Institutions and Foreign Investors Flock to Domestic Market Short ETFs

"No Practical Benefit in Selling Below KOSPI 2400"

Need for Defensive Asset Allocation in Bonds, Gold, and Cash Equivalents

Until last month, individual investors who were betting on a decline in the domestic stock market have been switching to buying positions. As the domestic stock market, which had plummeted due to the tariff shock, has taken a breather, experts are advising to focus on medium- to long-term asset protection rather than short-term profit generation.

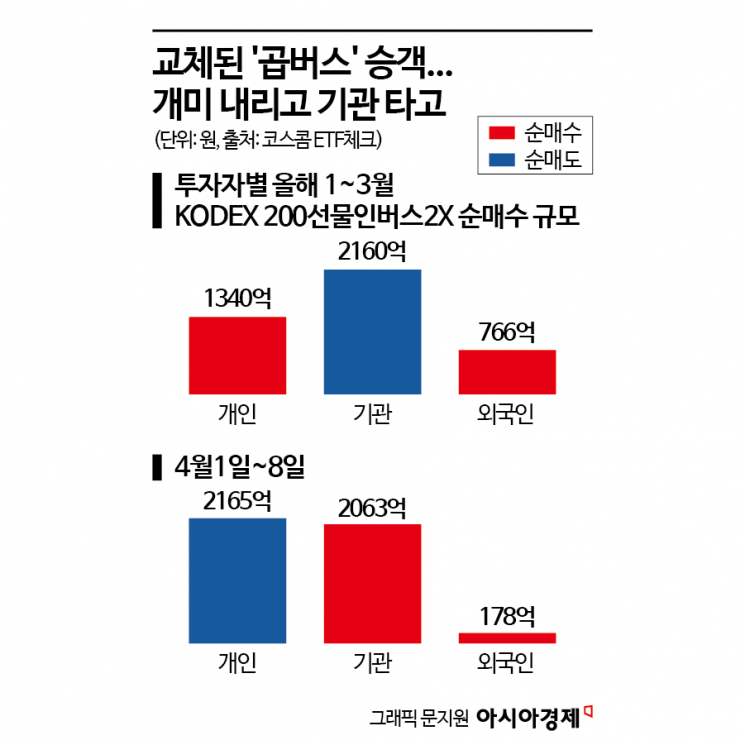

According to Koscom on the 9th, individual investors sold 216.5 billion KRW worth of 'KODEX 200 Futures Inverse 2X' over the past week until the previous day. This contrasts with the net buying volume of 350 billion KRW compared to the beginning of the year until last month. The volume sold by individuals was absorbed by institutions (206.3 billion KRW) and foreigners (18 billion KRW).

This ETF, known as the so-called 'Gopbus (Multiply Inverse),' tracks the daily return of the KOSPI 200 futures index with a -2x leverage. It profits when the index falls and incurs losses when it rises. Retail investors sold this ETF and started betting on the KOSPI rise by buying about 500 billion KRW worth of KODEX Leverage ETF.

Lee Kyung-min, a researcher at Daishin Securities, said, "Below the KOSPI 2400 level, there is no practical benefit in selling, and an active overweight strategy is effective. Semiconductor, automobile, secondary battery, internet, and pharmaceutical & bio sectors have valuations attractive enough to increase weights by utilizing short-term fluctuations from now on." He analyzed that since the KOSPI has entered a historically undervalued zone and political risks have been resolved, short-term shocks could be opportunities for bargain buying.

However, there is also an opinion that building a defensive portfolio from a medium- to long-term perspective is more important than reckless chasing purchases. DB Securities researcher Seol Tae-hyun emphasized, "Looking at asset returns after the S&P 500 index entered a bearish phase, bonds or cash-equivalent assets tend to record relatively higher returns than stocks. Even if some short-term profit opportunities are sacrificed, securing the stability of the medium- to long-term portfolio should be prioritized."

Gold, classified as a representative safe asset, is also mentioned as an effective asset allocation product during a sharp decline market. Earlier in June, Indian gold futures hit a historic high of 3,201 USD per ounce on the 2nd, but due to the consecutive global stock market crashes, profit-taking sales by investors facing margin calls (additional margin requirements) have led to a correction.

Hwang Byung-jin, a researcher at NH Investment & Securities, said, "The gold price drop last week was an inevitable adjustment due to short-term cash demand amid recession fears," adding, "This is an opportunity for bargain buying." Park Hee-chan, a researcher at Mirae Asset Securities, explained, "Gold's value is increasing not only from a medium- to long-term perspective but also as a short-term market risk hedge along with the Japanese yen. If the US stock market becomes more volatile, the yen could strengthen further as a safe asset."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.