SNE Research analyzes the impact of the U.S.-China tariff war on Korean battery companies

North American production and material localization emerge as key factors for success

Domestic battery companies' global market share expected to decline amid intensifying competition

ESS market projected to surge with renewable energy and AI expansion

Analysis suggests that South Korean battery-related companies are facing both opportunities and challenges due to the tariff war and pressure policies imposed by the Trump administration in the U.S. It is pointed out that North American production and localization of materials will determine the industry's success or failure.

At the 'Next-Generation Battery Conference 2025' hosted by SNE Research on the 10th at El Tower in Yangjae-dong, Seoul, Oh Ik-hwan, Vice President of SNE Research, explained, "Due to the high tariff policies of the second Trump administration, investment and operating costs for North American facilities are increasing, and there is a risk of market contraction," but added, "The increasing demand to replace China in the electric vehicle and energy storage system (ESS) markets is an opportunity factor."

The second Trump administration, following its America First policy, has consecutively announced high reciprocal tariffs not only on China but also on allies such as the European Union (EU), Japan, and South Korea, citing the need to address trade deficits. Amid this, efforts to curb China in advanced industries such as batteries, semiconductors, and artificial intelligence (AI) are intensifying.

In March, the U.S. House of Representatives passed the 'Reducing Dependence on Overseas Adversary Batteries Act,' effectively targeting Chinese-made batteries. This bill, which will be applied from October 2028, stipulates that when using funds from the U.S. Department of Homeland Security, batteries from six Chinese companies including CATL, BYD, Gotion, and EVE Energy cannot be used.

Regarding these developments, Vice President Oh Ik-hwan stated, "With the imposition of high tariffs on Chinese batteries, competitiveness can be secured through local production and supply," and explained, "Especially if the Chinese battery ban bill is finalized after passing the Senate and presidential signature, Chinese batteries will no longer be usable."

Battery material companies with high dependence on Chinese raw materials are expected to face immediate shocks. Representative materials include lithium hexafluorophosphate (LiPF6), a raw material for electrolytes; graphite, used in anode materials; and lithium, the main raw material for cathode materials. SNE Research suggested, "The years 2025 to 2026 will be a turning point for success through North American production and material localization," and recommended, "Facility investments must be completed and production ramped up before the window of opportunity closes."

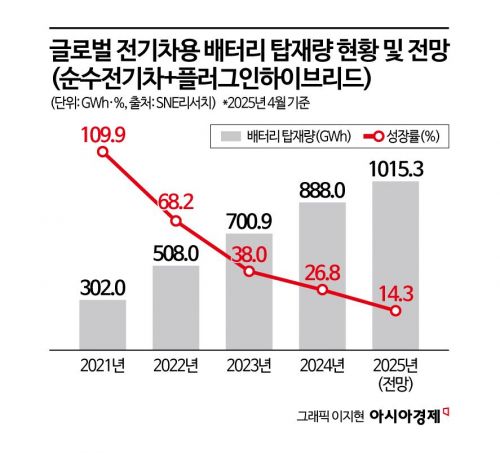

Meanwhile, SNE Research forecasted that the electric vehicle sales growth rate this year will remain at 15.4%, slowing down compared to last year's 26.1%. In Europe, the EU's relaxation of automobile carbon emission regulations is slowing the spread of electric vehicles, and in North America, the automotive market is expected to contract due to the impact of Trump's reciprocal tariffs.

Accordingly, the global growth rate of battery installations for electric vehicles this year is projected to remain at 14.3%, lower than last year's 26.8%. Due to the expansion of Chinese battery companies' overseas advances and the slowdown in advanced markets, the market share of domestic battery companies is expected to continuously decline. SNE Research predicted that the market share of the three domestic battery companies?LG Energy Solution, Samsung SDI, and SK On?in the global market excluding China will decrease by 1.7 percentage points to 41.8% compared to last year.

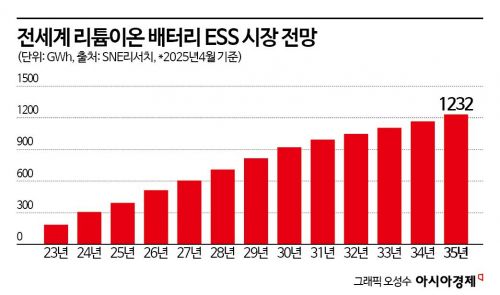

The ESS market is expected to surge due to the expansion of renewable energy and artificial intelligence (AI). SNE Research projected that the global lithium-ion battery ESS market will grow 6.7 times from 185 gigawatt-hours (GWh) in 2023 to 1,232 GWh in 2035. Among this, the market for power grid stabilization is expected to account for 85% of the total and lead the ESS market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)