Gwangju Chamber of Commerce and Industry, Survey of 47 Companies

Below Baseline for 11 Consecutive Quarters

Dampened Consumer Sentiment Cited as Main Factor

Department Stores Hit by Tariffs and Sluggish Domestic Demand

"Government Must Restore Confidence in the Domestic Market"

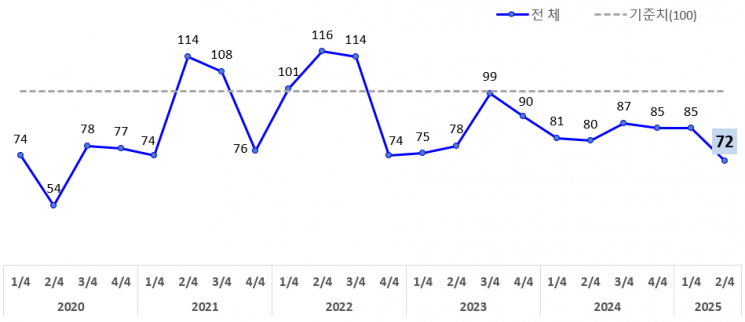

Trend of Retail Business Sentiment Index (RBSI) in Gwangju Area. Provided by Gwangju Chamber of Commerce and Industry

Trend of Retail Business Sentiment Index (RBSI) in Gwangju Area. Provided by Gwangju Chamber of Commerce and Industry

The retail and distribution industry in Gwangju is expected to continue experiencing an economic downturn in the second quarter of this year.

According to the Gwangju Chamber of Commerce and Industry (Chairman Han Sangwon) on the 9th, a survey conducted on 47 retail and distribution companies in Gwangju regarding the '2025 Q2 Retail Business Survey Index (RBSI)' showed a score of 72, down from the previous quarter's 85, indicating that the economic downturn is expected to persist.

This is attributed to the prolonged situation of high inflation, high interest rates, and high exchange rates since the second half of 2022, now compounded by recent domestic political instability, resulting in continued stagnation of the domestic market. As a result, the business sentiment index has failed to recover the baseline (100) for 11 consecutive quarters.

The Retail Business Survey Index (RBSI) is an indicator that numerically expresses the on-site business sentiment of distribution companies. A score above 100 means more companies expect the next quarter to improve compared to this quarter, while a score below 100 indicates the opposite.

The main factor affecting this quarter's performance was 'dampened consumer sentiment due to continued high inflation' (57.4%). This was followed by ▲domestic political uncertainty (46.8%), ▲increased cost burden (40.4%), ▲imposition of US import tariffs (17.0%), ▲expanding influence of Chinese e-commerce in the domestic market (12.8%), and ▲rising import prices due to exchange rate increases (12.8%).

By business type, all sectors?including hypermarkets, department stores, convenience stores, and supermarkets?were expected to experience a downturn. Hypermarkets (75) fell below the baseline (100) due to factors such as Homeplus's corporate rehabilitation process and increased costs from inflation. Department stores (50) were also predicted to see a decline in business sentiment due to tariff hikes initiated by Trump and sluggish domestic demand.

Convenience stores (59) were expected to remain stagnant due to prolonged domestic market stagnation, weakened consumer sentiment, and the emergence of competing channels like Daiso. Supermarkets (91) saw a slight recovery from the previous quarter's forecast (73) due to increased small-quantity, high-frequency purchases caused by high inflation and stronger price competitiveness compared to convenience stores. However, the downturn is still expected to persist.

Regarding whether the imposition of US import tariffs would lead to reduced exports and a slowdown in the consumer market, 80.8% of responding companies answered 'strongly agree' or 'agree.' On whether domestic political uncertainty would dampen consumer sentiment, 78.8% responded 'strongly agree' or 'agree.'

Regarding increased import prices and consumer burden due to rising exchange rates, 87.2% of respondents answered 'strongly agree' or 'agree.'

When asked whether a base interest rate cut would positively impact consumer sentiment by reducing burdens in the asset market (stocks, real estate) and household debt, 34.0% responded 'neutral,' followed by 'disagree' at 29.8%, 'strongly disagree' at 17.0%, 'agree' at 14.9%, and 'strongly agree' at 4.3%.

Regarding the expected timing of domestic market recovery, 55.3% predicted 'after 2026,' followed by 'after 2028' at 19.1%, 'second half of 2025' at 15.0%, and 'after 2027' at 10.6%. No companies expected a recovery in the first half of this year.

A Gwangju Chamber of Commerce and Industry official stated, "The ongoing stagnation of the domestic market and weakened consumer sentiment are having a serious negative impact on the retail and distribution industry's business sentiment, which is directly linked to the survival and growth of companies. The government must strengthen policies for price control and consumption promotion to restore confidence in the stagnant domestic market and revitalize the economy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.