Fed's Dual Mandate of Price Stability and Full Employment

Trump Pressures for Rate Cuts

Powell Says "Economy Is Good"... Remains Cautious on Rate Cuts

Economic defense or inflation (price increase) control.

The U.S. Federal Reserve (Fed) is caught in a tariff dilemma. Due to the uncertainty of tariff policies under the Donald Trump administration, it is difficult to determine whether to shift the focus of monetary policy toward economic stimulus or price stability. The market expects the number of interest rate cuts this year to increase from the previously anticipated three times to five times following the announcement of reciprocal tariffs.

The Financial Times (FT) reported on the 8th (local time), "President Donald Trump's tariffs have shocked the global market, and the Fed faces a difficult problem," adding, "The question is whether to lower interest rates to prevent a recession or maintain high rates to preempt a new inflation surge."

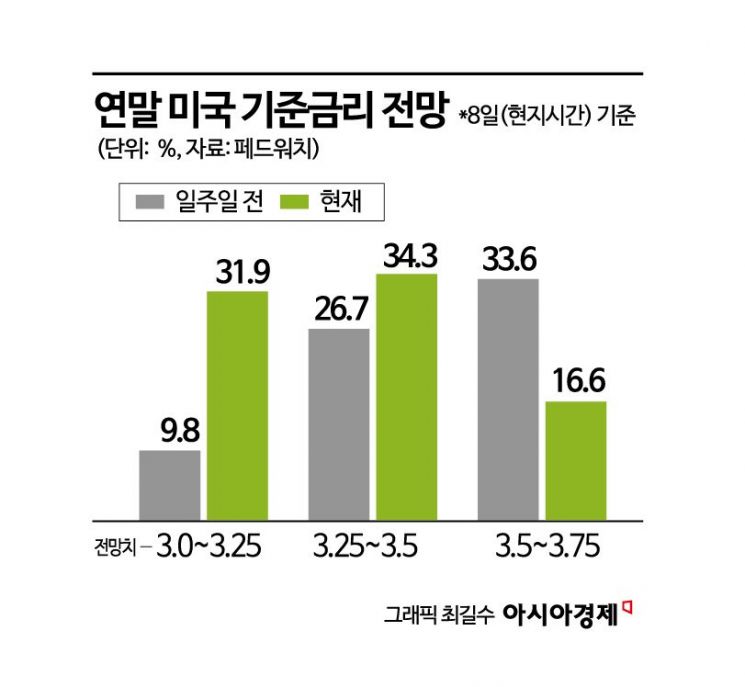

The market expects the Fed to increase the number of rate cuts this year. According to the Chicago Mercantile Exchange (CME) FedWatch on that day, 34.3% of the interest rate futures market predicted that the year-end benchmark interest rate would fall to 3.25?3.5%. The view that it would reach 3.0?3.25% also sharply increased from 9.8% a week ago to 31.9%. Currently, the U.S. benchmark interest rate is 4.25?4.5% per annum, which means that, based on a 0.25 percentage point cut, the market expects at least four to five rate cuts this year. Before President Trump launched the tariff barrage, the market had forecast three rate cuts. Previously, the Fed held the benchmark interest rate steady at both Federal Open Market Committee (FOMC) regular meetings held this year in January and March.

Concerns about a recession are also deepening. Goldman Sachs raised the probability of a U.S. economic recession within 12 months from 35% to 45%, and the global investment bank Barclays in the UK predicted by the 9th that if reciprocal tariffs are not withdrawn, the U.S. and the European Union (EU) are likely to experience a recession.

President Trump, who triggered fears of a recession, continues to pressure for rate cuts. On the 4th, he posted on his social media platform Truth Social, "Now is the perfect time to cut interest rates," adding, "Fed Chair Jerome Powell is always late, but he can quickly change that image now."

Despite President Trump's demands for rate cuts and the possibility of a recession, the Fed appears to be maintaining a 'wait-and-see mode' while monitoring the impact of tariffs on prices and waiting for clear signs of a recession. Chair Powell, in a conference speech held on the 4th in Arlington, Virginia, assessed the current U.S. economic situation as "still in good shape" and stated that decisions on rate cuts would be made after further observation.

According to the U.S. Department of Labor's employment report, nonfarm payrolls increased by a significantly higher-than-expected 228,000 in March, indicating a strong labor market through March. However, the March employment data did not reflect the effects of reciprocal tariffs, so the full impact of tariffs has yet to be seen.

This makes the Fed's decision more difficult, as it has the dual mandate of price stability and full employment. The Washington Post (WP) noted, "The Fed, tasked with stabilizing prices and maintaining a healthy job market, faces a difficult situation," adding, "Economists suggest the Fed may eventually have to choose which threat is more urgent: inflation or job losses."

Another reason the Fed is maintaining a cautious stance is the unpredictable tariff policy of the Trump administration. Chair Powell has stated, "It will be very difficult to assess the economic impact of tariff increases until there is greater certainty about the specific items subject to tariffs, tariff levels, duration, and the scope of retaliation by trade partners."

Some argue that, based on the Fed's past decision-making approach, it will wait for clear evidence that the economy is deteriorating before taking action. Adam Posen, president of the Peterson Institute for International Economics (PIIE), said, "The Fed will not preemptively judge the impact of tariffs or President Trump's fiscal plans (such as significant tax cuts)." Richard Clarida, former Fed Vice Chair and economic advisor at PIMCO, assessed, "The Fed is unlikely to cut rates based on forecasts or models predicting economic slowdown; they are focusing only on concrete evidence."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)