Expansion of High Value-Added Products

Decrease in General-Purpose Memory Supply

Surging DRAM Demand in China Also a Factor

Set Manufacturers May Secure DRAM Stock

Before U.S. Tariffs Take Effect

Micron: "Additional Charges Imposed"

U.S. Tariffs on Memory Modules and SSDs

Samsung Electronics and SK Hynix

Expected to Negotiate Prices with Clients

Prices of semiconductor DRAM have surged sharply this month. The prices of major products have risen by more than 5% over the past week. The price surge is attributed to major memory companies such as Samsung Electronics and SK Hynix increasing the proportion of high value-added products like High Bandwidth Memory (HBM) while relatively reducing the supply of general-purpose DRAM. Although this is positive for securing profits for domestic semiconductor companies, it is uncertain whether the price strength will continue due to many variables such as the impact of U.S.-imposed tariffs.

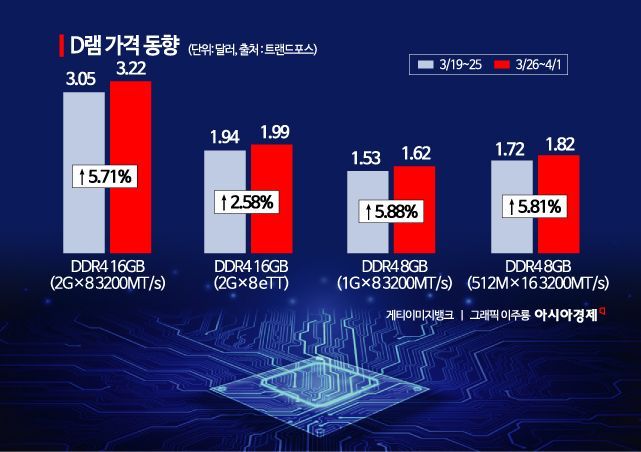

According to the industry on the 9th, global market research firm TrendForce recently released a "DRAM Price Trend" report stating that the spot price of DDR4 8G products (1Gx8 3200MT/s), which was $1.580 (about 2,348 KRW) from the third to the fourth week of March (March 19?25), rose by 4.18% to $1.646 (about 2,446 KRW) one week later (March 26?April 1). The DDR4 16G product (2Gx8 3200MT/s) increased by 5.57%, from $3.05 (about 4,533 KRW) to $3.22 (about 4,786 KRW) during the same period.

Compared to last month’s DRAM price trend, which rose by an average of about 3% per week, the rate of increase has grown even larger since the beginning of this month.

TrendForce cited a decrease in general-purpose memory supply as the cause. Major companies such as Samsung Electronics, SK Hynix, and Micron have focused on high value-added memory products like HBM, naturally reducing DRAM production and causing price increases. There is also a view that the surge in DRAM demand within China has contributed to the price rise. Under China’s government policy called 'Igu Hwan Sin (以舊換新, a policy encouraging the replacement of old consumer goods with new products),' demand for new smartphones, PCs, and home appliances has increased, which in turn has boosted demand for DRAM used in these products.

The related industry is paying close attention to the U.S. announcement of imposing "semiconductor tariffs." An industry insider emphasized, "After the U.S. announced plans to impose tariffs on semiconductors, it is highly likely that set manufacturers (TVs, smartphones, etc.) moved to secure DRAM quantities in advance before the tariffs took effect." In the case of copper, after the U.S. government announced tariffs, many companies began exporting copper to the U.S. market early, causing copper prices outside the U.S. to surge sharply; semiconductors are showing a similar phenomenon.

There are also "rosy forecasts" that the rise in DRAM prices will revitalize the recently sluggish memory market. Although there have been industry reports of production cuts such as Samsung Electronics and SK Hynix reducing the number of DRAM production lines, general-purpose DRAM still accounts for 60?70% of the total products produced by the two companies.

As DRAM prices rise, attention is also focused on whether semiconductor companies will raise prices for major products. To reassure customers who receive DRAM supplies, there is a possibility of negotiating prices at an appropriate level before prices rise further. Micron is reacting most sensitively to prices. According to foreign media on the 8th (local time), Micron announced price increases for DRAM products last month and decided to impose additional charges on some products due to U.S. tariffs. Media outlets reported, "Micron recently informed U.S. customers of plans to increase fees for memory modules and solid-state drives (SSD)."

Semiconductors are currently excluded from the reciprocal tariffs announced by U.S. President Donald Trump. However, storage devices such as memory modules and SSDs are subject to tariffs like other products. Micron has factories mainly in Asia, including China, Taiwan, Japan, Malaysia, and Singapore, and imports products produced in these factories into the U.S., making it difficult to avoid the impact of tariffs. It is also analyzed that Samsung Electronics and SK Hynix will engage in price negotiations reflecting variables such as DRAM price increases and U.S. tariffs with their major customers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.