Top 5 Banks: 47.3% Household Loans

Bottom 5 Banks: 21.4%, About Half the Average

"Expanding Household Loans for Local and Small Banks"

Polarization within the savings bank sector is intensifying. Large banks with substantial asset sizes diversified their portfolios mainly around household loans, which are relatively stable sources of income, while smaller banks relied on corporate loans focused on real estate project financing (PF).

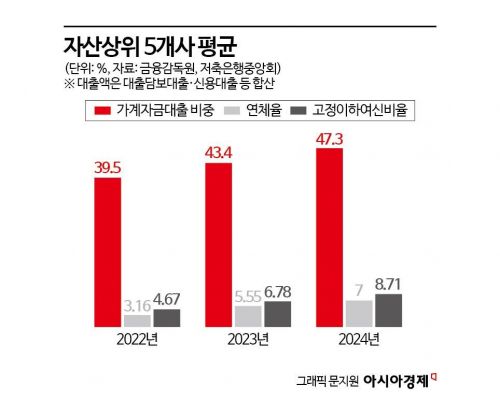

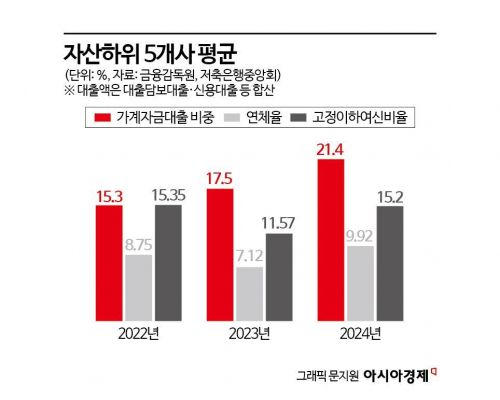

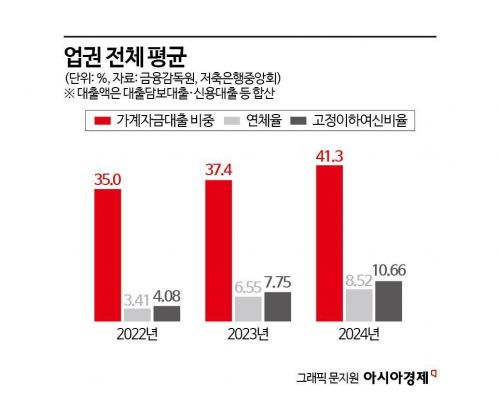

According to the Financial Supervisory Service and the Korea Federation of Savings Banks on the 9th, the proportion of household loans among the top five savings banks by assets (SBI, OK, Korea Investment, Welcome, Accuon) was 47.3% last year, exceeding the sector average of 41.3%. The bottom five banks (Daewon, Daea, Oseong, Raon, Central) had a proportion of 21.4%, about half the sector average.

Large banks strengthened their retail business and succeeded in expanding household loans. They advanced their proprietary credit scoring systems (CSS) and enhanced their mobile platform competitiveness to attract high-quality customers. Based on sophisticated credit evaluation capabilities using alternative information such as delinquency history, assets, and telecommunications bill payment trends, they reduced risk and secured profits. Since their main customers are medium- to low-credit borrowers, strict screening to select customers with low delinquency risk is advantageous for maintaining soundness.

Small banks faced difficulties in acquiring high-quality customers due to poor CSS infrastructure, personnel, and sales bases. Consequently, they had no choice but to focus on high-risk corporate loans such as PF loans. When portfolios concentrate on corporate loans centered on real estate PF, profitability and asset soundness may deteriorate during a real estate market downturn. In fact, last year, the delinquency rate for corporate loans was 12.81%, about three times higher than the 4.53% for household loans.

As a result, the gap in asset soundness was also significant. The top five banks had a delinquency rate of 7% and a non-performing loan ratio of 8.71%, both lower than the sector averages of 8.52% and 10.66%, respectively. The bottom five banks recorded a delinquency rate of 9.92% and a non-performing loan ratio of 15.2%, significantly exceeding the averages.

Economic disparities by operating region also fueled polarization. The top five banks are located in the Seoul metropolitan area, including Seoul and Gyeonggi, where customer income levels are high and economic activity is vigorous.

According to Statistics Korea, as of 2023, the gross regional domestic product (GRDP) per capita in Seoul (home to SBI, OK, Welcome, Accuon) was 58.25 million KRW, and in Gyeonggi, it was 43.07 million KRW. In contrast, the GRDP per capita in Gyeongbuk and Jeonbuk, where the bottom five banks are located, was 48.81 million KRW and 36.28 million KRW, respectively, lower than the metropolitan area.

This explains why large banks had an advantage in acquiring high-quality customers, while local small banks faced limitations in customer acquisition.

The difference in personnel was also stark. The top five banks had an average of 611 employees, whereas the bottom five had only 16.

The government is promoting a project to advance CSS to strengthen the household loan capabilities of local and small savings banks. The Korea Federation of Savings Banks is leading a customized CSS advancement support project in cooperation with private credit information companies (CB), fintech firms, and the Credit Information Agency.

Incentives for non-face-to-face personal credit loans are also provided to small and medium-sized banks. For example, 50% of non-face-to-face loan performance generated outside the operating area is excluded from the denominator when calculating the mandatory loan ratio, thereby reducing the credit burden within the operating area.

An industry insider said, "Diversifying the loan portfolio centered on household loans is a strategy to reduce risk during an economic slowdown," adding, "Local and small banks should also be supported to increase the proportion of household loans through CSS advancement and expansion of non-face-to-face channels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)