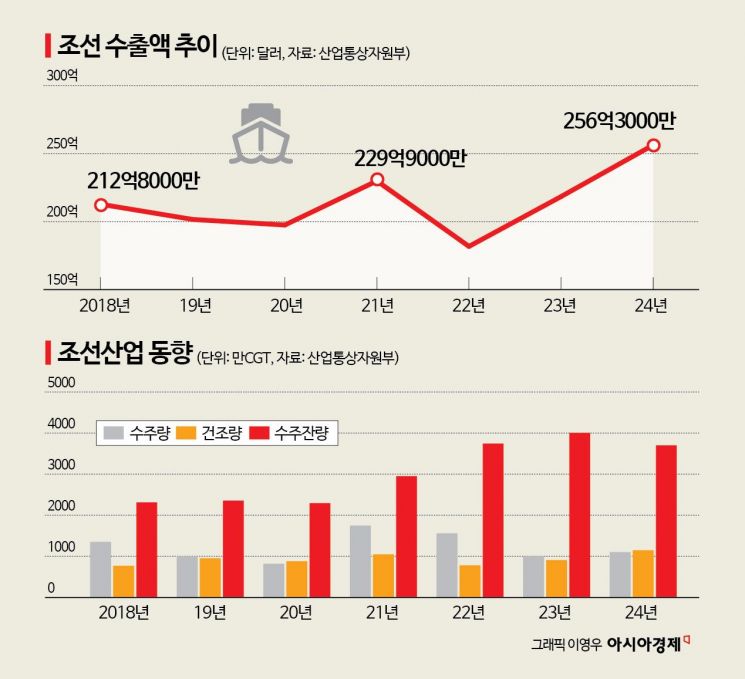

Announcement of 'Plan to Expand Shipbuilding RG Supply' on the 8th

Supporting the Booming Shipbuilding Industry

Difficulties in Rapidly Expanding RG Issuance to Meet Demand

Diversification of RG Issuing Institutions

The government has decided to support the shipbuilding industry by expanding advance payment refund guarantees (RG) for medium-sized shipbuilders. In the future, not only the Korea Development Bank but also the Export-Import Bank of Korea and commercial banks will actively issue RGs to medium-sized shipbuilders. Banks issuing RGs will also be granted exemption benefits. This measure aims to ensure that financial institutions do not hesitate to provide the guarantees essential for ship orders, and even if defaults occur, they will not be held liable.

On the 8th, the government announced the 'Plan to Expand the Supply of Shipbuilding RGs' at the Economic Ministers' Meeting and the Industrial Competitiveness Enhancement Ministers' Meeting, chaired by Deputy Prime Minister and Minister of Economy and Finance Choi Sang-mok. Financial institutions such as the Export-Import Bank of Korea, which have not been issuing RGs to medium-sized shipbuilders, will now promote issuance. Commercial banks, including the Korea Development Bank, which already issue RGs, plan to expand the issuance scale based on recent improvements in their financial conditions.

An RG is a system where a third party, such as a bank, compensates for damages if a shipbuilder fails to build a ship within the agreed period or goes bankrupt. Usually, when a shipowner places an order with a shipbuilder, they pay a certain amount as an advance payment. If the shipbuilder fails to deliver the ship, the shipowner loses the advance payment, but with an RG, they can recover it from the guarantor institution. For this reason, most shipbuilding contracts require an RG. If RG issuance is refused, the order contract may be halted.

Although the government is increasing financial support to revitalize the shipbuilding industry, the scale of RGs issued to medium-sized shipbuilders remains small. According to the Financial Services Commission, as of December last year, only two medium-sized shipbuilders, Daehan Shipbuilding and K Shipbuilding, had received RGs totaling $790 million. Compared to the total RG issuance of $15.4 billion for all shipbuilders, RG issuance is concentrated mainly on large companies. Despite improved financial structures of medium-sized shipbuilders due to strong ship orders, financial institutions remain reluctant to actively issue RGs due to their experience of bearing large losses from defaults by medium-sized shipbuilders in the early 2010s.

A government official stated, “Medium-sized companies face difficulties obtaining RGs despite having many ship orders and improved operating profits, which are opportunity factors. Going forward, if financial structure improvements are expected through winning promising projects, we will establish screening criteria to allow flexible RG issuance based on future value.” Currently, even if a company wins projects with high future value, RG issuance is limited by screening criteria focused on corporate credit ratings based on current financial statements. Therefore, the government will begin preparing screening criteria for flexible RG issuance.

Exemption from Liability Even if Default Occurs Without Intent or Gross Negligence

Banks that provide guarantees to shipbuilders will receive 'exemption' benefits. This means that financial institutions will not hesitate to provide the guarantees essential for ship orders, as they will not be held responsible even if defaults occur in the future. If there is no intent or gross negligence and the government’s ‘order guidelines’ are followed, exemption will be supported during inspections by the Financial Supervisory Service and audits by relevant ministries, even if defaults occur later.

To this end, the regulations on inspections and sanctions of financial institutions will pre-designate RG operations that have undergone business feasibility reviews by external accounting firms according to the order guidelines as subjects eligible for exemption. The audit regulations of each ministry will also be utilized. For the Export-Import Bank of Korea, the Ministry of Economy and Finance’s audit regulations will be applied, and for the Korea Trade Insurance Corporation, the Ministry of Trade, Industry and Energy’s audit regulations will be used. By applying a system that exempts liability if the work is conducted for public interest and without intent or gross negligence, the government plans to encourage financial institution employees to actively issue RGs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)