Over Half of Last Year's Total Issuance in Just the First Quarter

Responding to Rate Cuts and Accounting Changes

Capital Securities Issuance May Decline as Financial Authorities Signal 'Core Capital' Regulation

It has been revealed that insurance companies issued nearly 5 trillion won worth of capital securities in the first quarter of this year alone.

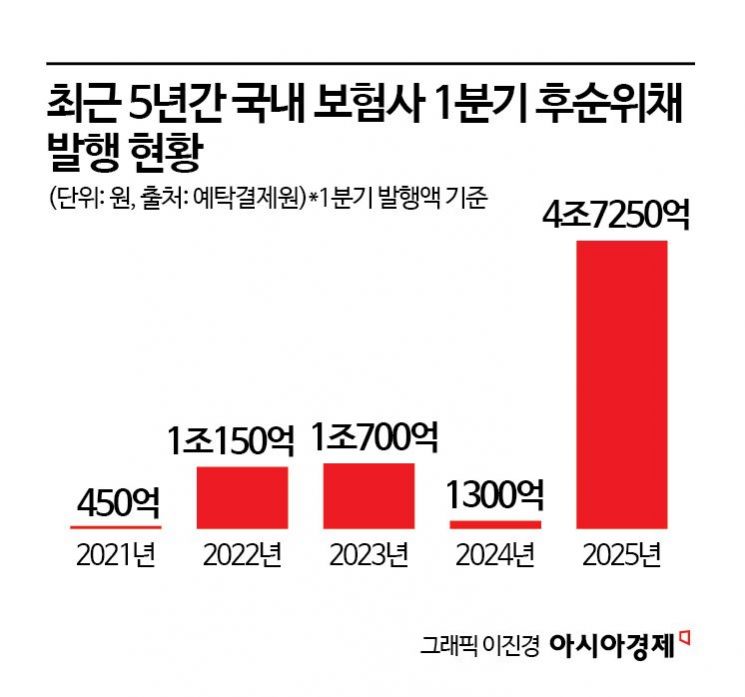

According to the Korea Securities Depository on the 9th, the issuance amount of capital securities (subordinated bonds and hybrid capital securities) by insurance companies in the first quarter of this year recorded 4.725 trillion won. This already exceeded half of last year's total issuance amount of 8.655 trillion won, which was the largest ever. Even considering only the first quarter, the scale of capital securities issuance this year is exceptional. Looking at the issuance status of capital securities by insurance companies over the past five years, it was 45 billion won in 2021, 1.015 trillion won in 2022, 1.07 trillion won in 2023, and 130 billion won in 2024.

The insurance companies that issued the most capital securities in the first quarter of this year were DB Insurance and Hyundai Marine & Fire Insurance, each with about 800 billion won. DB Insurance initially planned to issue subordinated bonds worth 400 billion won in February, but due to excess demand in the book-building process, the issuance amount was doubled. Hyundai Marine & Fire Insurance also planned to issue subordinated bonds worth 400 billion won last month but increased the amount to 800 billion won due to higher-than-expected demand.

ABL Life, which Woori Financial Group is pursuing to acquire, issued subordinated bonds worth 150 billion won last month. ABL Life initially conducted a demand forecast for a public offering of subordinated bonds worth 100 billion won, but orders only reached 73 billion won. Ultimately, it failed to fill the issuance limit, which was opened up to 200 billion won, and issued only 150 billion won through additional subscriptions. ABL Life has issued subordinated bonds worth 450 billion won in three rounds over the past six months. It appears to have taken steps to defend its solvency ratio (K-ICS) ahead of the possible approval of Woori Financial Group's acquisition of Tongyang Life and ABL Life as early as May.

The reason insurance companies have been issuing capital securities one after another since the beginning of this year is that the base interest rate cuts began in earnest from the second half of last year. Capital securities are usually issued to increase K-ICS, but K-ICS decreases as interest rates fall. Some companies also proactively issued capital securities due to concerns that corporate bond investment sentiment would weaken amid financial market volatility caused by the impeachment crisis and the inauguration of the Trump administration's second term. Some insurers issued capital securities additionally to compensate for the decline in K-ICS caused by the no-surrender and low-surrender insurance lapse rate guidelines applied from last year's financial results.

However, the scale of capital securities issuance by insurance companies is likely to decrease from the second quarter. This is because financial authorities recently announced that they will place more weight on core capital (capital stock, retained earnings, etc.) rather than supplementary capital such as capital securities when evaluating the soundness of insurance companies. As part of this, the authorities plan to establish a 'core capital K-ICS' within the first half of the year and finalize the regulatory level. If the core capital K-ICS does not meet the standard in the future, direct sanctions such as prompt corrective actions are expected. Taejun Jung, a researcher at Mirae Asset Securities, said, "The insurance capital regulation enhancement plan announced by the financial authorities last month aims to reduce supplementary capital issuance," adding, "Insurance companies are likely to avoid capital increases, which are the most certain way to increase core capital, and may also take a conservative approach to shareholder returns to preserve core capital."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.