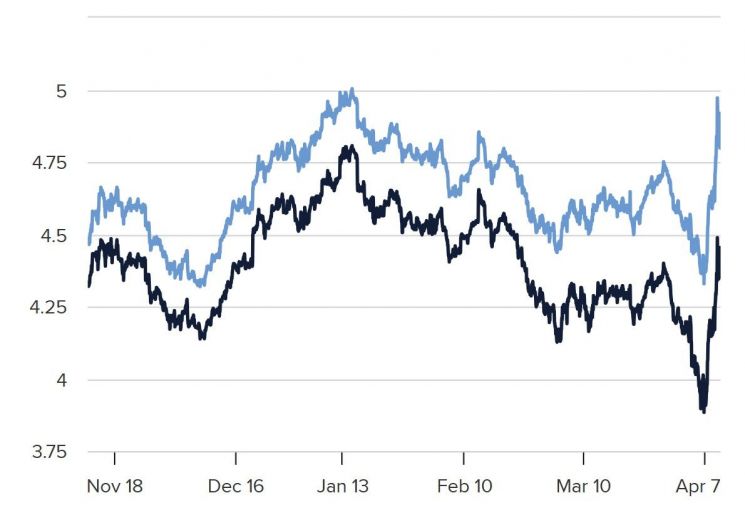

10-Year and 30-Year U.S. Treasury Yield Trends. Blue line represents 30-year, black line represents 10-year, unit: %. CNBC

10-Year and 30-Year U.S. Treasury Yield Trends. Blue line represents 30-year, black line represents 10-year, unit: %. CNBC

The recent surge in US Treasury yields is believed to have been mainly driven by concerns over mutual tariffs. US economic media CNBC noted, "As the US's new tariff measures took effect and China and the European Union (EU) announced retaliatory actions, US Treasuries faced massive sell-offs." Typically, US Treasuries are regarded as a representative safe asset, with demand increasing during financial crises, but this time the pattern was different.

Looking more closely at the causes, the liquidation of hedge funds' 'basis trades' and responses to margin calls were identified as the main reasons. According to global investment bank (IB) Jefferies, recent US Treasury trading showed a decline in the so-called basis trades, a hedge fund arbitrage strategy between cash and futures Treasury positions. This pattern is similar to what was seen during the COVID-19 pandemic. Jefferies analysts pointed out in a client report, "The recent movements resemble the competition for cash that occurred amid fears of COVID-19 spread."

The US government described these movements as a "normal deleveraging" phenomenon, drawing a line against interpretations that it signals abnormality. US Treasury Secretary Scott Beznos said in an interview with Fox Business that the surge in bond yields reflects "one of the deleveraging shocks currently underway in the market," adding, "Some large leveraged participants experiencing losses have no choice but to deleverage." He supported this view by stating, "I do not think this is a systemic problem," and assessed, "Although uncomfortable, this is a normal deleveraging phenomenon occurring in the bond market."

However, as perceptions grew that even US Treasuries were unstable, cash demand increased. Robert Ditchner, senior portfolio manager at US bond manager Nuveen, said, "Foreign funds invested in the US, whether in bonds or stocks, are now questioning whether they should return to their home countries." The British economic weekly The Economist also expressed concern, calling it "the most worrying sign of a financial crisis among many signs so far," and warned, "This is not just a symptom of market stress but a cause that will lead to more problems."

There is also speculation that the US Federal Reserve (Fed) might directly intervene to stabilize the US Treasury market. Jefferies analysts said that while it is not yet "clear" that the Fed must intervene to stabilize the market, they believe "it is not far off until stabilization measures are implemented."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.